Mt. Gox Moves Over $2.8 Billion in Bitcoin – BTC Price is Dropping

23.07.2024 9:42 2 min. read Alexander Stefanov

Mt. Gox, a Japanese crypto exchange that collapsed in 2014, continues to transfer significant amounts into Bitcoin (BTC) as part of a plan to repay its obligations to creditors.

Mt. Gox reportedly transferred 42,587 BTC worth about $2.85 billion into an internal wallet on Tuesday, July 23. Another 5,110 BTC was also transferred from another internal wallet, bringing the exchange’s current holdings to 90,344 BTC worth about $6 billion.

Mt. Gox just moved 42,587 $BTC ($2.84B) 20 minutes ago, including:

➡️37,477 $BTC ($2.5B) to a new wallet “15yPUC”, probably to repay creditors;

➡️ 5,110 $BTC ($341M) to another internal cold wallet of Mt. Gox.Currently, Mt. Gox still holds 101,507 $BTC ($6.78B).

Follow… https://t.co/LQ053wigB3 pic.twitter.com/bmP4EpPNw4

— Spot On Chain (@spotonchain) July 23, 2024

Earlier, on July 16, Mt. Gox announced that it had begun paying out Bitcoin and Bitcoin Cash to 13,000 of its roughly 20,000 creditors, accompanying a significant $6 billion transfer of Bitcoin.

After the latest transfers, the bankrupt crypto exchange’s current holdings stand at 90.344 BTC worth about $6.02 billion, according to Arkham.

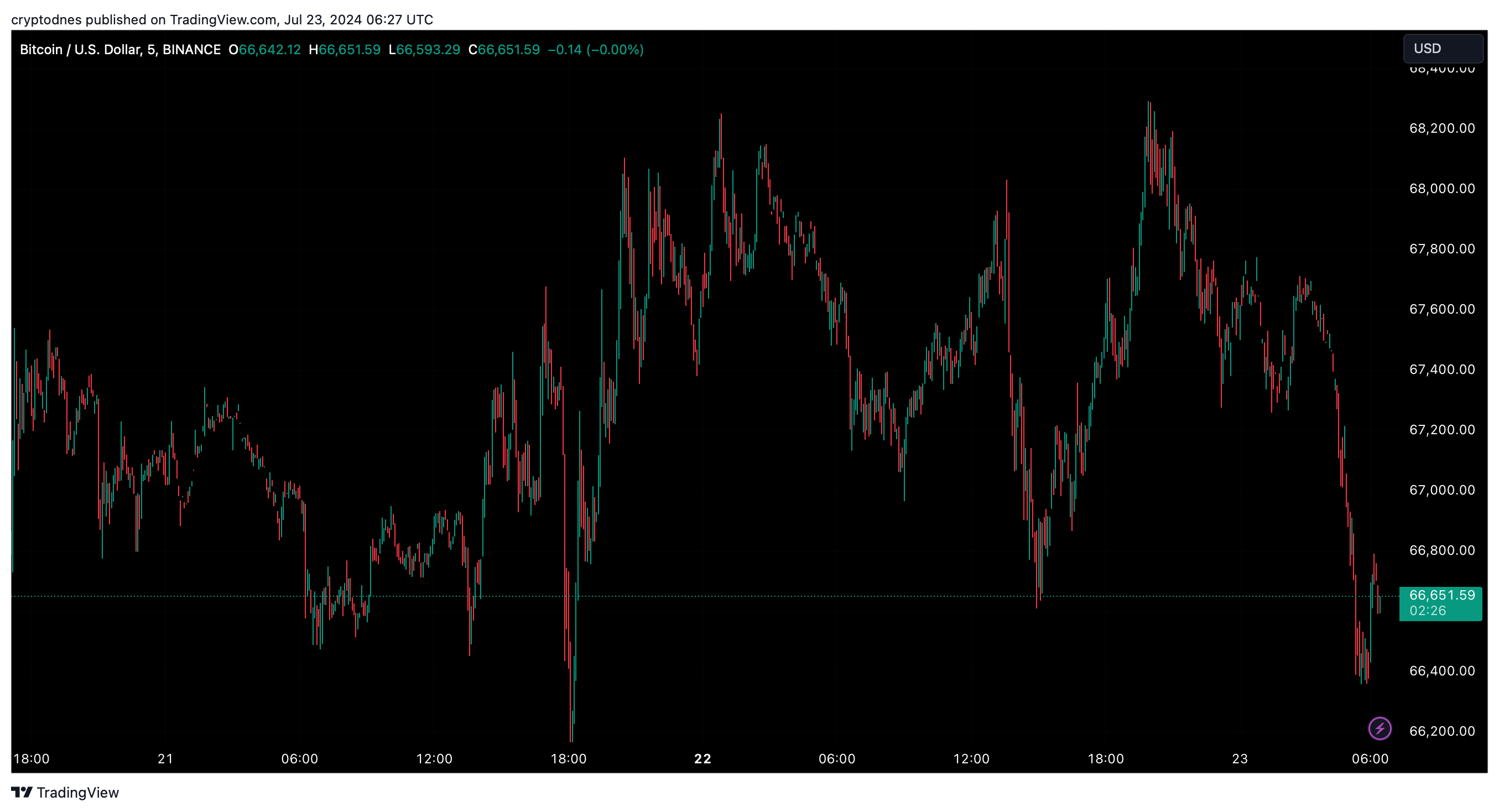

Bitcoin’s significant moves have fueled speculation about their impact on the crypto market as happened a few weeks ago.

At the time of writing, the price of BTC has fallen and lost 1.52% of its value in the last 24 hours, trading at $66,645. However, the decline in the price of Bitcoin may be temporary as it has remained steady at $65,000 following another significant move by Mt. Gox on July 16.

-

1

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

Gold advocate Peter Schiff issued a stark warning on monetary policy and sparked fresh debate about Bitcoin’s perceived scarcity. In a pair of high-profile posts on July 12, Schiff criticized the current Fed rate stance and challenged the logic behind Bitcoin’s 21 million supply cap.

Bitcoin Price Hits Record Highs as Exchange Balances Plunge

A sharp divergence has emerged between Bitcoin’s exchange balances and its surging market price—signaling renewed long-term accumulation and supply tightening.

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

Bitcoin touched a new all-time high of $118,000, but what truly fueled the rally?

Bitcoin Lesson From Robert Kiyosaki: Buy Now, Wait for Fear

Robert Kiyosaki, author of Rich Dad Poor Dad, has revealed he bought more Bitcoin at $110,000 and is now positioning himself for what macro investor Raoul Pal calls the “Banana Zone” — the parabolic phase of the market cycle when FOMO takes over.

-

1

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read