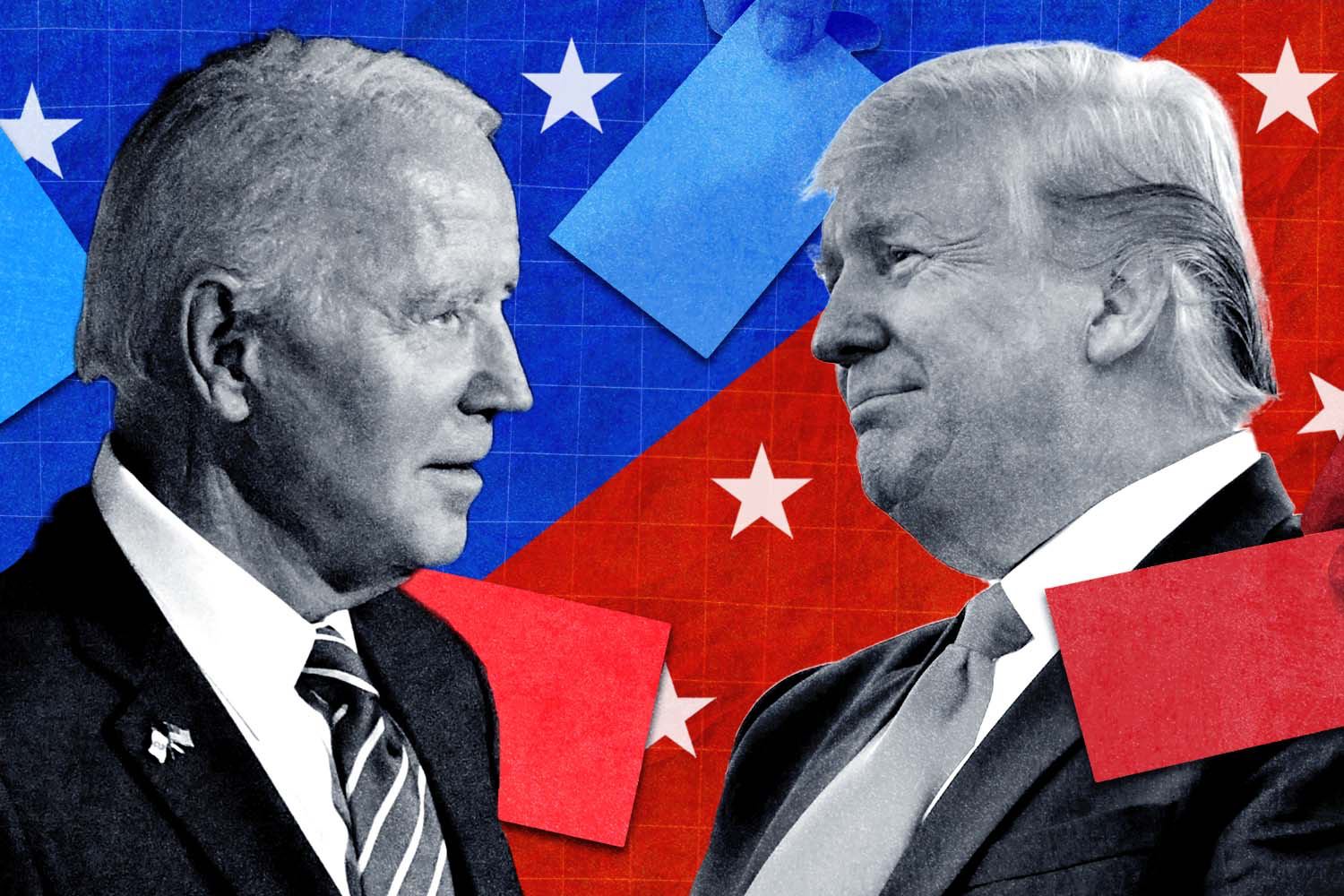

Crypto Platform Expands BTC and ETH Options Ahead of 2024 US Election

17.07.2024 20:00 1 min. read Alexander Stefanov

Deribit is launching BTC and ETH options expiring on November 8, 2024, ahead of the US presidential election.

This move aims to cater to investor strategies anticipating market movements tied to the election, scheduled for November 5.

The top derivatives exchange announced on social media that these early options will allow clients to speculate and hedge positions in response to potential election outcomes. Trading begins at 8 AM UTC on July 18 to facilitate strategic positioning.

Deribit has been a dominant force in the crypto derivatives market, contributing significantly to the $51.1 billion Bitcoin options trading volume, with over $2 billion in open interest in recent trading periods.

READ MORE:

Here’s Why Bitcoin Could Hit $100,000 Soon

This initiative adds election-related options to its diverse array of trading products developed to meet client demands.

The introduction of election-themed options aligns with a broader trend in blockchain-based political finance, enabling global participation in US election events.

This includes platforms like Polymarket, where users can engage in prediction markets on election outcomes amidst heightened market interest following recent political developments.

-

1

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

06.06.2025 13:00 1 min. read -

2

Canada Green-Lights First XRP ETF, Beating the U.S. to Market

17.06.2025 9:00 1 min. read -

3

Top 4 Cryptos to Watch This Summer, Offering 1000x Growth Potential

16.06.2025 13:43 4 min. read -

4

Uphold Wants to Pay Yield on XRP – Here’s the Work-Around

15.06.2025 19:00 2 min. read -

5

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

Chainlink Bounces From Key Support, Eyes Breakout From Downtrend

Cryptocurrency analytics firm MakroVision has shared its technical assessment of Chainlink (LINK) price action.

Pennsylvania Man Sentenced to 8 Years for $40M Crypto Ponzi Scheme

The U.S. Department of Justice has sentenced Dwayne Golden, 57, of Pennsylvania to 97 months in prison for orchestrating a fraudulent crypto investment scheme that stole over $40 million from investors.

-

1

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

06.06.2025 13:00 1 min. read -

2

Canada Green-Lights First XRP ETF, Beating the U.S. to Market

17.06.2025 9:00 1 min. read -

3

Top 4 Cryptos to Watch This Summer, Offering 1000x Growth Potential

16.06.2025 13:43 4 min. read -

4

Uphold Wants to Pay Yield on XRP – Here’s the Work-Around

15.06.2025 19:00 2 min. read -

5

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read