Bitcoin ETFs Inflows Show Strong Investor Confidence

16.07.2024 13:00 1 min. read Alexander Stefanov

Following Bitcoin's price surge to over $60,000 on July 14 and subsequent strong performance through July 16, investors in BTC ETFs appear to be maintaining their confidence in the asset.

At the time of writing, BTC was trading at around $63,220, having briefly broken $65,000 on Binance in the early hours of the day.

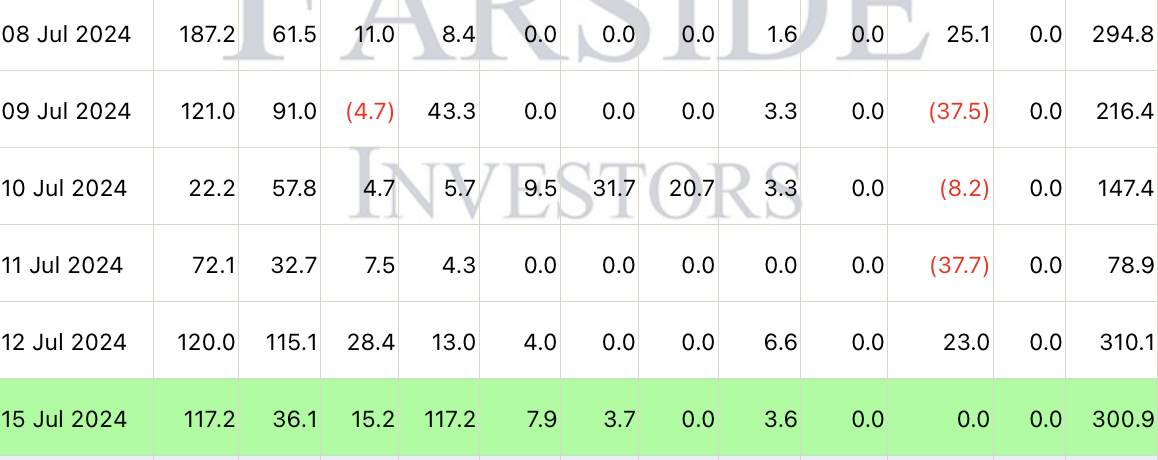

On Friday, July 12, U.S.-based spot Bitcoin ETFs saw inflows of $310.1 million, their best result since June 5. For the entire week beginning July 8 and ending July 12, inflows totaled about $1.047 billion.

Investor momentum and faith doesn’t seem to be waning, as on Monday (July 15) these ETFs realized a total of $300.9 billion in inflows.

According to Farside, the majority of those inflows were directed to BlackRock’s ETF (IBIT) and the ARK 21Shares Bitcoin ETF (ARKB), which saw equal amounts – $117.2 million.

They were followed by the Fidelity Wise Origin Bitcoin Fund (FBTC), which registered $36.1 million.

VanEck’s ETF (HODL) and that of Invesco (BTCO) also saw inflows, but much more modest, registering $3.6 million and $7.9 million, respectively.

-

1

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

2

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read -

5

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

Bitcoin’s network hashrate has fallen 3.5% since mid-June, marking the sharpest decline in computing power since July 2024.

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

Bitcoin has officially overtaken Alphabet (Google’s parent company) in global asset rankings, becoming the sixth most valuable asset in the world, according to the latest real-time market data.

-

1

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

2

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read -

5

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read