Bitcoin Continues to Struggle – Here Are 3 Factors That Could Spark a Price Recovery

09.07.2024 18:00 2 min. read Alexander Stefanov

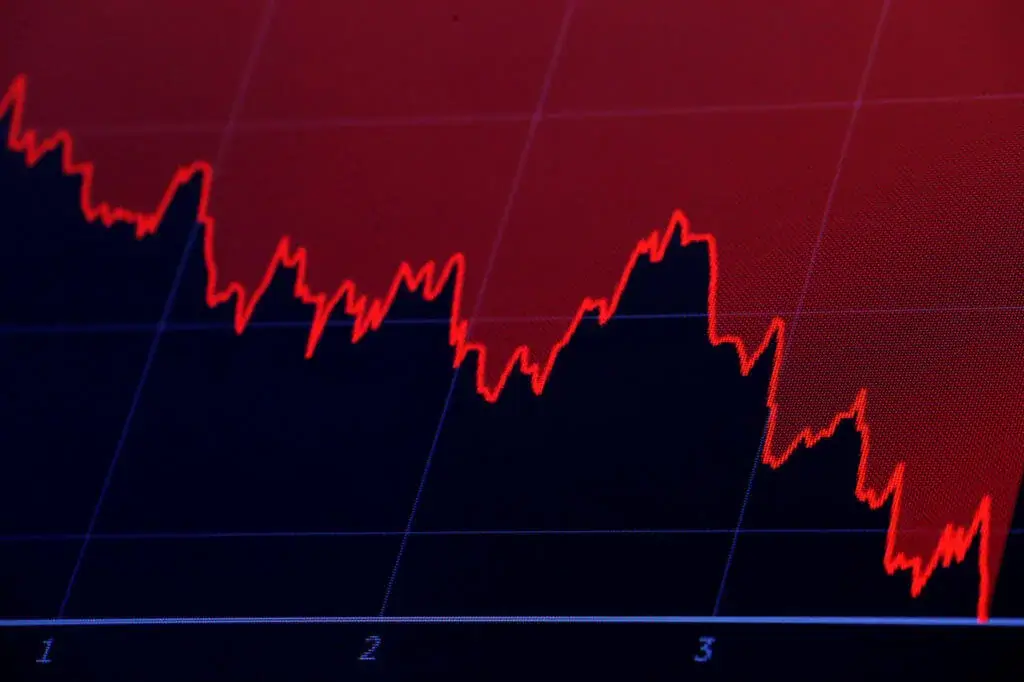

Since the beginning of June Bitcoin has been grappling with significant volatility, struggling to regain its bullish momentum.

According to recent analysis, Bitcoin may have hit a local low after dropping to $53,219 on July 3. This decline was driven by fears of substantial BTC sell-offs from Mt. Gox creditors and the German government.

However, Bitcoin managed to rebound over the weekend, climbing back above $58,000. Bitfinex analysts interpreted weekend data as indicating a potential stabilization point for Bitcoin, despite Mt. Gox still needing to distribute a significant portion of its Bitcoin holdings to creditors.

Three key factors were highlighted by analysts as potential catalysts for a Bitcoin recovery in the near term; the Short-Term Holder Profit Ratio (SOPR), perpetual futures funding rates and gap between implied and historical volatility.

READ MORE:

Australia Approves Another Spot Bitcoin ETF

SOPR dropped to 0.97 by July 6, suggesting that short-term investors were selling at a loss, potentially exhausting their selling pressure.

Bitcoin perpetual futures saw negative funding rates for the first time since May 1, indicating a stabilization or nearing a market bottom.

Lastly, analysts pointed to a narrowing gap between implied and historical volatilities, suggesting increased market stability and potentially preventing further significant price declines.

Despite these optimistic signals, Bitcoin’s recovery was hampered by recent negative developments, including concerns over capitulating miners, Bitcoin transfers in Germany, Mt. Gox issues, and cautious Federal Reserve comments on interest rate adjustments.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

4

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read -

5

Here is What to Expect From Bitcoin by End of 2025

17.06.2025 19:00 2 min. read

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

Bitcoin’s network hashrate has fallen 3.5% since mid-June, marking the sharpest decline in computing power since July 2024.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

4

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read -

5

Here is What to Expect From Bitcoin by End of 2025

17.06.2025 19:00 2 min. read