Bitcoin ETFs in the US Slow Down Their Inflows

26.07.2024 15:00 1 min. read Kosta Gushterov

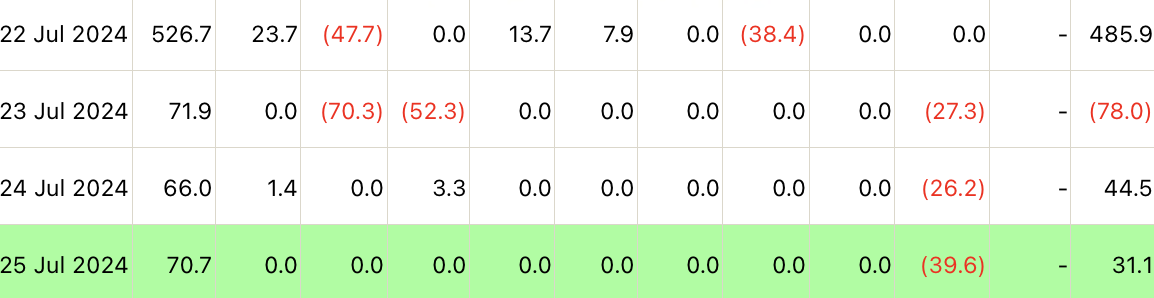

After U.S.-based spot Bitcoin exchange traded funds (ETFs) saw their highest inflows since June 4 on Monday (July 22), momentum slowed toward the end of the week.

Farside reported that spot BTC ETFs received a total of $31.1 million on July 25.

While the results are positive, they are well down from the $485.9 million raised on Monday.

Reportedly, only BlackRock’s iShares Bitcoin Trust (IBIT) recorded inflows equivalent to $70.7 million, while almost all other funds recorded neutral performance.

The exception was Greyscale’s GBTC, which again recorded outflows of $39.6 million.

-

1

Bitcoin and Ethereum Face $6 Billion Reckoning as Bears Tighten Grip

17.10.2025 9:30 1 min. read -

2

ETF Inflows Signal Confidence as Bitcoin Consolidates

10.10.2025 13:00 2 min. read -

3

Galaxy Digital swaps Bitcoin rigs for AI servers in Texas

11.10.2025 19:00 1 min. read -

4

Crypto ETFs Hit by $755M in Withdrawals Following Trump Tariff Shock

14.10.2025 11:00 1 min. read -

5

Bitcoin’s Volatility Hits Record Low as Derivative Selling Pressure Fades – Analysts Warn of Sharp Move Ahead

08.10.2025 15:00 2 min. read

Big Players Short Bitcoin as Market Confidence Wavers

Bitcoin faced renewed downward pressure on Thursday as large holders, known as whales, began aggressively shorting the market ahead of Wall Street’s opening bell.

Bitcoin Volatility Erupts – Traders Fear Massive Sell-Off Ahead of CPI Data

Bitcoin hovered around $109,000 on Oct. 23, with traders watching a narrowing price corridor and growing market tension.

Altcoin ETFs on the Rise as Government Shutdown Delays SEC Reviews

Traders and investors have been eagerly anticipating the arrival of altcoin ETFs, even as the recent U.S. government shutdown has slowed the regulatory review process.

Standard Chartered Predicts Bitcoin Rally – Here’s What Could Drive It

Despite last month’s $19 billion market liquidation, Standard Chartered remains confident that Bitcoin (BTC) is poised for a significant rebound.

-

1

Bitcoin and Ethereum Face $6 Billion Reckoning as Bears Tighten Grip

17.10.2025 9:30 1 min. read -

2

ETF Inflows Signal Confidence as Bitcoin Consolidates

10.10.2025 13:00 2 min. read -

3

Galaxy Digital swaps Bitcoin rigs for AI servers in Texas

11.10.2025 19:00 1 min. read -

4

Crypto ETFs Hit by $755M in Withdrawals Following Trump Tariff Shock

14.10.2025 11:00 1 min. read -

5

Bitcoin’s Volatility Hits Record Low as Derivative Selling Pressure Fades – Analysts Warn of Sharp Move Ahead

08.10.2025 15:00 2 min. read

On Friday, July 12, U.S.-based spot Bitcoin exchange traded funds (ETFs) registered inflows of $310.1 million, their best day since June 5 and for the entire week.

Following Bitcoin's price surge to over $60,000 on July 14 and subsequent strong performance through July 16, investors in BTC ETFs appear to be maintaining their confidence in the asset.

The winning streak for U.S. spot Bitcoin ETFs came to a sudden halt on Thursday, as investors withdrew over $358 million — the sharpest daily outflow since March.

ETF analyst Nate Geraci has noted a major milestone for Bitcoin exchange-traded funds (ETFs), which are now nearing a collective 1 million BTC in holdings - around 5% of Bitcoin’s total supply.

The crypto market has seen rapid growth in the last few months, with the market cap surpassing over $3.1T.

BlackRock’s IBIT Bitcoin ETF has quickly become the third-largest Bitcoin holder globally, trailing only behind Bitcoin's enigmatic creator, Satoshi Nakamoto.

In early January, U.S. spot Bitcoin exchange-traded funds (ETFs) experienced a sharp rebound, attracting nearly $1.9 billion in net inflows on January 3 and 6.

On April 17, 2025, U.S. spot Bitcoin ETFs experienced a significant uptick in inflows, while Ethereum ETFs saw no net movement, according to data from Farside Investors.

U.S.-listed spot Bitcoin ETFs continue to post strong inflows, recording their ninth consecutive day of net positive investment activity on Tuesday.

Bitcoin is once again at the center of market attention after a surge of fresh institutional demand and bold forecasts for the months ahead.

Spot Bitcoin (BTC) exchange-traded funds (ETFs) in the U.S. recorded net inflows of $194.6 million on Tuesday, reversing Monday's outflows.

Bitcoin ETF investors appear to be cashing out after a six-day streak of gains ended on November 14, with most ETFs seeing significant outflows.

On Monday (July 22), US-based spot Bitcoin exchange traded products (ETFs) saw their highest inflows since June 4.

Bitcoin exchange-traded funds (ETFs) in the United States recorded significant net outflows of nearly $100 million on Thursday, coinciding with a sharp decline in the U.S. stock market.

Spot Bitcoin ETFs recorded a massive influx of over $1 billion in a single day on Thursday, fueled by Bitcoin’s surge to a new all-time high above $118,000.

Bitcoin spot exchange-traded funds (ETFs) recently faced significant net outflows totaling $210 million, highlighting ongoing turbulence in the cryptocurrency market.

On Monday alone, U.S.-listed spot BTC ETFs recorded more than $250 million in outflows—the third straight day of withdrawals—suggesting a shift in sentiment as investors reassess their exposure.

On Wednesday, U.S. Bitcoin exchange traded funds (ETFs) saw net outflows totaling $37.2 million, the sixth consecutive day of negative flows.

Bitcoin has faced notable challenges as U.S. spot Bitcoin ETFs reported significant outflows, reflecting a shift in investor sentiment.

U.S. spot bitcoin ETFs experienced a surge in demand on Monday, recording $274.6 million in net inflows—their highest since early February.