Bitcoin Surges to Over $61,000 – What Could be the Reason?

13.08.2024 20:21 1 min. read Alexander Stefanov

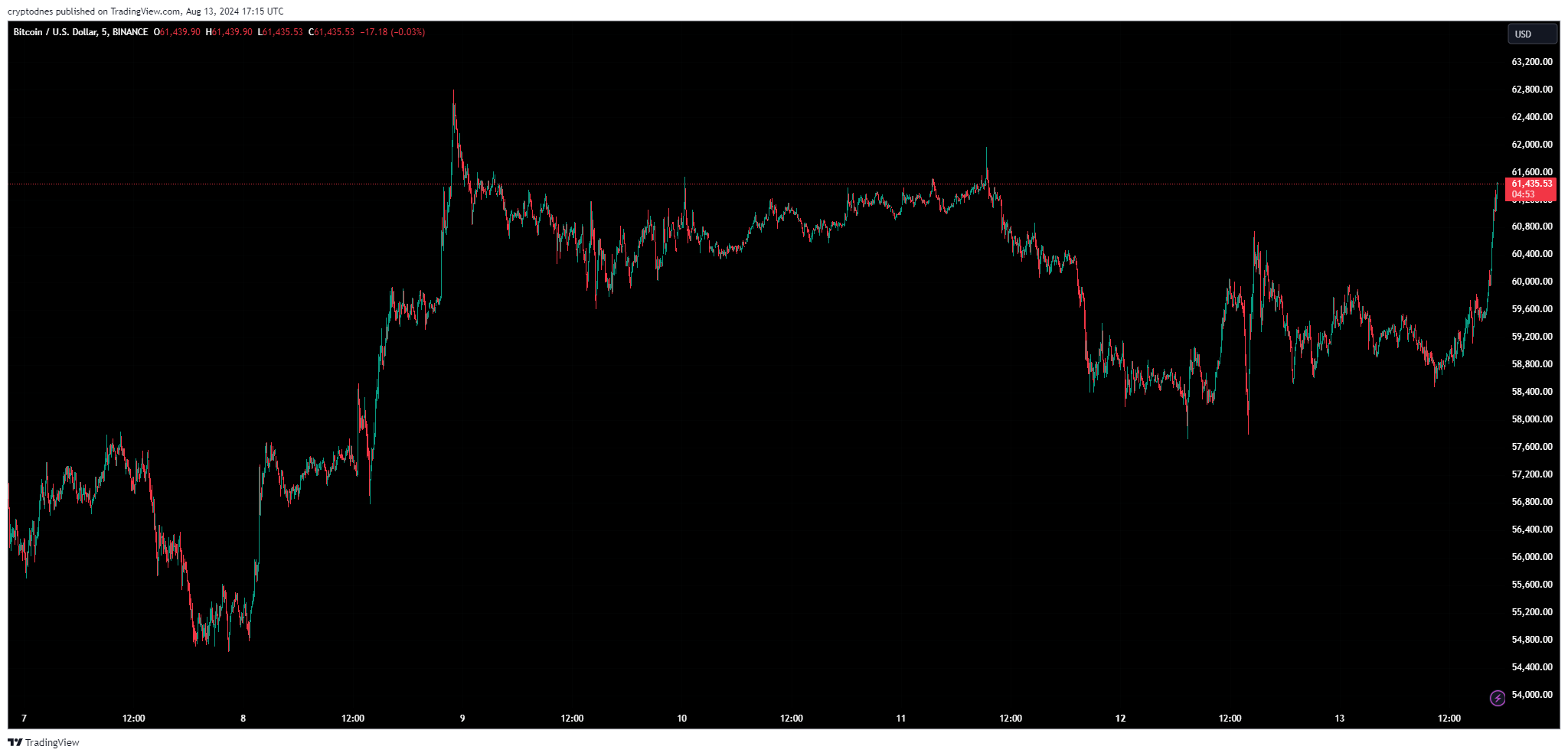

After experiencing a notable downturn, Bitcoin has managed to regain ground yet again in what looks like a short-term market revival.

Bitcoin’s price surged by around 2.6% in the past hour to $61,150. During the last 7 days, Bitcoin gained 7.4% after the recent lows and has a 24-hour volume of over $30 billion.

The number one crypto by market cap has a valuation of $1.2 billion, according to CoinMarketCap data.

Looking at the 1-day technical analysis from TradingView, there doesn’t seem to be any indication of where BTC is headed next. The summary and oscillators show “neutral” at 10 and 9, respectively, while moving averages point to “sell” at 8.

In the past 24 hours, $108.55 million were liquidated from the crypto market – $57.55 million in shorts and $51 million in long positions, according to CoinGlass data.

Ethereum also registered a significant surge of 1.8% in less than an hour and is currently trading over $2,700. The top altcoin has a 24-hour volume of around $17.3 billion.

The main reason for this notable surge could be that Mt.Gox’s repayment plan may be coming to an end after a wallet related to the exchange started testing out transactions earlier today.

-

1

Bitcoin and Ethereum ETFs See Over $1 Billion in Daily Inflows

23.05.2025 17:22 1 min. read -

2

Pakistan Embraces Bitcoin with National Reserve Plan and New Crypto Framework

29.05.2025 15:02 1 min. read -

3

Pakistan Bets Big on Bitcoin and AI with Energy, Incentives, and a New Regulator

26.05.2025 15:00 2 min. read -

4

Bitcoin Price Prediction: Traders Are Betting Heavily on a New All-Time High for BTC – $140K Next?

27.05.2025 22:23 3 min. read -

5

Bitcoin Pulls Back to $108K, But Options Market Signals Sky-High Expectations

24.05.2025 11:00 1 min. read

Corporate Bitcoin Adoption Still in Early Days, Says Bitwise CIO

Matt Hougan, CIO at Bitwise Asset Management, believes a powerful shift is underway—one that could reshape how companies manage their capital.

Nasdaq-Listed Mercurity Aims to Join Bitcoin Treasury Trend

As more corporations embrace Bitcoin as a strategic asset, Mercurity Fintech is entering the arena with an ambitious $800 million fundraising effort aimed at building a long-term BTC reserve.

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

Michael Saylor, executive chairman of MicroStrategy, believes Bitcoin is on a long-term path to unprecedented highs, predicting it could eventually reach $1 million per coin.

Arthur Hayes Sees Trouble Ahead for Bitcoin as Global Tensions Rise

BitMEX co-founder Arthur Hayes is warning traders to prepare for rough waters ahead, as global markets brace for another round of economic tension.

-

1

Bitcoin and Ethereum ETFs See Over $1 Billion in Daily Inflows

23.05.2025 17:22 1 min. read -

2

Pakistan Embraces Bitcoin with National Reserve Plan and New Crypto Framework

29.05.2025 15:02 1 min. read -

3

Pakistan Bets Big on Bitcoin and AI with Energy, Incentives, and a New Regulator

26.05.2025 15:00 2 min. read -

4

Bitcoin Price Prediction: Traders Are Betting Heavily on a New All-Time High for BTC – $140K Next?

27.05.2025 22:23 3 min. read -

5

Bitcoin Pulls Back to $108K, But Options Market Signals Sky-High Expectations

24.05.2025 11:00 1 min. read