Record Hashrates Squeeze Bitcoin Mining Profits

17.07.2024 13:00 2 min. read Alexander Stefanov

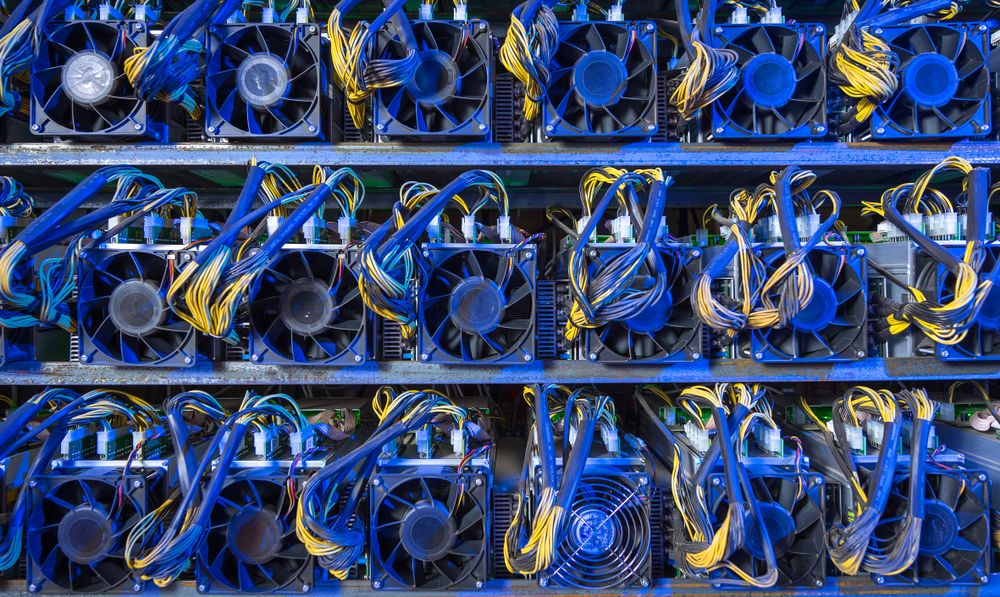

As Bitcoin mining becomes more challenging, miners face reduced profitability despite high trading values.

The network’s hashrate surged to 635 exahashes per second (EH/s) – at the time of writing it retraced to 594.43 EH/s) – increasing the competition and decreasing individual earnings. Although Bitcoin trades around $65,300, miners are not seeing significant gains due to the increased computing power required, which has tripled since November 2021.

This rise in hashrate has led to the lowest “hash price” in five years, now at $51.13 per terahash per second (TH/s), diminishing profitability for miners.

Industry experts are concerned about the future of Bitcoin mining. Kurt Wuckert Jr., CEO of Bitcoin SV mining pool Gorilla Pool, highlighted that profitability for miners is at a nearly six-year low.

He warned against investing in blockchain assets or mining equipment due to market uncertainties, emphasizing the role of electricity consumption and power arbitrage in mining profitability.

The centralization of mining power also raises concerns. Foundry and Antpool control 54% of all Bitcoin blocks mined in the past year, leading to questions about the network’s decentralization. This concentration of power among a few entities compromises Bitcoin’s distributed nature, posing potential security and governance risks.

Miners now navigate a competitive landscape with record-high hashrates and declining hash prices, squeezing profitability and making the future of Bitcoin mining uncertain.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

5

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

Bitcoin’s network hashrate has fallen 3.5% since mid-June, marking the sharpest decline in computing power since July 2024.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

5

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read