Bitcoin Faces Risk of Further Price Crash – What to Expect

05.08.2024 8:00 2 min. read Alexander Stefanov

Bitcoin has experienced a 10% decline in value over the past week, dropping from a peak of $69,801 on July 29 to around $57,000.

This price drop suggests a potential buying opportunity, yet trader activity indicates reluctance to invest during this dip.

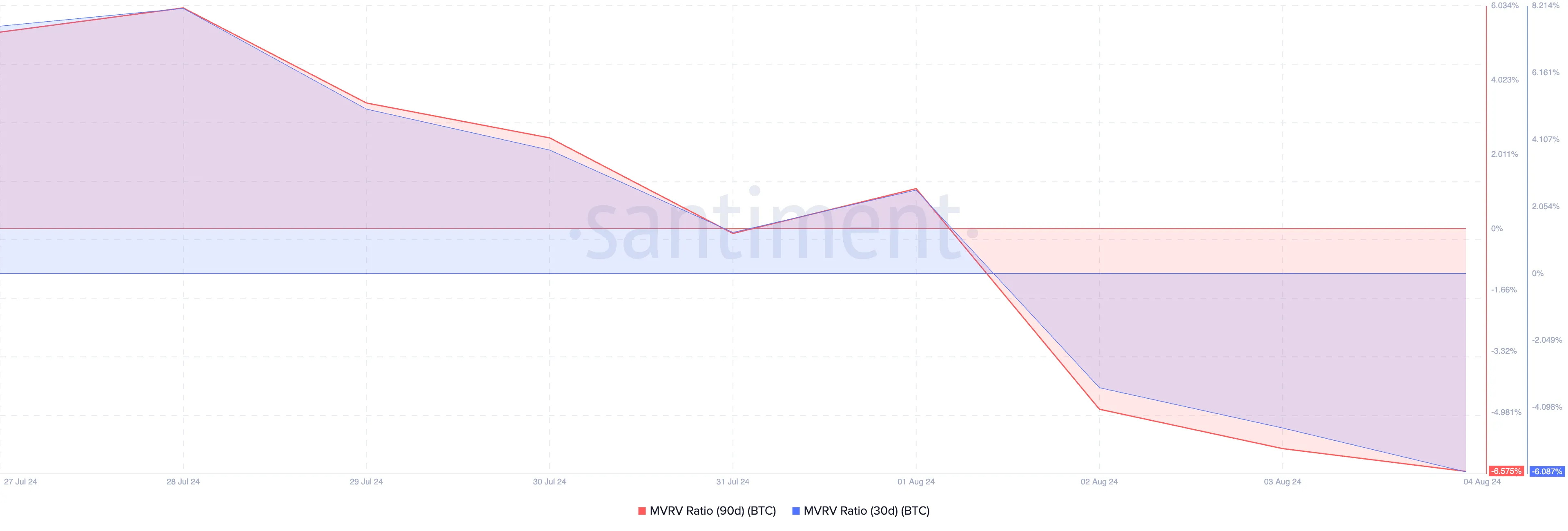

An important indicator, Bitcoin’s market value to realized value (MVRV) ratio, suggests the cryptocurrency might be undervalued. Santiment reports negative MVRV ratios for 30-day and 90-day periods, both below zero, signaling that Bitcoin’s market price is lower than the average purchase price of its tokens.

Typically, a negative MVRV ratio points to a good buying opportunity, but traders are currently cautious, fearing further declines.

The BTC Fear and Greed Index stands at 34, reflecting a fearful market sentiment. On-chain data provider Santiment notes that unlike a similar dip in early July, current market participants are not eager to buy the dip.

🤷 With this dip being roughly on par to the one we saw in early July, the same crowd enthusiasm for dip buying isn’t present… at least not yet. Look for $60K BTC or $2.9K ETH to be key psychological levels that may be enough for traders to open their wallets. pic.twitter.com/rRSVFMY4AW

— Santiment (@santimentfeed) August 3, 2024

Analysts warn that negative sentiment in the crypto market and adverse macroeconomic factors could push Bitcoin’s price to $50,000 or lower. CryptoQuant analyst Abramchart highlights that Bitcoin has failed to maintain the short-term support level of $64,580.

If it continues to fall, it might target the $53,000 to $54,000 range. Additionally, 10x Research points out that weakening economic indicators and potential stock market declines further increase this risk. They also suggest that a possible emergency rate cut by the Federal Reserve, in response to a declining stock market, could worsen Bitcoin’s decline by signaling economic distress rather than recovery.

-

1

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

2

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

-

1

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

2

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read