Bitcoin Bull Market Could Extend Until Late 2025, Analyst Suggests

08.09.2024 11:00 1 min. read Alexander Stefanov

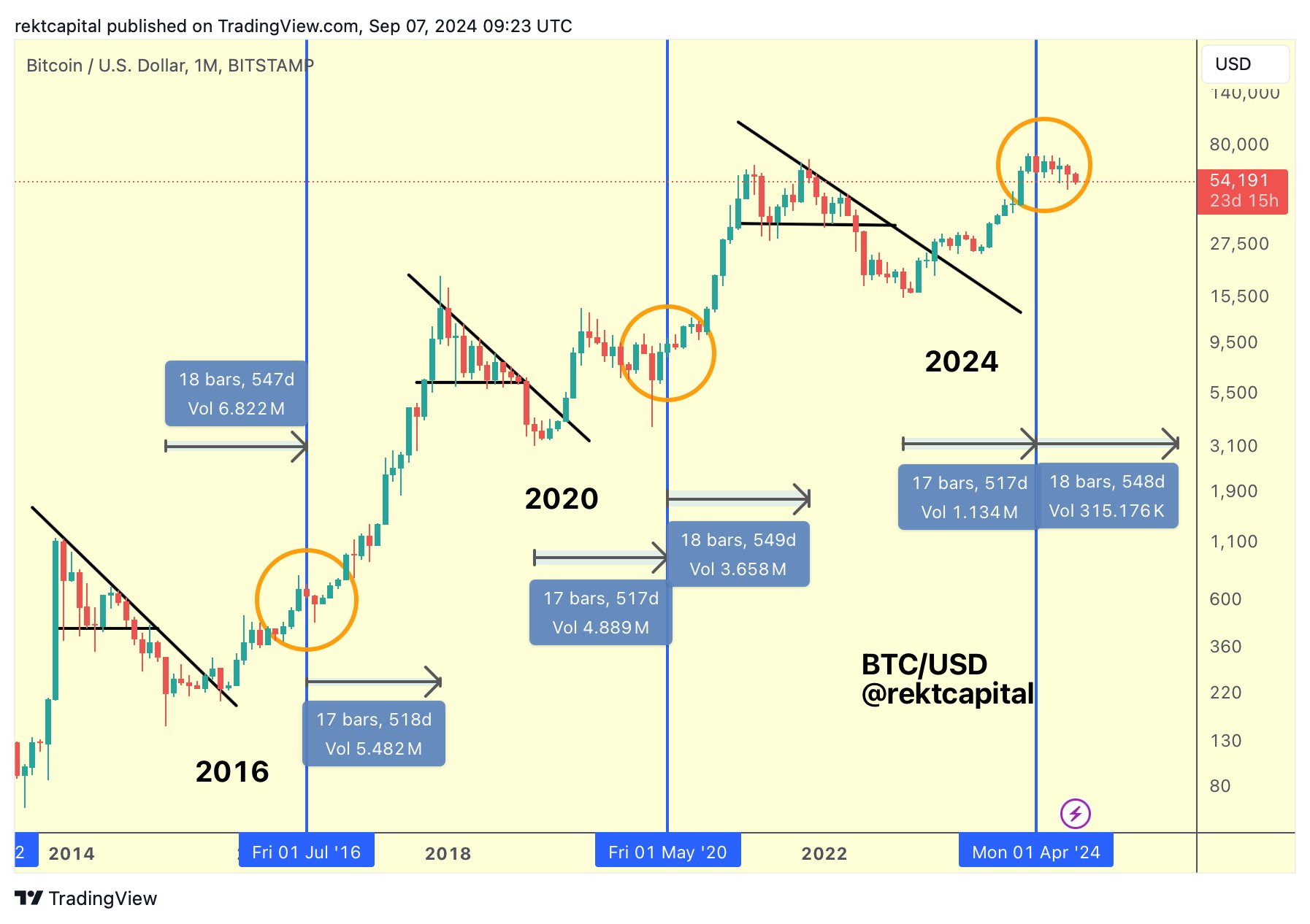

Cryptocurrency analyst Rekt Capital has presented a compelling analysis indicating that Bitcoin’s current bull market might last until October 2025.

This forecast is based on historical patterns related to Bitcoin halving events.

Rekt Capital observed that Bitcoin hit its lowest point 547 days before the 2016 halving and reached its peak 518 days afterward.

A similar trend was noted for the 2020 halving, with Bitcoin bottoming out 517 days before and peaking 549 days after the event.

Following this pattern, Bitcoin appears to have reached its low 517 days before the 2024 halving, suggesting that the next peak might align with October 2025, approximately 549 days later.

This analysis highlights a recurring pattern where Bitcoin’s market cycles are closely linked to halving events, with bear market lows and bull market highs occurring symmetrically around these events.

According to Rekt Capital, this trend indicates that the current bull market is likely still in progress and could continue for an extended period.

-

1

Bitcoin Extends Rally Above $125K Reaching New All Time High

05.10.2025 8:51 2 min. read -

2

CoinGecko Survey Shows Fewer New Investors Start With Bitcoin

28.09.2025 10:00 2 min. read -

3

U.S. Mining Giant Orders 50,000 Bitcoin Rigs as Difficulty Hits Record

03.10.2025 9:00 2 min. read -

4

Bitcoin Climbs Back Above $120,000: What’s Driving the Rally?

02.10.2025 19:11 2 min. read -

5

Cathie Wood Explains Why She Prefers Bitcoin Over Ethereum

28.09.2025 14:00 1 min. read

Can Bitcoin Outlast Stocks in the Age of Artificial Intelligence?

Trying to guess what the world of finance will look like in 50 years is almost impossible.

Elon Musk Emphasizes Bitcoin’s Superiority Over Traditional Currency

Elon Musk recently emphasized Bitcoin’s superiority over fiat on X, highlighting its foundation in energy — a resource that cannot be artificially created.

Bitcoin Faces Uncharted Territory After Historic Liquidation Wave

The Bitcoin market is teetering between fear and confusion after an unprecedented wave of $19 billion in liquidations rattled traders over the weekend.

Metaplanet’s Bitcoin Reserves Now Worth More Than the Company Itself

Japan’s Metaplanet has entered a rare situation where its market value has fallen below the worth of its own Bitcoin holdings — a reflection of changing investor sentiment toward Bitcoin treasury firms.

-

1

Bitcoin Extends Rally Above $125K Reaching New All Time High

05.10.2025 8:51 2 min. read -

2

CoinGecko Survey Shows Fewer New Investors Start With Bitcoin

28.09.2025 10:00 2 min. read -

3

U.S. Mining Giant Orders 50,000 Bitcoin Rigs as Difficulty Hits Record

03.10.2025 9:00 2 min. read -

4

Bitcoin Climbs Back Above $120,000: What’s Driving the Rally?

02.10.2025 19:11 2 min. read -

5

Cathie Wood Explains Why She Prefers Bitcoin Over Ethereum

28.09.2025 14:00 1 min. read

Glassnode, a leading on-chain analytics company, suggests that Bitcoin (BTC) still has potential for growth, according to its analysis of a key indicator.

A popular crypto expert believes Bitcoin (BTC) and other digital assets are still in the early stages of a long-term bull market.

CryptoQuant's CEO, Ki Young Ju, has indicated that on-chain data suggests a resurgence of the Bitcoin (BTC) bull market.

Bitcoin is showing strong signs of a bull market, according to CryptoQuant CEO Ki Young Ju.

A crypto expert has shared his perspective on Bitcoin (BTC), Solana (SOL), and other major digital assets, pointing out that the recent market trends suggest a “bear trap” rather than a long-term downturn.

Bitcoin’s potential for a bull run might depend on the trajectory of the US Dollar Index (DXY), according to prominent crypto trader CarpeNoctom.

CryptoQuant CEO Ki Young Ju has warned that Bitcoin’s current market cycle may have already peaked, suggesting that traders shouldn’t anticipate a major rally in the next six to twelve months.

VanEck, a well-known asset management company, remains optimistic about Bitcoin’s price potential, forecasting substantial growth in the coming months.

A cryptocurrency analyst named Kripto Poyraz recently shared his insights on Bitcoin’s current bull market.

The cryptocurrency landscape is constantly shifting, with some projects gaining traction while others struggle to maintain relevance.

The cryptocurrency landscape is constantly shifting, with some projects gaining traction while others struggle to maintain relevance.

Bitcoin's price remains in a tight range, with investors wary of potential declines.

Bitcoin’s upward momentum is gaining steam, with the asset hovering just under the $100,000 mark after briefly touching a local high near $97,940.

Bitcoin’s recent dive below $50,000 has left the investment community trying to understand the abrupt market shift.

Bitcoin Cash (BCH) has surged more than 7% in 24 hours, breaking above $644 for the first time since April 2024.

Bitcoin Cash (BCH) has seen a steady decrease in value recently, currently trading at $373 - a 2.4% drop in the past 24 hours.

Bitcoin gained 2.10% in the past 24 hours, extending its price to roughly $113,928, according to CoinMarketCap data.

Bitcoin gained 1.2% in the past 24 hours, trading around $115,600 on September 12. The broader crypto market also posted a modest rebound, with total capitalization up 1.68%, as optimism around regulatory clarity and renewed ETF inflows outweighed short-term profit-taking by whales.

Bitcoin (BTC) gained 0.7% in the past 24 hours, trading abovr $116,500, and extended its weekly rise to 4.7%.