What Could Indicate a Signal for Ethereum’s Price?

29.09.2024 17:30 2 min. read Alexander Stefanov

Ethereum has shown a remarkable price recovery in recent weeks, leading some analysts to suggest that this could be just the beginning of a promising trend for altcoin.

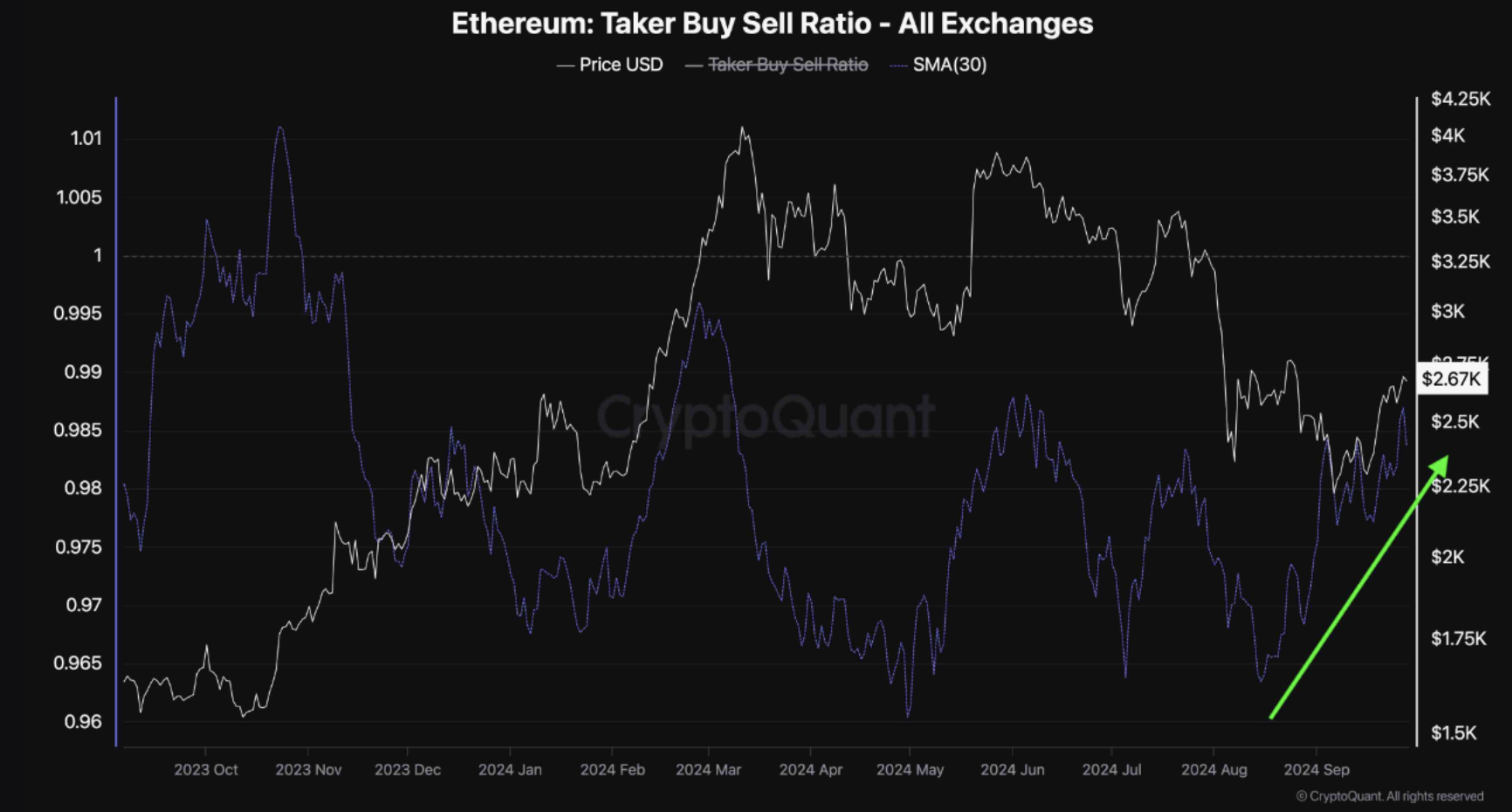

One of them recently shared an intriguing analysis regarding Ethereum’s price movement in a post on CryptoQuant. The focus of the analysis is “buy/sell“, which estimates transaction volumes for a specific cryptocurrency.

When this ratio exceeds 1, it indicates that the volume of purchases exceeds the volume of sales, which is often seen as a bullish sign suggesting that investors are willing to pay more for the asset.

Conversely, a buy/sell ratio below 1 means that the volume of sales is greater than the volume of purchases, which usually reflects bearish sentiment among investors as more sellers are willing to part with their assets at lower prices.

As shown in the highlighted chart, the 30-day simple moving average (SMA) of Ethereum’s bid/ask ratio has remained below the 1 threshold for the past several months. This trend indicates that there are more sellers than buyers, leading to an increase in the supply of tokens on the open market.

However, there has been a recent rise in the 30-day SMA after Ethereum found support just above the $2,100 mark. The buy/sell ratio of buyers has now reached its highest level since mid-June, suggesting that bearish pressure may be easing.

The analyst stressed that if the buy/sell ratio continues to rise, it could signal a change in favor of the bulls in the Ethereum market. This level of active buying could pave the way for a potential rally in altcoin prices.

-

1

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

4

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

5

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read

Altcoin Breakout: ResearchCoin, Electroneum, and REI Network Lead The Rally

A wave of bullish momentum is sweeping through smaller-cap altcoins, with ResearchCoin (RSC), Electroneum (ETN), and REI Network (REI) all recording substantial 24-hour gains.

ETF Speculation and Legal Clarity Renew Optimism for XRP and Solana

XRP is drawing fresh investor attention as optimism builds around its legal standing and potential exchange-traded products (ETPs).

Ethereum: What The Last Move Tells us About the Next One

Ethereum is showing strength in the face of broader market weakness, holding firm even as Bitcoin and other major assets trend downward.

PENGU Price Eyes Bounce From Key Support Level – What’s Next?

Pudgy Penguins’ native token $PENGU is attracting renewed attention from traders after showing consistent support at a key technical level.

-

1

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

4

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

5

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read