Bitcoin ETFs See $37 Million in Outflows, Led by Grayscale’s Massive Withdrawals

05.09.2024 14:00 1 min. read Alexander Stefanov

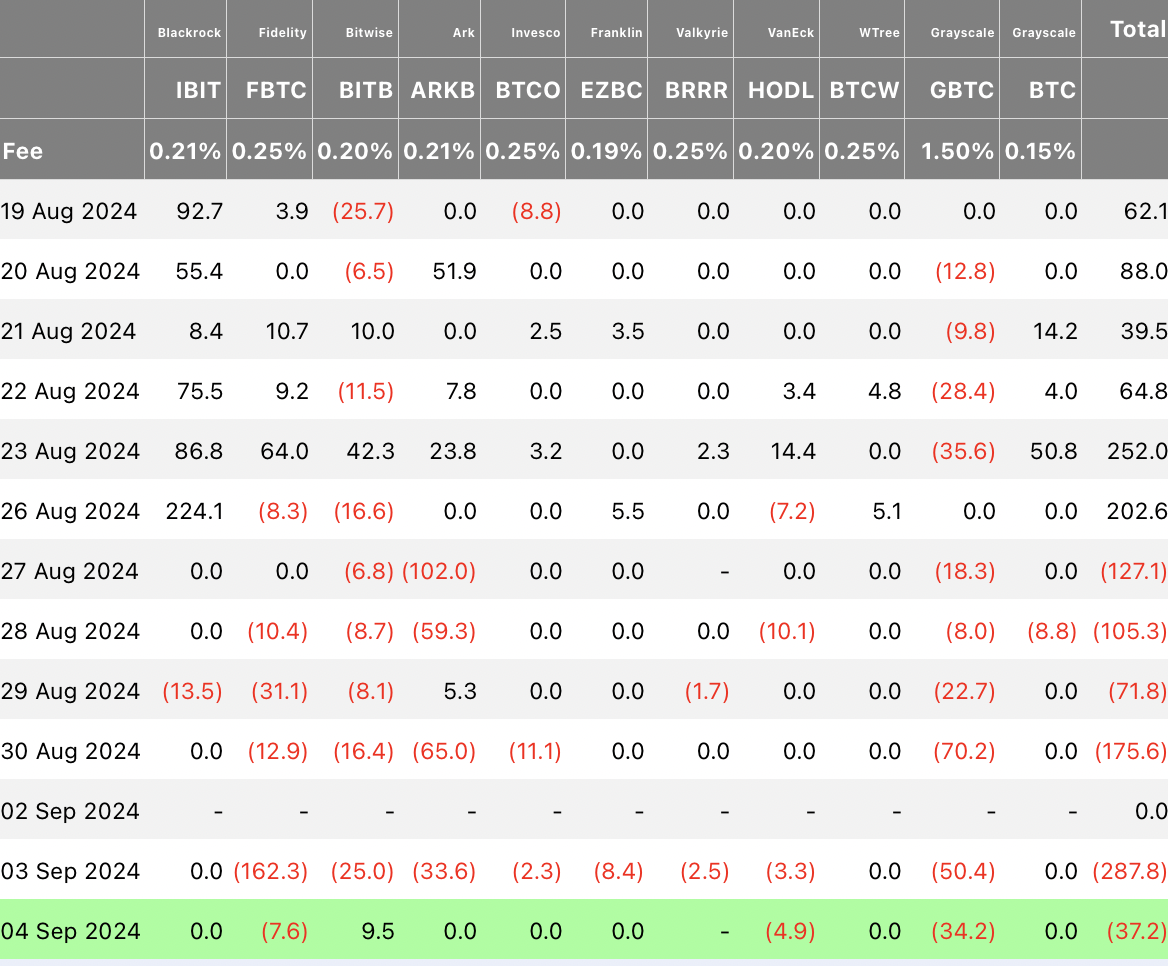

On Wednesday, U.S. Bitcoin exchange traded funds (ETFs) saw net outflows totaling $37.2 million, the sixth consecutive day of negative flows.

Grayscale’s GBTC, the second-largest spot Bitcoin ETF by net asset size, led the outflows with $34.2 million leaving the fund.

Other notable outflows came from Fidelity’s FBTC with $7.6 million and VanEck’s HODL, which lost $4.9 million.

Bitwise’s BITB was the only Bitcoin ETF to record net inflows, bringing in $9.5 million.

BlackRock’s IBIT, the largest spot Bitcoin ETF, and seven other funds saw no activity on the day.

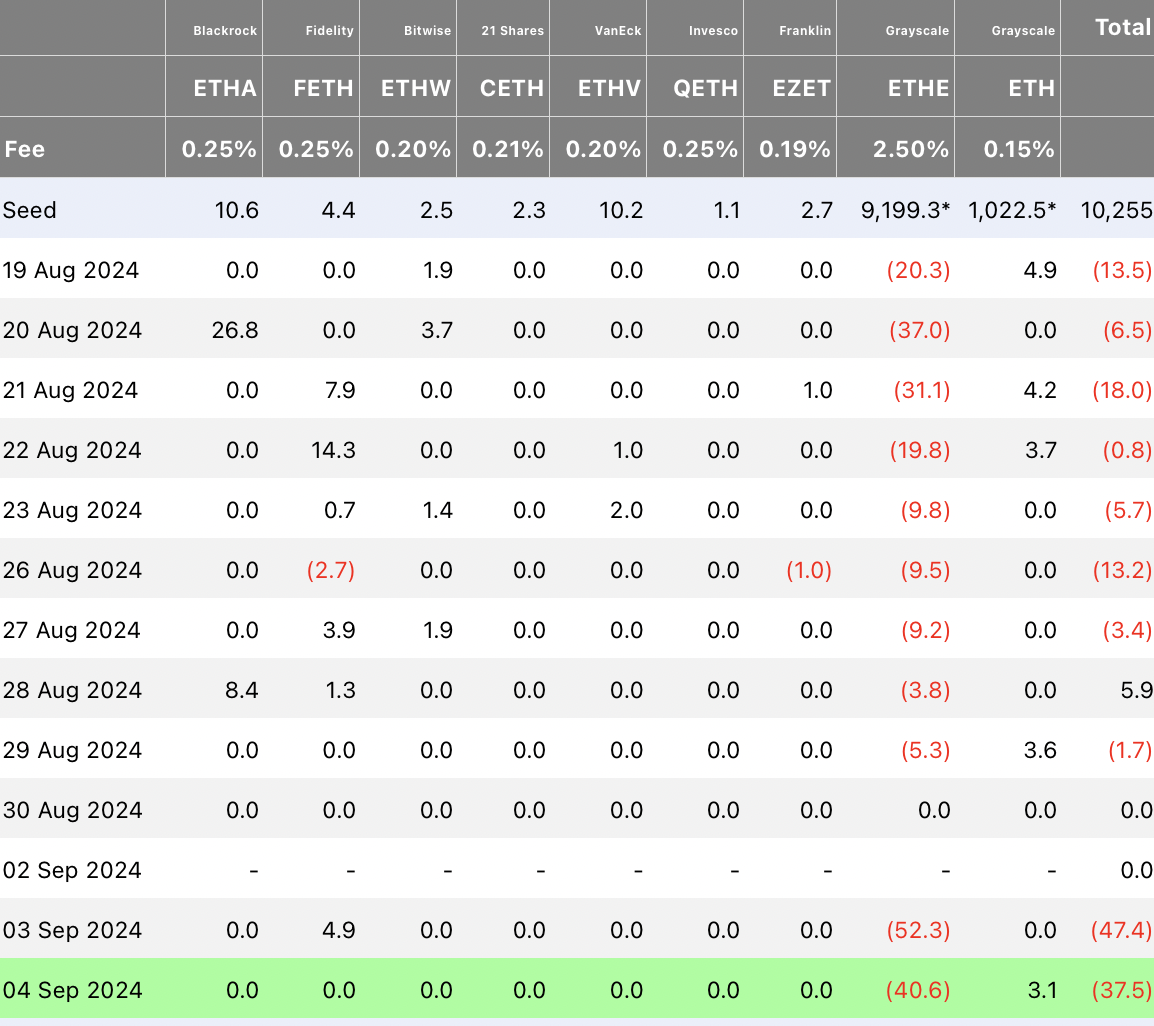

Spot Ethereum ETFs also faced outflows, with net outflows totaling $37.5 million, continuing a two-day streak of outflows.

Grayscale’s ETHE led the way with $40.63 million, while its Ethereum Mini Trust (ETH) saw $3.1 million in inflows. The other 7 Ethereum ETFs saw no activity.

-

1

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

2

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

06.07.2025 8:00 2 min. read -

3

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

17.07.2025 15:30 2 min. read -

4

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

5

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read

Elon Musk’s SpaceX Moves $150M in Bitcoin

SpaceX has moved 1,308 BTC—worth roughly $150 million—to a new wallet address, marking its first on-chain activity in more than three years.

Here’s When the Bitcoin Cycle May Peak, Based on Past bull Markets

According to a new chart shared by Bitcoin Magazine Pro, the current Bitcoin market cycle may be entering its final stretch—with fewer than 100 days remaining before a potential market top.

Bitcoin Price Prediction: $130K in Sight After ‘Crypto Week’ Boost

Bitcoin (BTC) is once again hovering near its all-time high today as trading volumes have jumped by 13% in the past 24 hours upon breaking the $119,000 barrier, favoring a bullish Bitcoin price prediction. The top crypto has booked gains of 16% in the past 30 days and reached a new record at $123,091 earlier […]

Support Test or Breakout Ahead? Bitcoin Hovers at Key Decision Zone

Bitcoin is consolidating around $119,000 after last week’s all-time high above $123,000.

-

1

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

2

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

06.07.2025 8:00 2 min. read -

3

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

17.07.2025 15:30 2 min. read -

4

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

5

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read