Grayscale’s Ethereum ETF Outflows Declined – How Did Bitcoin ETFs Fare?

13.08.2024 12:35 1 min. read Kosta Gushterov

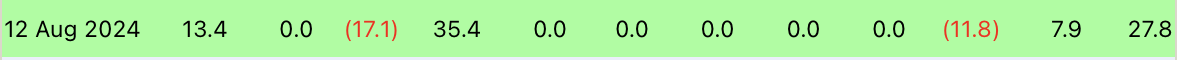

On August 12, spot Bitcoin exchange-traded funds (ETFs) in the U.S. recorded net inflows of just $27.8 million.

According to Farside, Grayscale’s GBTC-converted fund and Bitwise’s BITB were the only ETFs to experience outflows for the day, with $11.8 million and $17.1 million, respectively.

BlackRock’s Bitcoin fund (IBIT) was one of three funds to see inflows, adding $13.4 million. ARKB was the best performer of the day, bringing in $35.4 million, while Hashdex’s DEFI registered $7.9 million.

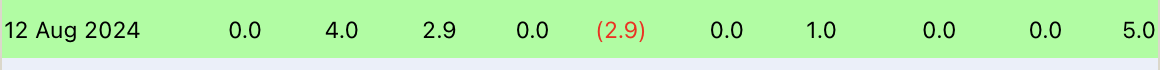

On the other hand, spot Ethereum ETFs also posted positive results on Monday, with total inflows amounting to $5 million.

The largest inflow was recorded by Fidelity’s FETH, with $4 million, followed by Bitwise’s ETHW with $2.9 million and Franklin Templeton’s EZET with $1 million.

Interestingly, Grayscale’s ETHE, which had previously seen large outflows, registered a neutral result this time.

-

1

Altcoin Market Poised for Turbulence as Key Support Levels Flash Signals

16.06.2025 21:00 2 min. read -

2

Pi Coin Eyes Potential Reversal After 70% Slide, Chart Pattern and Upcoming Event Hint at Rebound

24.06.2025 11:00 2 min. read -

3

Lion Group Bets Big on Altcoins With $500M Hyperliquid Strategy

20.06.2025 12:00 1 min. read -

4

Whale Activity Signals Possible Turning Points for Key Altcoins, Says Santiment

14.06.2025 20:00 2 min. read -

5

Fetch.AI Commits $50M to Token Buyback Amid Platform Growth

20.06.2025 16:00 1 min. read

Arthur Hayes Warns of Bitcoin Pullback to $90,000: Here is Why

BitMEX co-founder Arthur Hayes has issued a cautious outlook for Bitcoin and the broader crypto market, predicting a possible short-term downturn as the U.S. government shifts its liquidity strategy.

Bitcoin Whales Accumulate as Long-Term Holders Hit All-Time High

Bitcoin’s bullish undercurrent continues to strengthen as on-chain data and derivatives market behavior reveal aggressive accumulation from long-term holders and whales.

Ethereum Core Developer Launches Foundation to Push ETH to $10,000

Zak Cole, a prominent Ethereum core developer, has unveiled a bold new initiative aimed at significantly expanding the Ethereum ecosystem and driving the price of ETH to $10,000.

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

According to a new report by CryptoQuant, Chainlink (LINK) is locked in a prolonged accumulation phase between $12 and $15, driven by aggressive whale behavior amid muted retail participation.

-

1

Altcoin Market Poised for Turbulence as Key Support Levels Flash Signals

16.06.2025 21:00 2 min. read -

2

Pi Coin Eyes Potential Reversal After 70% Slide, Chart Pattern and Upcoming Event Hint at Rebound

24.06.2025 11:00 2 min. read -

3

Lion Group Bets Big on Altcoins With $500M Hyperliquid Strategy

20.06.2025 12:00 1 min. read -

4

Whale Activity Signals Possible Turning Points for Key Altcoins, Says Santiment

14.06.2025 20:00 2 min. read -

5

Fetch.AI Commits $50M to Token Buyback Amid Platform Growth

20.06.2025 16:00 1 min. read