BlackRock CEO Backs Bitcoin as Key Investment for Economic Uncertainty

22.09.2024 9:00 1 min. read Kosta Gushterov

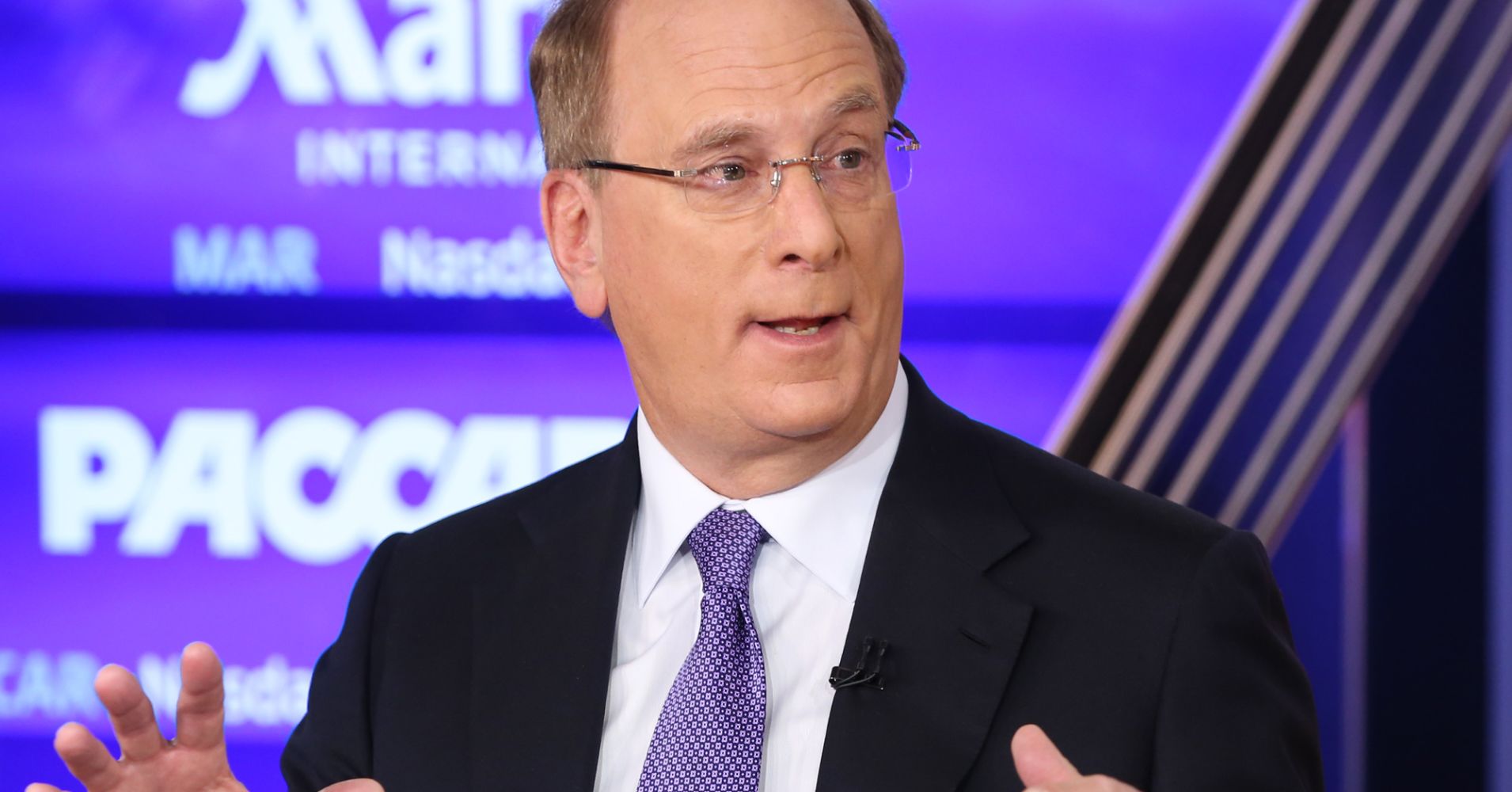

BlackRock CEO Larry Fink has expressed strong support for Bitcoin, affirming its legitimacy as a financial asset during a recent interview with CNBC.

According to Fink, Bitcoin’s ability to deliver uncorrelated returns makes it a valuable tool for diversifying investment portfolios, despite the potential for misuse that exists with any asset.

Fink further explained that Bitcoin is particularly appealing to investors concerned about macroeconomic challenges, such as currency devaluation caused by excessive national deficits.

In countries where financial instability is a concern, Bitcoin provides a distinct investment opportunity for those seeking alternatives to traditional financial systems.

He also pointed out that Bitcoin allows individuals to maintain greater control over their finances in situations where national currencies may be at risk.

Fink concluded by reiterating his belief in Bitcoin’s role in a diversified investment strategy, highlighting its decentralized structure as a hedge against economic uncertainty.

-

1

Bitcoin Climbs Back Above $120,000: What’s Driving the Rally?

02.10.2025 19:11 2 min. read -

2

Massive Options Expiry Could Shake Bitcoin and Ethereum Prices Today

10.10.2025 10:00 2 min. read -

3

Swissblock Flags Bitcoin Breakout Potential as Altcoins Near Reset Zone

27.09.2025 10:11 2 min. read -

4

Bitcoin Crash Triggers $19B Liquidation Wave Across Exchange

11.10.2025 13:30 2 min. read -

5

Bitcoin’s Parabolic Curve Enters Final Stage, Analyst Says

05.10.2025 16:00 1 min. read

Bitcoin ETFs See Heavy Outflows as Ethereum Funds Draw Fresh Inflows

U.S. crypto ETFs moved in opposite directions on Wednesday as investors continued to tread carefully after last week’s flash crash.

D.C. Coffee Chain Becomes First Retailer to Accept Bitcoin at the Register

Compass Coffee in Washington, D.C. has made history as the first retailer to process Bitcoin payments directly through Square’s point-of-sale system.

Crypto Market Weakens: Bitcoin Holds Line, Ethereum Struggles at $4K

The global crypto market has come under renewed selling pressure, shedding about $60 billion in the past day to settle around $3.75 trillion.

Bitcoin and Ethereum ETFs Recover Momentum on Rate-Cut Speculation

A sudden market pivot has brought US Bitcoin and Ethereum ETFs back into favor after recent turbulence.

-

1

Bitcoin Climbs Back Above $120,000: What’s Driving the Rally?

02.10.2025 19:11 2 min. read -

2

Massive Options Expiry Could Shake Bitcoin and Ethereum Prices Today

10.10.2025 10:00 2 min. read -

3

Swissblock Flags Bitcoin Breakout Potential as Altcoins Near Reset Zone

27.09.2025 10:11 2 min. read -

4

Bitcoin Crash Triggers $19B Liquidation Wave Across Exchange

11.10.2025 13:30 2 min. read -

5

Bitcoin’s Parabolic Curve Enters Final Stage, Analyst Says

05.10.2025 16:00 1 min. read

BlackRock CEO Larry Fink has raised alarms over a possible U.S. recession, warning that the downturn may have already begun.

Larry Fink, the CEO of BlackRock, shared his outlook on U.S. interest rates, suggesting that while a rate cut might be possible in the near future, an increase could be on the horizon if the economy continues its strong performance.

Larry Fink, the head of the world’s largest asset management firm, has suggested that Bitcoin could experience a significant surge in value if sovereign wealth funds begin to invest in the digital asset.

Larry Fink, the chief executive officer of the largest asset manager in the world BlackRock, described Bitcoin as "digital gold".

Securitize, in collaboration with BlackRock, is launching its BUIDL tokenized fund on the Avalanche network, with the contract already deployed and funded, signaling a concrete initiative.

BlackRock has significantly strengthened its position in the Bitcoin ecosystem, with its total exposure now surpassing $5.4 billion as of the first quarter of 2025, based on figures from Timechainindex.

BlackRock is ramping up its engagement with U.S. regulators, meeting with the SEC’s Crypto Task Force on May 9 to present its growing suite of digital asset products and to push forward conversations around the evolving regulatory landscape.

U.S. Bitcoin exchange traded funds (ETFs) posted a fifth straight day of positive net inflows on Wednesday, totaling $105.9 million.

The SEC's approval of spot Ethereum ETFs has sparked interest in future crypto ETF launches, with some anticipating Solana ETFs might be next.

BlackRock Investment Institute is skeptical about the Federal Reserve implementing as many rate cuts as the bond market anticipates.

Financial giant BlackRock just released a video for investors in Ethereum (ETH) ETFs.

BlackRock's head of digital assets, Robert Mitchnick, acknowledged that the trading activity and inflows for spot Ethereum ETFs lag significantly behind those of Bitcoin ETFs.

BlackRock has introduced its iShares Bitcoin ETF to Canadian investors, providing a simplified way to gain Bitcoin exposure without direct ownership.

Global investment giant BlackRock has taken two major steps to strengthen its foothold in the cryptocurrency sector.

BlackRock's BUIDL fund is expanding its reach to multiple blockchains, including Aptos, Arbitrum, Avalanche, Optimism, and Polygon.

BlackRock is preparing to introduce a Bitcoin Spot Exchange-Traded Fund (ETF) in Europe, marking a significant expansion of its cryptocurrency offerings beyond the United States.

BlackRock is reportedly negotiating with centralized exchanges, including Binance, OKX, and Deribit, to enable the use of its BUIDL fund as collateral for derivatives trading, according to an October 18 report from Bloomberg.

BlackRock is reportedly preparing to purchase nearly 10% of the shares in Circle Internet Financial Ltd.’s upcoming IPO, expanding its existing role as manager of the Circle Reserve Fund, which backs USDC with roughly $30 billion in assets.

BlackRock is preparing to expand its Bitcoin ETF lineup with a new product designed to generate yield from the cryptocurrency’s volatility.

BlackRock, the largest asset management firm globally, recently reported a significant investment in the iShares Bitcoin Trust ETF (IBIT), acquiring 2,535,357 shares worth $91.6 million.