Bitcoin Set for Third Parabolic Surge in Current Cycle, Analyst Suggests

17.07.2024 17:00 2 min. read Alexander Stefanov

A noted crypto strategist, Kevin Svenson, has highlighted Bitcoin (BTC) as potentially entering its third parabolic phase within the current market cycle, drawing comparisons to its historical performance in 2017.

Svenson pointed out that in 2017, Bitcoin experienced several phases of parabolic growth, where each shorter-term surge was followed by a consolidation before launching into a larger upward trend. He suggests that the current market conditions in 2024 resemble those preceding Bitcoin’s significant vertical rallies in the past.

My #BITCOIN Prediction

= Higher than you thought possible✍️ The peak price target is not displayed on this chart. I’m simply showing the expected structure. #BTC $BTC 🔗https://t.co/QWfMfxCqiW pic.twitter.com/f29ovFn9f6

— Kevin Svenson (@KevinSvenson_) July 15, 2024

Svenson emphasized that the key factors driving this potential parabolic move include a renewed sense of optimism among investors and a resurgence in market momentum.

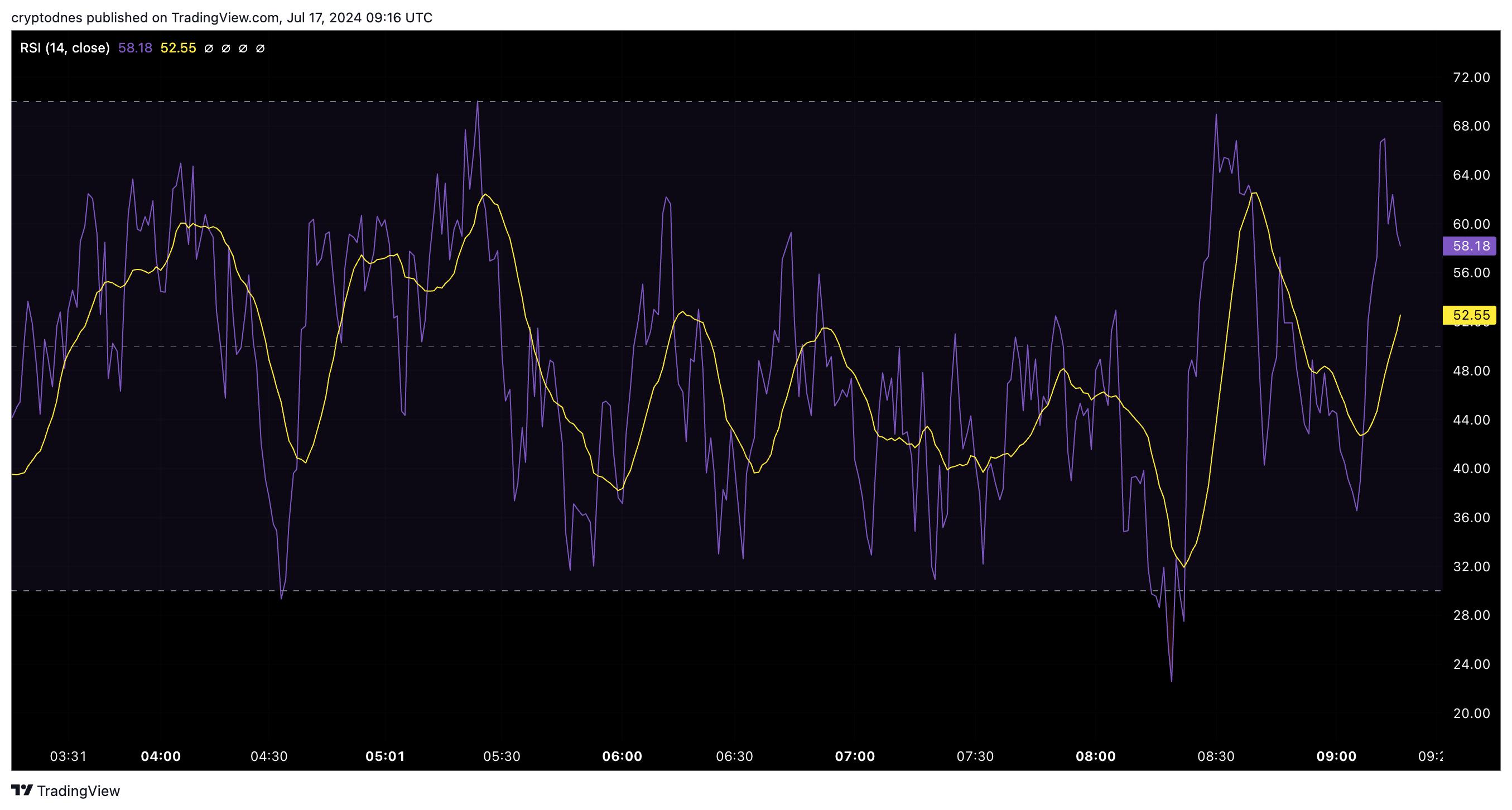

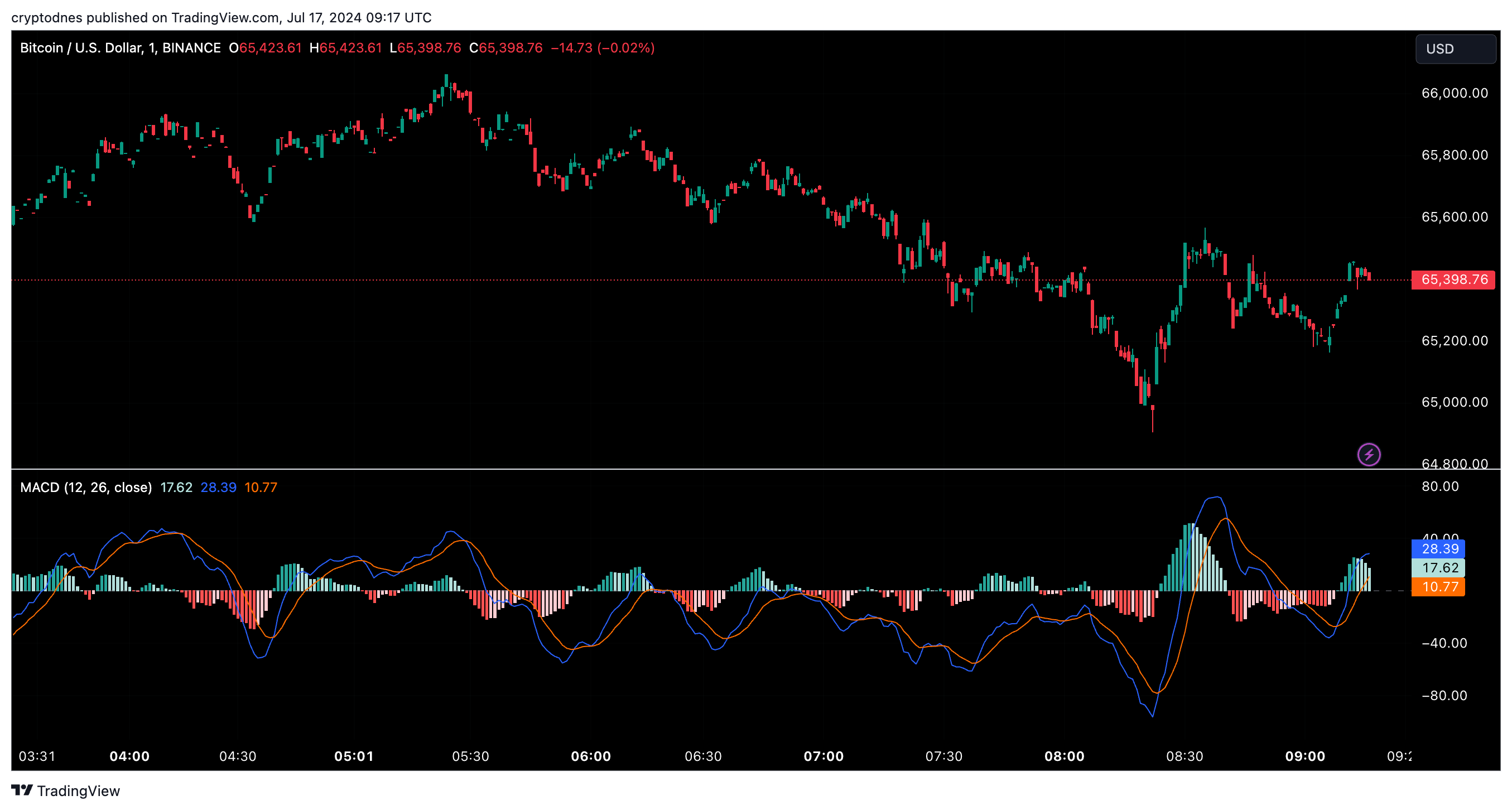

According to him, Bitcoin’s technical indicators, such as the relative strength index (RSI) and the moving average convergence divergence (MACD), support this bullish outlook.

The RSI, a momentum indicator, has shown strong support levels similar to those observed before previous parabolic phases.

Meanwhile, the MACD, a trend indicator, indicates a shift from bearish to bullish momentum, signaling a potential acceleration in Bitcoin’s price movement.

Svenson’s analysis suggests that if Bitcoin can maintain its current trajectory and overcome key resistance levels, it could pave the way for another significant uptrend similar to those seen during previous market cycles.

This prediction has sparked interest among cryptocurrency enthusiasts and investors who closely follow Bitcoin’s price movements as an indicator of broader market sentiment and potential future trends in the digital asset space.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

5

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

Bitcoin’s network hashrate has fallen 3.5% since mid-June, marking the sharpest decline in computing power since July 2024.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

5

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read