Bitcoin Whales Buy the Dip, Signaling Potential Bullish Momentum

09.07.2024 16:00 1 min. read Alexander Stefanov

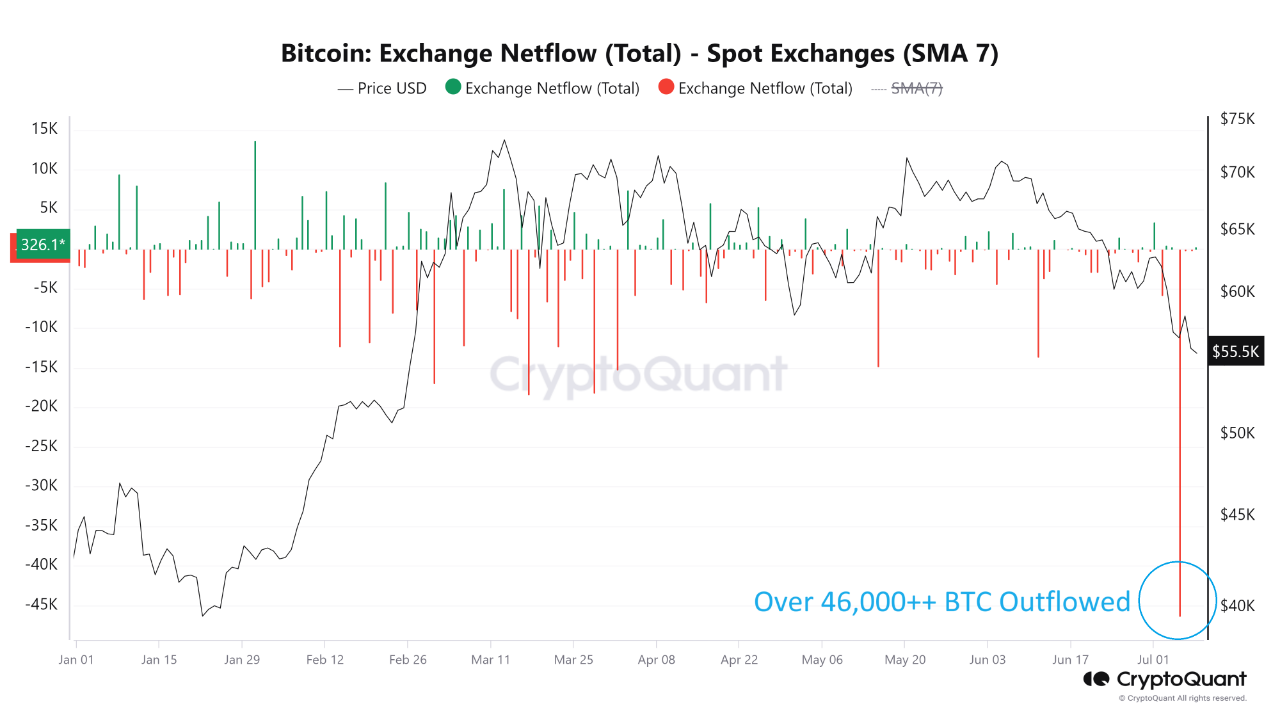

Large crypto holders are aggressively purchasing Bitcoin amid market dips, as new data from CryptoQuant shows.

In 2024, Bitcoin withdrawals from exchanges have reached unprecedented rates. Over 46,000 BTC, worth more than $2.6 billion, have been moved off exchanges on July 5, indicating a shift towards long-term holding.

This trend suggests optimism for Bitcoin’s price. Whales are betting on a future rise, even as many investors sell in panic, favoring long-term investment over short-term volatility.

Significant outflows from spot and derivatives exchanges indicate a reduction in risk exposure. Moving Bitcoin to private wallets points to a strategy focused on stability and future gains, potentially reducing market volatility.

READ MORE:

Australia Approves Another Spot Bitcoin ETF

The increased activity from whales, despite recent price drops, is a positive indicator for Bitcoin’s future. Observing these significant investors betting on a price increase is promising for the market.

-

1

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

2

Bitcoin Pauses Below $110K as Analysts Eye Consolidation Phase

15.06.2025 20:00 1 min. read -

3

Here is What to Expect From Bitcoin by End of 2025

17.06.2025 19:00 2 min. read -

4

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

5

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

-

1

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

2

Bitcoin Pauses Below $110K as Analysts Eye Consolidation Phase

15.06.2025 20:00 1 min. read -

3

Here is What to Expect From Bitcoin by End of 2025

17.06.2025 19:00 2 min. read -

4

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

5

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read