Nearly Half of Bitcoin’s Supply Remains Flat: What It Means for Investors

14.08.2024 18:30 1 min. read Alexander Stefanov

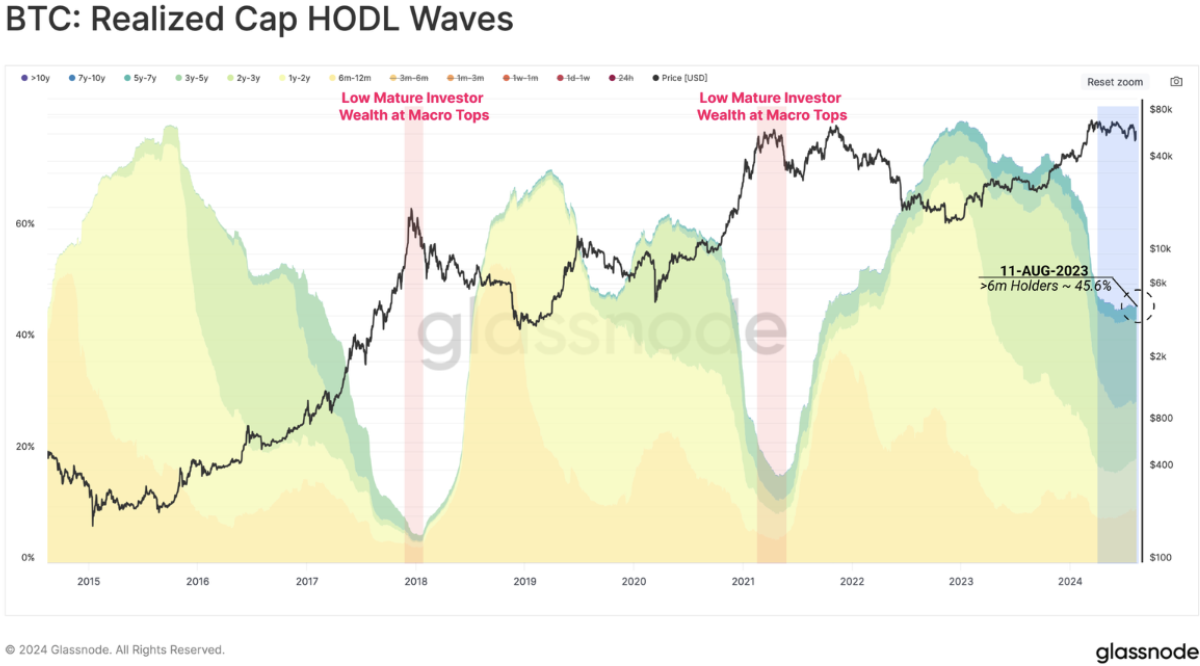

According to data from Glassnode, nearly half of Bitcoin's total supply has remained flat over the past six months, reflecting strong investor confidence.

Despite significant market volatility and a new all-time high reached five months ago, many Bitcoin holders have opted not to sell.

Glassnode’s findings indicate that over 45% of all BTC have been inactive in their portfolios for at least six months. This trend suggests that many long-term holders (LTH) – those who have held their coins for a minimum of 155 days – are keeping their investments rather than cashing them in during price spikes.

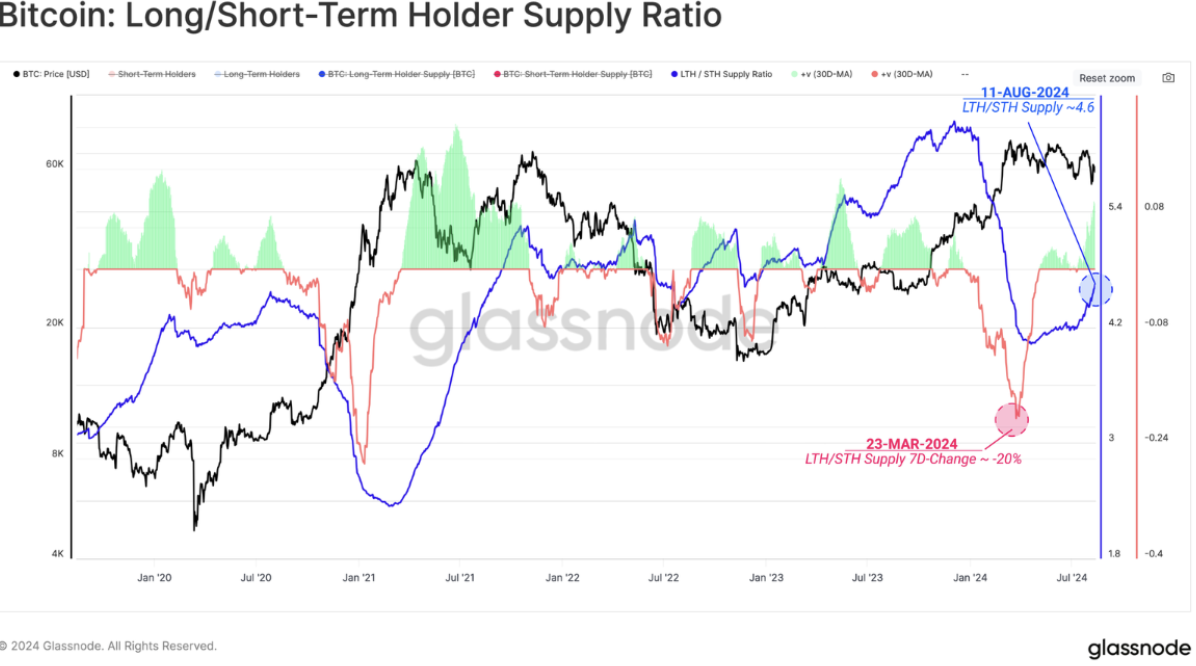

Traditionally, LTH have been known to sell off their coins in periods leading up to historic highs, such as the run-up to the March peak. However, recent data suggests a change, with LTH increasingly choosing to hold onto their coins.

This has contributed to the stabilisation and subsequent increase in the proportion of the network’s wealth controlled by them.

The company’s report points to a significant slowdown in LTH selling pressure, allowing wealth held by long-term investors to remain at historically high levels compared to previous all-time peaks. This shows that despite the selling pressure, many Bitcoin investors are confident in the asset’s long-term prospects.

While market sentiment remains cautious due to concerns about potential sell-offs and retests of recent lows, some analysts see reasons for optimism.

-

1

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read -

2

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

3

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read -

4

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

27.06.2025 12:00 1 min. read -

5

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

Bitcoin (BTC) has hit a new all-time high today at $123,090 as per data from CoinMarketCap and trading volumes have exploded as a result. Nearly $180 billion worth of Bitcoin has exchanged hands in the past 24 hours. This represents a 284% increase during this period. This volume accounts for 7.5% of BTC’s circulating supply. […]

Bitcoin Price Prediction From Bernstein After the Recent All-Time High

As Bitcoin surged to another record high above $123,000 on Monday, analysts at Bernstein offered a bullish long-term outlook for the digital asset, forecasting a transformative period ahead for the entire crypto sector.

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

Bitcoin treasury firm Strategy—formerly known as MicroStrategy—has expanded its already-massive BTC holdings with a fresh $472.5 million acquisition.

Robert Kiyosaki Reacts to Bitcoin’s Surge Past $120K: “I’m Buying One More”

Famed author of Rich Dad Poor Dad, Robert Kiyosaki, has once again thrown his support behind Bitcoin following its recent surge above $120,000, calling it a win for those who already hold the asset—and a wake-up call for those who don’t.

-

1

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read -

2

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

3

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read -

4

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

27.06.2025 12:00 1 min. read -

5

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read