Michael Saylor is Looking for a Government Bitcoin Bailout – Peter Schiff

26.07.2024 20:15 2 min. read Alexander Stefanov

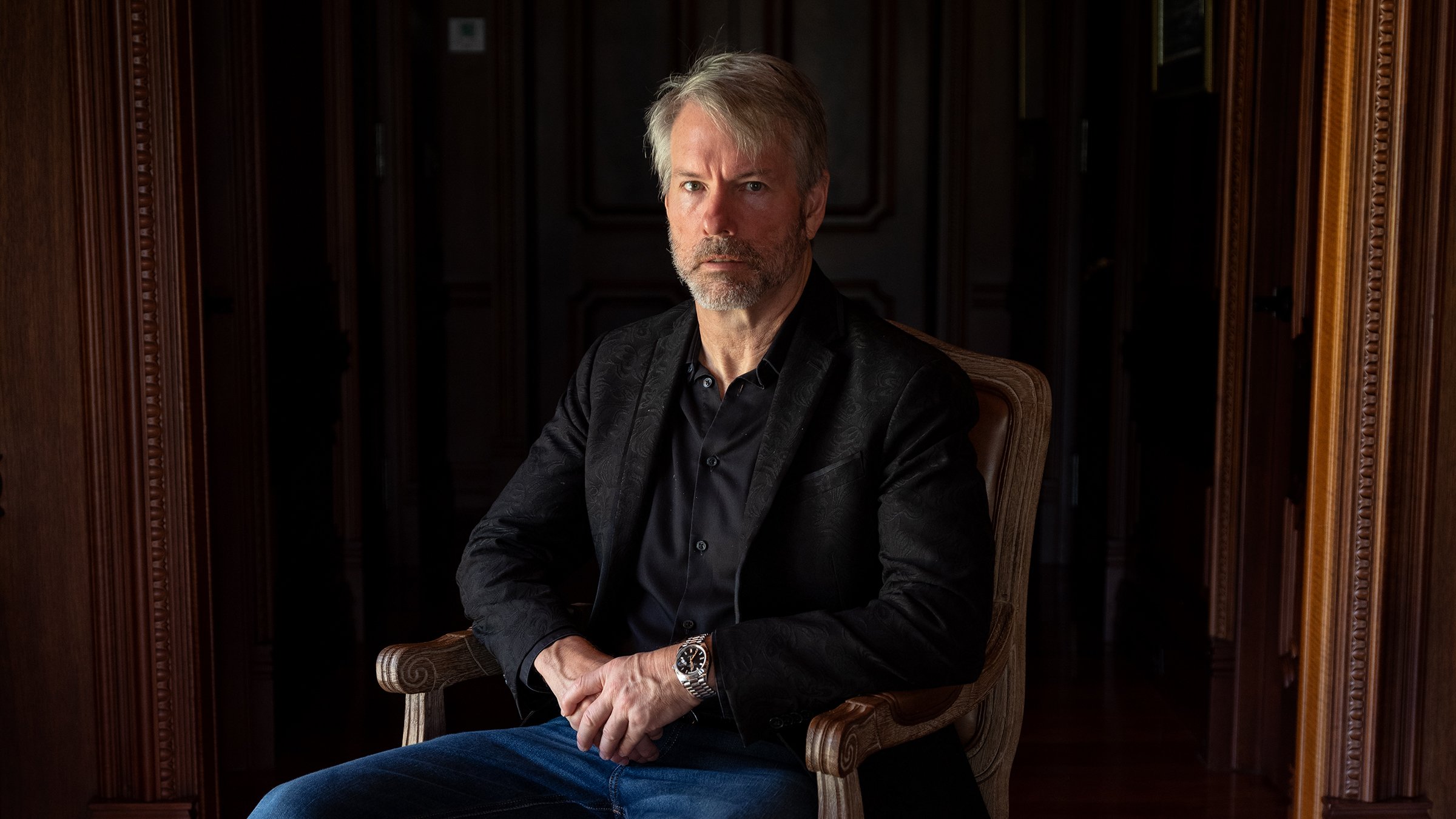

Economist Peter Schiff has harshly criticized Michael Saylor, the founder of MicroStrategy, for his recent Bitcoin advocacy.

Saylor’s proposal suggested that the U.S. should back its currency with Bitcoin, comparing it to “cyber Manhattan.”

Saylor argued that adopting Bitcoin could bolster the U.S. economy similarly to historic land acquisitions like the Louisiana Purchase.

He urged the government to acquire a significant Bitcoin reserve, drawing a parallel to its existing gold and land holdings.

[readmroe id=”134178″]Schiff rejected Saylor’s proposal, denouncing it as a form of a pyramid scheme. He warned that such a move could endanger taxpayers if the scheme fails.

Ironically, @saylor is looking for a government #Bitcoin bailout. He knows the Bitcoin blockchain letter is running out of chain and wants the U.S. government to become the buyer of last resort, leaving American taxpayers as the ultimate bag holders in the Bitcoin pyramid scheme.

— Peter Schiff (@PeterSchiff) July 26, 2024

Schiff criticized Bitcoin as lacking real value and yield compared to traditional investments and commodities.

The renowned economis also targeted the Bitcoin documentary “God Bless Bitcoin,” accusing it of falsely portraying Bitcoin as an equitable investment and efficient in energy use. He argued that Bitcoin is wasteful and that early investors have an unfair advantage over later entrants.

The exchange highlights the ongoing debate over Bitcoin’s role and value in the financial system, with Saylor envisioning a pivotal role for Bitcoin and Schiff remaining a vocal skeptic.

-

1

Here’s Why Bitcoin Could Be Gearing Up for Its Next Move Despite the Pullback

09.06.2025 8:00 2 min. read -

2

BlackRock and Fidelity Pour Over $500M Into Bitcoin in One Day

25.06.2025 21:00 1 min. read -

3

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

4

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

5

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

Coinbase CEO Brian Armstrong has spotlighted a significant acceleration in institutional crypto adoption, driven largely by the surging popularity of exchange-traded funds and increased use of Coinbase Prime among major corporations.

What Will Happen With the Stock Market if Trump Reshapes the Fed?

Jefferies chief market strategist David Zervos believes an upcoming power shift at the Federal Reserve could benefit U.S. equity markets.

U.S. Bank Advises Clients to Drop These Cryptocurrencies

Anchorage Digital, a federally chartered crypto custody bank, is urging its institutional clients to move away from major stablecoins like USDC, Agora USD (AUSD), and Usual USD (USD0), recommending instead a shift to the Global Dollar (USDG) — a stablecoin issued by Paxos and backed by a consortium that includes Anchorage itself.

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

Ethereum co-founder Vitalik Buterin has voiced concerns over the rise of zero-knowledge (ZK) digital identity projects, specifically warning that systems like World — formerly Worldcoin and backed by OpenAI’s Sam Altman — could undermine pseudonymity in the digital world.

-

1

Here’s Why Bitcoin Could Be Gearing Up for Its Next Move Despite the Pullback

09.06.2025 8:00 2 min. read -

2

BlackRock and Fidelity Pour Over $500M Into Bitcoin in One Day

25.06.2025 21:00 1 min. read -

3

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

4

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

5

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read