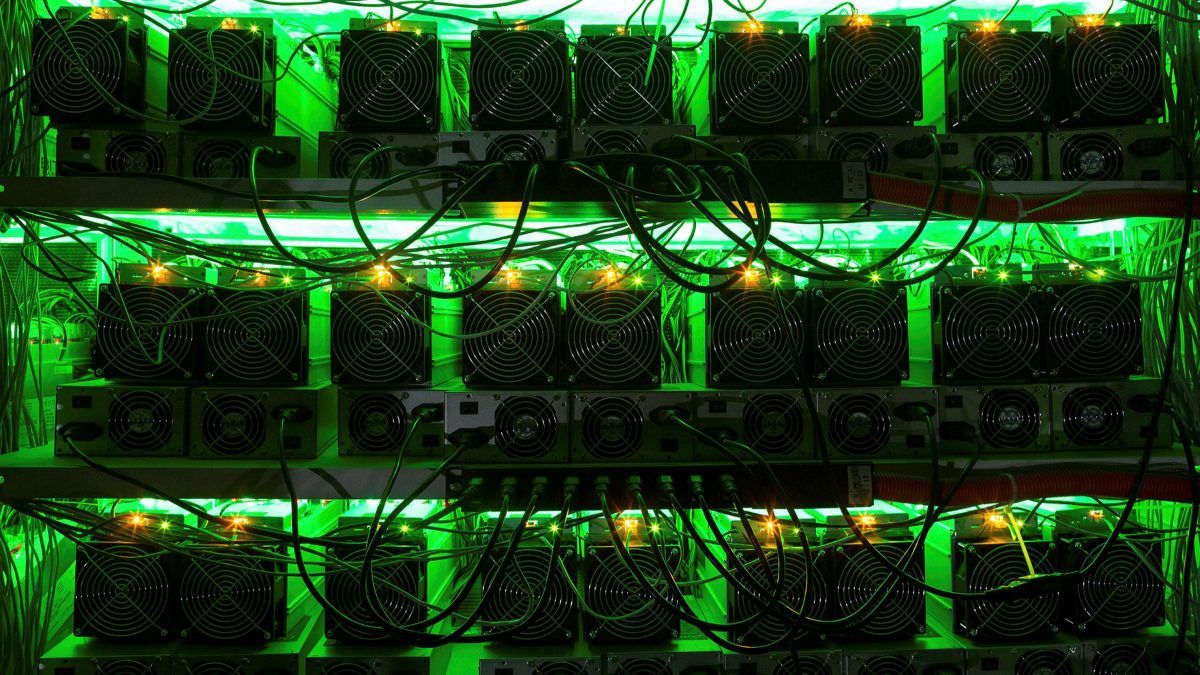

Riot Platforms Buys Block Mining to Expand Bitcoin Mining Capacity

24.07.2024 19:00 1 min. read Alexander Stefanov

Riot Platforms, a major player in Bitcoin mining, has acquired Block Mining, a miner based in Kentucky, in a deal valued at $92.5 million.

This acquisition is set to enhance Riot’s mining capabilities significantly.

The company announced that the purchase will immediately add 60 megawatts (MW) to its operational capacity, with plans to expand Block Mining’s two facilities to a total of 110 MW by the end of 2024. This expansion would increase Riot’s overall potential capacity to 2 gigawatts.

Riot CEO Jason Les highlighted that the acquisition will diversify the company’s operations across the U.S. and accelerate growth in Kentucky. The deal includes $18.5 million in cash and $74 million in Riot common stock.

Despite the acquisition, Riot reported a decline in Bitcoin production, mining 255 BTC in June, a decrease from both May and June of the previous year. Riot’s stock fell by 5.31% on Tuesday and has decreased by nearly 25% year-to-date.

-

1

Japan’s Metaplanet Aims for 1% of All Bitcoin with Bold Market Move

06.06.2025 19:00 1 min. read -

2

Here’s Why Bitcoin Could Be Gearing Up for Its Next Move Despite the Pullback

09.06.2025 8:00 2 min. read -

3

BlackRock and Fidelity Pour Over $500M Into Bitcoin in One Day

25.06.2025 21:00 1 min. read -

4

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

5

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read

U.S. Bank Advises Clients to Drop These Cryptocurrencies

Anchorage Digital, a federally chartered crypto custody bank, is urging its institutional clients to move away from major stablecoins like USDC, Agora USD (AUSD), and Usual USD (USD0), recommending instead a shift to the Global Dollar (USDG) — a stablecoin issued by Paxos and backed by a consortium that includes Anchorage itself.

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

Ethereum co-founder Vitalik Buterin has voiced concerns over the rise of zero-knowledge (ZK) digital identity projects, specifically warning that systems like World — formerly Worldcoin and backed by OpenAI’s Sam Altman — could undermine pseudonymity in the digital world.

What Are the Key Trends in European Consumer Payments for 2024?

A new report by the European Central Bank (ECB) reveals that digital payment methods continue to gain ground across the euro area, though cash remains a vital part of the consumer payment landscape — particularly for small-value transactions and person-to-person (P2P) payments.

History Shows War Panic Selling Hurts Crypto Traders

Geopolitical conflict rattles markets, but history shows panic selling crypto in response is usually the wrong move.

-

1

Japan’s Metaplanet Aims for 1% of All Bitcoin with Bold Market Move

06.06.2025 19:00 1 min. read -

2

Here’s Why Bitcoin Could Be Gearing Up for Its Next Move Despite the Pullback

09.06.2025 8:00 2 min. read -

3

BlackRock and Fidelity Pour Over $500M Into Bitcoin in One Day

25.06.2025 21:00 1 min. read -

4

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

5

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read