BlackRock’s IBIT Bitcoin ETF Sees First Net Inflow in Three Weeks

17.09.2024 18:44 1 min. read Alexander Stefanov

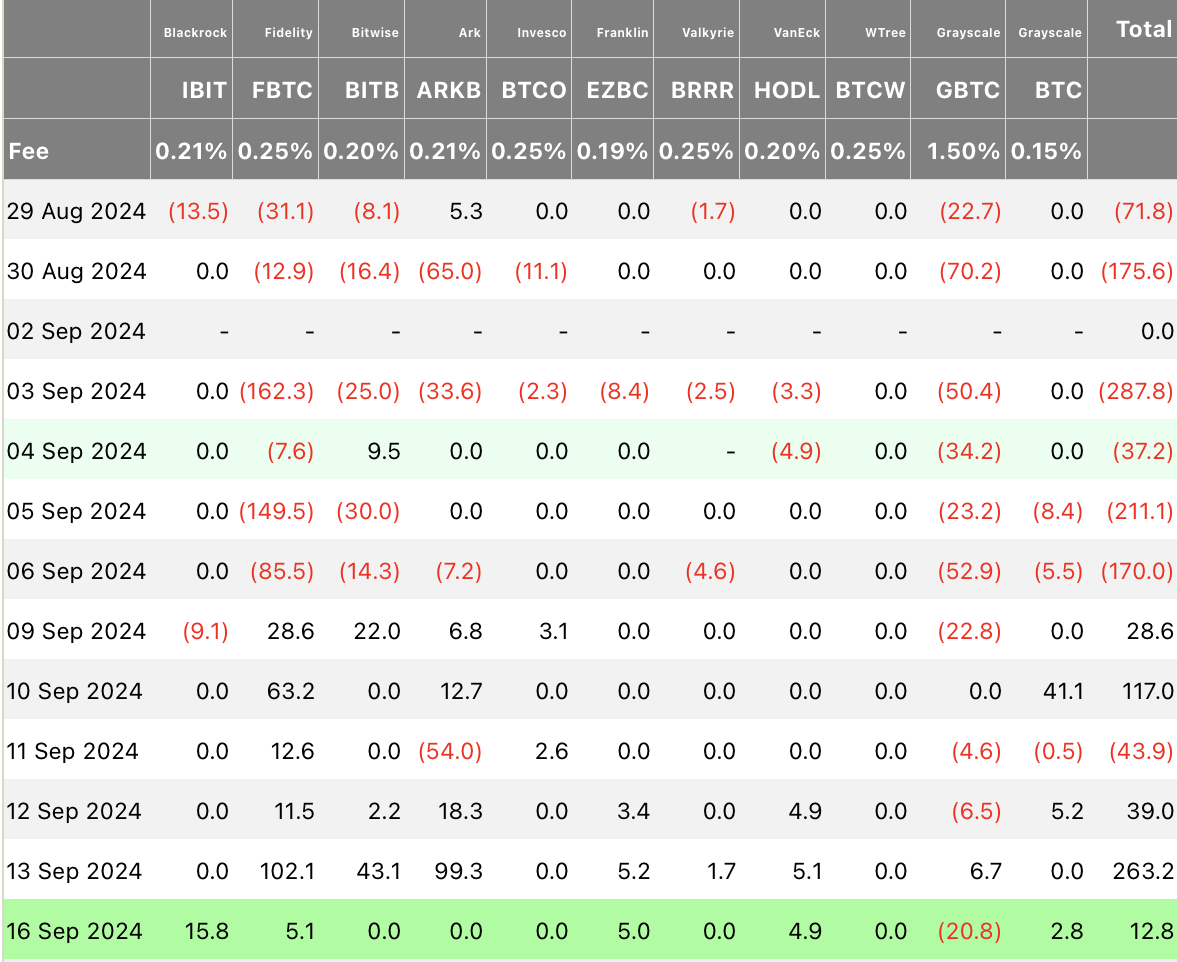

BlackRock’s IBIT Bitcoin ETF recorded its first daily net inflow in three weeks, bringing in $15.8 million.

This marks the end of a prolonged period of stagnant or negative flows, which had lasted since August 26. Prior to this, the ETF had experienced 11 consecutive days without positive inflows and two days of net outflows on August 29 and September 9.

On the same day, other Bitcoin ETFs also saw net inflows: Fidelity’s FBTC added $5.1 million, Franklin Templeton’s EZBC saw $5 million, and VanEck’s HODL gained $4.9 million, according to CoinGlass data.

Conversely, Grayscale’s high-fee Bitcoin ETF, GBTC, experienced net outflows of $20.8 million on Friday, despite recent inflows of $6.7 million. Its mini-merchant BTC had a modest net inflow of $2.8 million.

BlackRock’s IBIT remains the leader in spot Bitcoin ETF flows, with $20.9 billion in net inflows since January. Fidelity’s FBTC follows with $9.6 billion, while Grayscale’s GBTC has seen net outflows exceeding $20 billion.

-

1

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

2

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

3

Bitcoin Struggles as Selling Pressure Mounts Amid Geopolitical Turmoil

13.06.2025 15:00 2 min. read -

4

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read -

5

Why Michael Saylor Bet on Bitcoin During the COVID Cash Crisis

12.06.2025 19:00 2 min. read

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

-

1

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

2

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

3

Bitcoin Struggles as Selling Pressure Mounts Amid Geopolitical Turmoil

13.06.2025 15:00 2 min. read -

4

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read -

5

Why Michael Saylor Bet on Bitcoin During the COVID Cash Crisis

12.06.2025 19:00 2 min. read