Bitcoin Breaks $68K, After Recent Price Slump

26.07.2024 23:01 1 min. read Alexander Stefanov

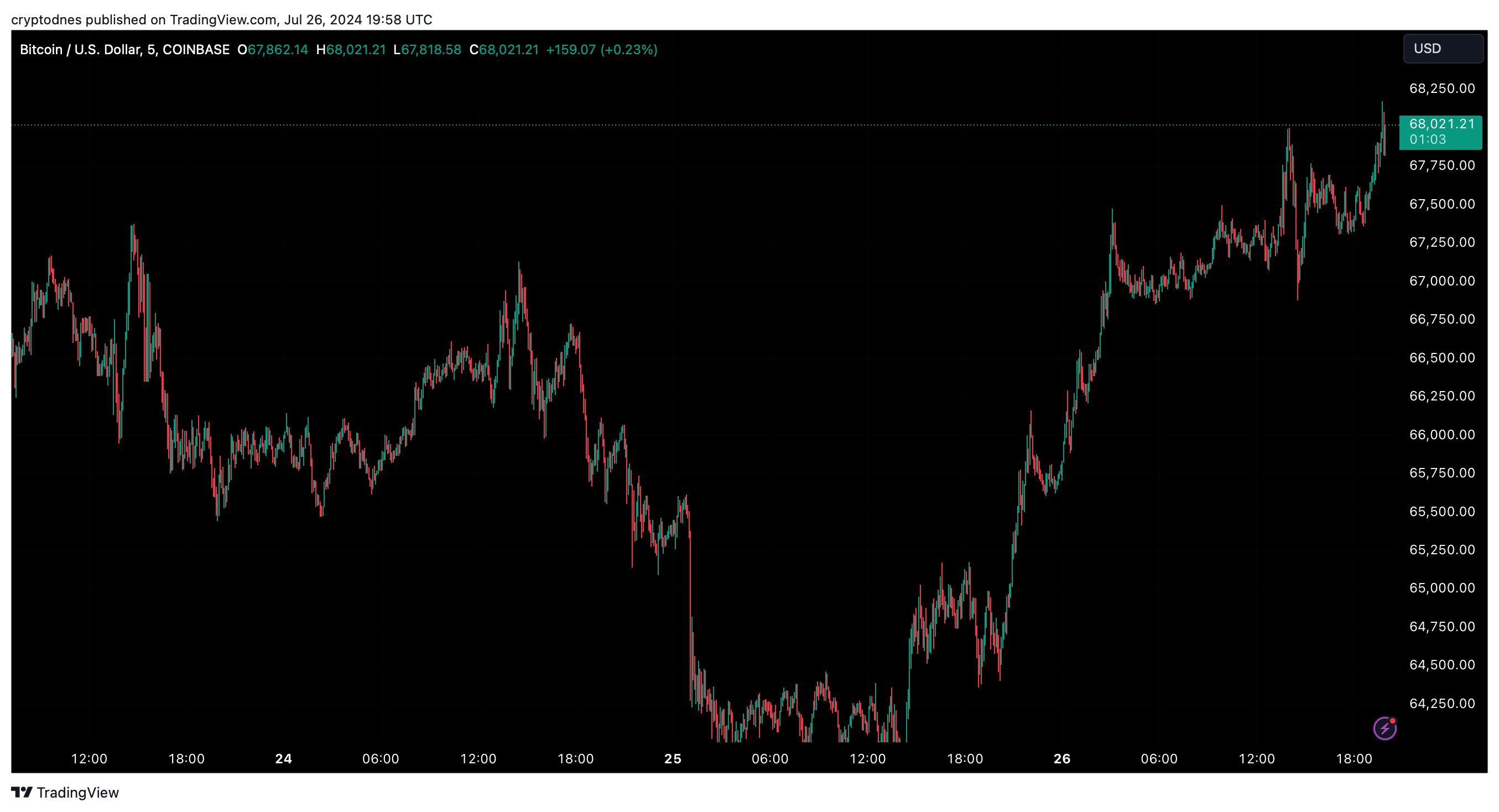

Bitcoin managed to regain its bullish momentum after the recent crypto market correction.

After the recent stock market crash, that deleted over $1 trillion, and the crypto market correction, Bitcoin is again on track to the $70,000 barrier.

At the time of writing, Bitcoin is trading at slightly over $68,000 after a 5% surge in the past 24 hours and has a $32.1 billion volume.

The total market cap of the crypto market reached $2.4 trillion after surging 4% and Bitcoin represents $1.34 of the total value.

According to CoinGlass data, $122.90 million were liquidated in the past 24 hours ($40.3 million in long positions and $82 million in shorts),

The 1-day technical analysis from TradingView also showcases the investors’ bullish santiment. The summary and moving averages show “strong buy” at 16, while the oscilators point to “buy” at 2.

-

1

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

2

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

-

1

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

2

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read