Bitcoin Holders Retain Assets as Exchange Activity Drops

17.09.2024 10:00 1 min. read Alexander Stefanov

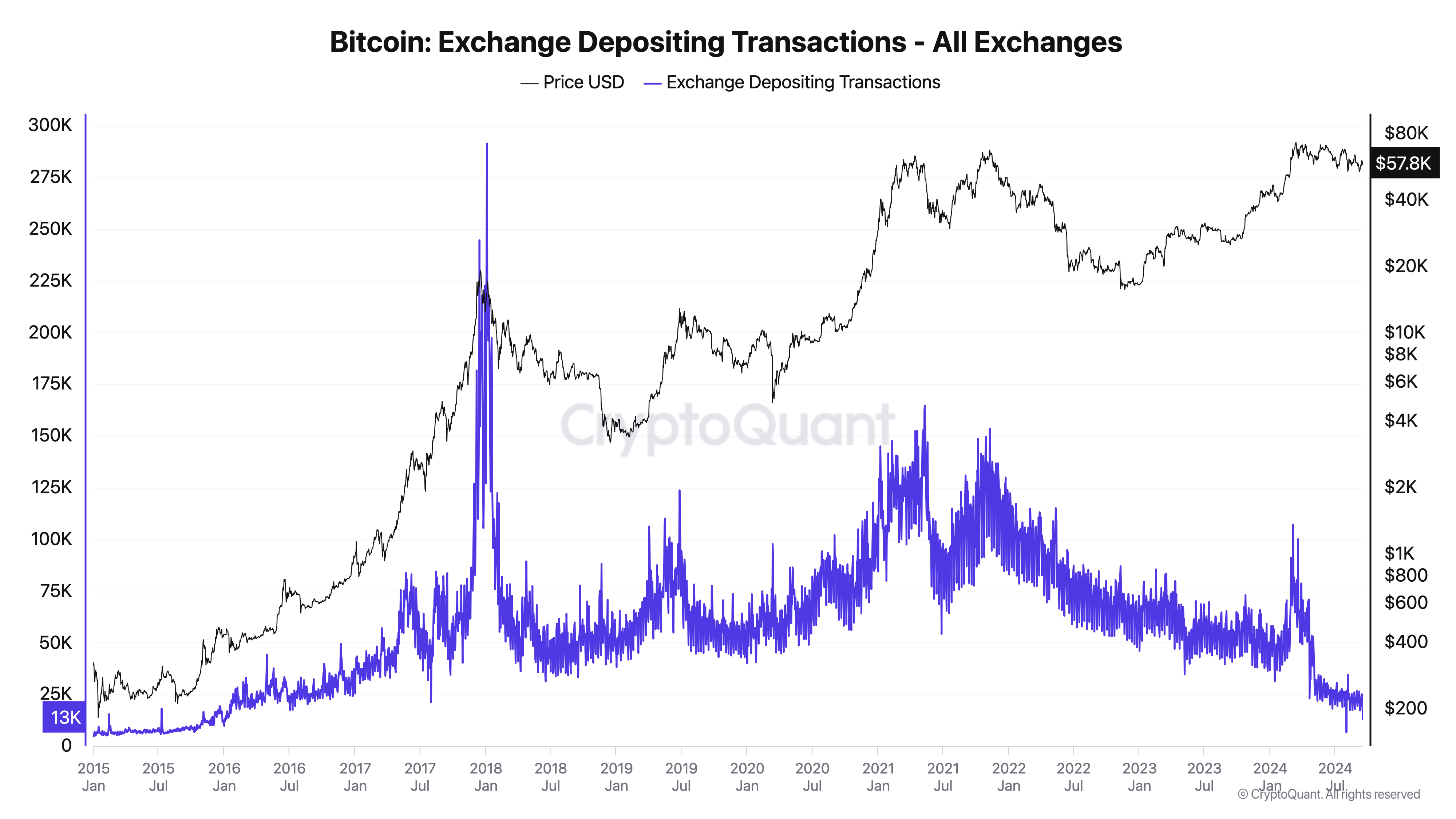

Bitcoin (BTC) continues to struggle with breaking the $60,000 threshold, but this has not led to a sell-off among holders.

In fact, many are retaining their assets, as evidenced by a drop in exchange activity.

The daily number of Bitcoin addresses sending funds to exchanges has recently reached a multi-year low. This decline aligns with market expectations surrounding the Federal Reserve’s decision on September 18.

On-chain data reveals a decrease in Exchange Depositing Addresses, a metric tracking Bitcoin inflows to exchanges. This figure peaked for the year on March 5 and has been declining since.

In the past week alone, deposits to exchanges have fallen by 19%. A drop in this metric typically indicates that investors are holding their Bitcoin rather than selling.

This reduced exchange activity comes amid speculation about a potential 50% chance of a 0.5% rate cut by the Federal Reserve. The easing of Bitcoin’s selling pressure suggests investors might be anticipating a more favorable market. This sentiment is also reflected in Bitcoin’s funding rate, which turned positive recently after a week of negative values.

-

1

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

2

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

3

Bitcoin Struggles as Selling Pressure Mounts Amid Geopolitical Turmoil

13.06.2025 15:00 2 min. read -

4

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read -

5

Why Michael Saylor Bet on Bitcoin During the COVID Cash Crisis

12.06.2025 19:00 2 min. read

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

-

1

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

2

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

3

Bitcoin Struggles as Selling Pressure Mounts Amid Geopolitical Turmoil

13.06.2025 15:00 2 min. read -

4

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read -

5

Why Michael Saylor Bet on Bitcoin During the COVID Cash Crisis

12.06.2025 19:00 2 min. read