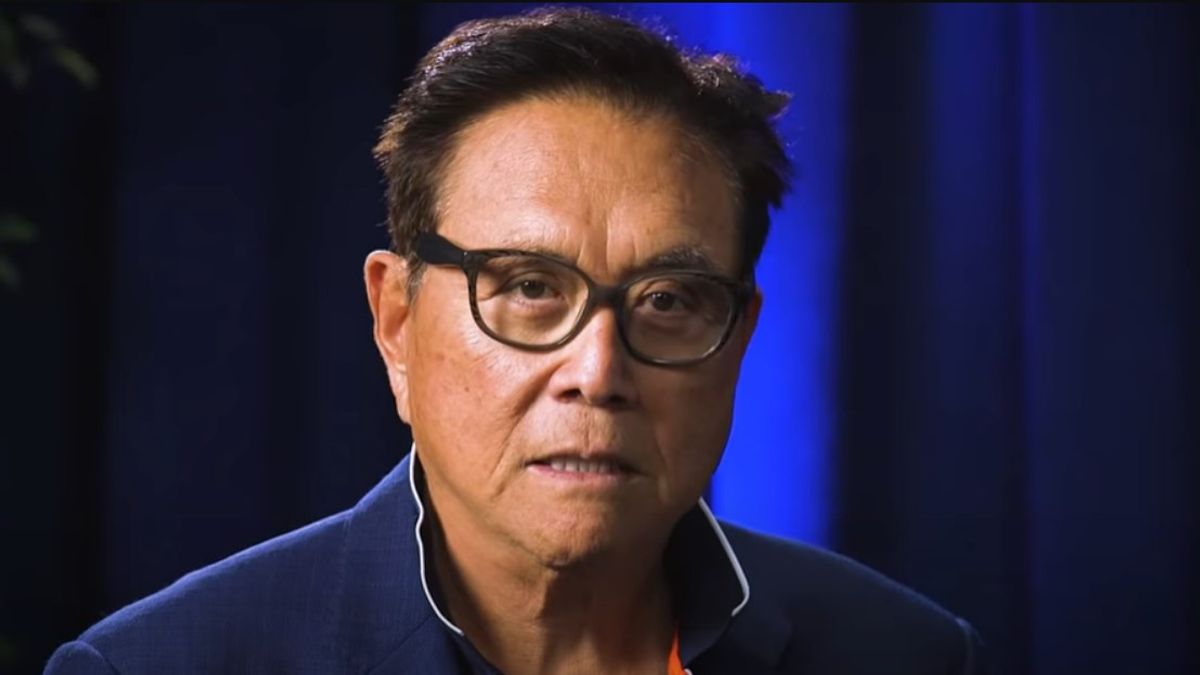

Trillions in U.S. Debt Pile Up, It’s Time to Buy Bitcoin – Robert Kiyosaki

22.08.2024 12:08 1 min. read Alexander Stefanov

Robert Kiyosaki, the best-selling author of Rich Dad Poor Dad, recently took to X to express concerns over the United States' rapidly growing national debt.

In a striking comparison, Kiyosaki pointed out that a trillion seconds equals roughly 31,688 years. He emphasized that the U.S. now accumulates this much debt every 100 days.

Kiyosaki’s message is clear: the relentless increase in national debt is unsustainable. His tweet underscores his long-held belief in alternative assets like gold, silver, and Bitcoin as protective measures against economic instability.

For years, Kiyosaki has been vocal about his skepticism toward traditional financial systems, advocating for investments in tangible assets and cryptocurrencies. As the U.S. continues to face mounting fiscal challenges, his call for action resonates with those concerned about inflation, currency devaluation, and financial security.

The trillion-dollar debt figure Kiyosaki references is a stark reminder of the scale of the problem. His advice to invest in gold, silver, and Bitcoin reflects a growing sentiment among investors seeking safe havens amid economic uncertainty. Whether or not one agrees with his perspective, his commentary adds to the ongoing debate about the future of the global financial system.

-

1

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

2

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

5

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

Robert Kiyosaki Predicts When The Price of Silver Will Explode

Robert Kiyosaki, author of Rich Dad Poor Dad, has issued a bold prediction on silver, calling it the “best asymmetric buy” currently available.

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

Bitcoin’s network hashrate has fallen 3.5% since mid-June, marking the sharpest decline in computing power since July 2024.

-

1

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

2

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

5

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read