Mt. Gox Has Once Again Transferred Billions of Dollars Worth of Bitcoins

24.07.2024 9:27 1 min. read Kosta Gushterov

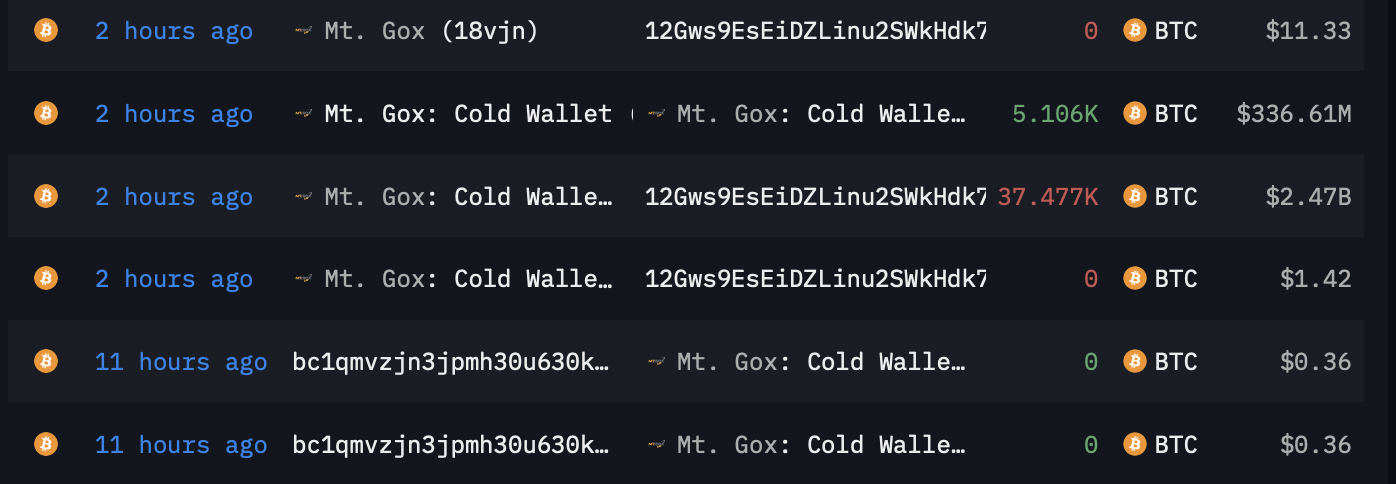

On July 24 the defunct Japanese crypto exchange Mt. Gox transferred 37,477 BTC, equivalent to $2.5 billion at the time of the transaction, to an unknown crypto address.

According to Arkham Intelligence, a blockchain analytics company, out of the total amount, 5,106 BTC were additionally transferred to another cold wallet owned by Mt. Gox.

This transaction took place after the exchange transferred $2.8 billion in BTC to various wallets on July 22. Of that, $340 million was sent to four wallets linked to the Bitstamp crypto exchange.

According to CryptoQuant, aroud 40% of the amounts owed to Mt. Gox’s creditors have been paid at the time of publication. This indicates that 60%, or $5.6 billion, is still in the process of being distributed to creditors.

36% of the Mt. Gox Bitcoin has been distributed to creditors

“The trustee holds 141,686 $BTC, which will be distributed over time. With yesterday’s transaction, 36% of the Bitcoin has been moved to their former users.” – By @JA_Maartun

Link 👇https://t.co/SwU1ufNoQr pic.twitter.com/LMUBPrZBPN

— CryptoQuant.com (@cryptoquant_com) July 17, 2024

-

1

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

2

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

-

1

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

2

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read