Bitcoin Fear Index Plunges Amid Market Volatility

12.08.2024 18:00 1 min. read Alexander Stefanov

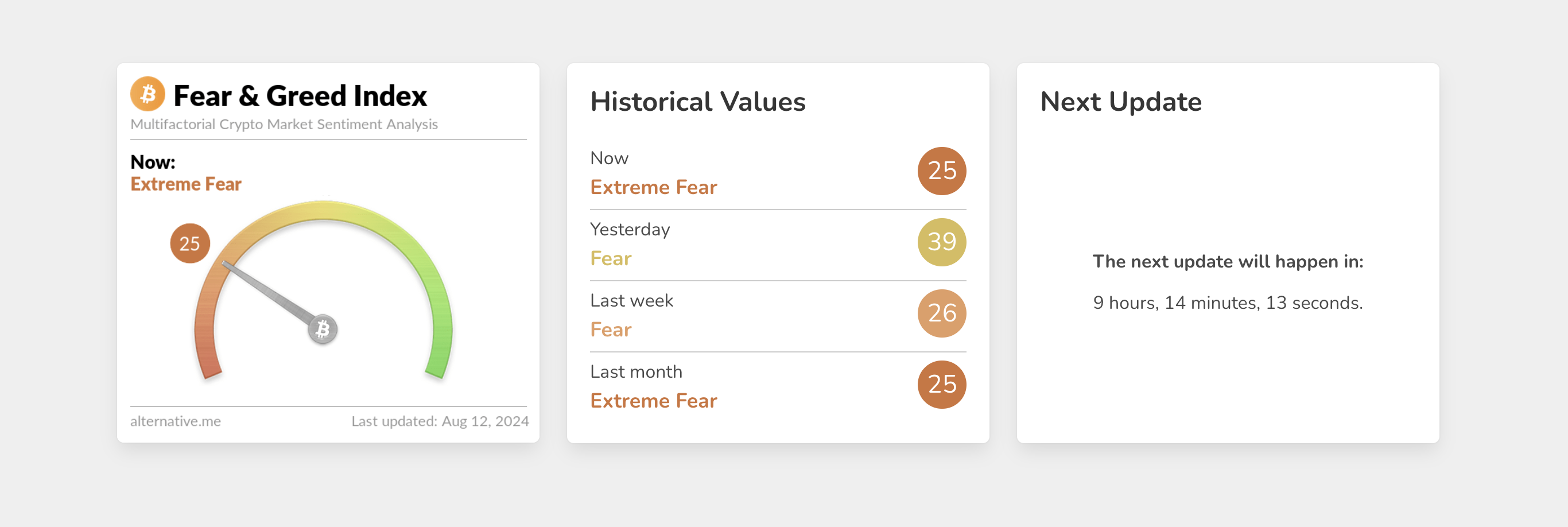

The Bitcoin Fear & Greed Index has plummeted to "extreme fear," scoring 25 out of 100.

This drop followed Bitcoin’s intraday low of $58,134 on Monday on Bitstamp. CoinGlass data reveals that over $123 million in long positions were liquidated.

Last Monday, Bitcoin experienced a significant crash, falling to $49,557 on Bitstamp, influenced by global stock market contagion. However, Bitcoin quickly rebounded along with global stocks, reclaiming the $60,000 level by Thursday. This marked Bitcoin’s most substantial rally since February 2022.

Institutional investors played a key role in the recovery, with BlackRock’s Bitcoin ETF remaining stable despite the market downturn. Nonetheless, Bitcoin bulls faced challenges in sustaining momentum, with the cryptocurrency failing to stay above $60,000.

JPMorgan analysts recently warned of a lack of bullish catalysts for Bitcoin, highlighting the vulnerability of equities as a concern for crypto.

At the time of writing, S&P 500 and Nasdaq futures are flat, suggesting Bitcoin’s bearish trend is not directly tied to the stock market. Additionally, Bitcoin has formed its first death cross of 2024, which might indicate a bearish reversal, though this is often considered a lagging indicator based on historical data.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

4

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

5

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

4

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

5

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read