Germany Sold Another 500 BTC Worth $28 Million

08.07.2024 10:22 1 min. read Alexander Stefanov

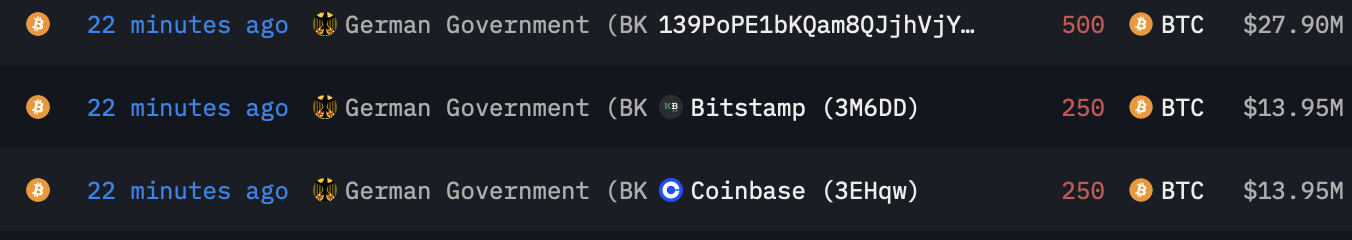

On July 8, a wallet belonging to the German government designated as "German Government (BKA)" transferred 500 BTC to crypto exchanges and another 500 BTC to a government-affiliated address.

The first transaction, consisting of 250 BTC, was sent to the US cryptocurrency exchange platform Coinbase, followed by another transaction of the same value to Bitstamp. The total value of the two transactions was around $27.9 million.

In addition, another 500 BTC were moved to the now familiar wallet identified as “139Po“.

After these latest transfers, the wallet still holds 38,826 BTC, totaling $2.16 billion.

Amid the concerns these sales are creating among investment circles, one familiar face in the crypto industry joked about Germany.

Recently, Justin Sun joked that Germany’s disappointing quarterfinal elimination from the UEFA Euro 2024 Cup tournament could be related to their decision to “sell too much Bitcoin.”

-

1

Chinese Bitcoin Mining Giants Shift to U.S. Amid Rising Tariff Pressures

19.06.2025 21:00 2 min. read -

2

Norwegian Mining Firm Adopts Bitcoin as Treasury Reserve

23.06.2025 22:00 1 min. read -

3

Bitcoin’s Biggest Holders Could Trigger Next Major Crash, Analyst Warns

16.06.2025 12:00 1 min. read -

4

Ethereum Loses Retail Momentum as Bitcoin Pulls Ahead

20.06.2025 21:00 1 min. read -

5

Retail Mood Turns Sour—And That Could Be Bullish for Bitcoin, Says Analyst Firm

21.06.2025 19:00 1 min. read

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

According to on-chain analyst Darkfost, Bitcoin is entering a new stage of on-chain behavior marked by two key developments: a rare third peak in the SOPR Trend Signal during a single bull cycle and a sustained outflow dominance in exchange flows.

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

According to the latest Santiment report, the crypto market is entering a critical phase, with a mix of bullish on-chain signals and cautionary sentiment indicators.

Mysterious $8.6B Bitcoin Transfer Sparks Speculation Over Satoshi-Era Wealth

In a stunning on-chain event that has reignited curiosity across the crypto community, more than $8.6 billion worth of Bitcoin linked to the network’s earliest years—commonly referred to as the “Satoshi era”—was quietly moved on Friday in what analysts believe is the largest single transfer of early-mined BTC ever recorded.

Esports Giant Moves Into Bitcoin Mining

The parent company behind the iconic esports brand Ninjas in Pyjamas (NIP) is taking a sharp turn into the world of Bitcoin mining, signaling a significant evolution from pure entertainment to digital infrastructure.

-

1

Chinese Bitcoin Mining Giants Shift to U.S. Amid Rising Tariff Pressures

19.06.2025 21:00 2 min. read -

2

Norwegian Mining Firm Adopts Bitcoin as Treasury Reserve

23.06.2025 22:00 1 min. read -

3

Bitcoin’s Biggest Holders Could Trigger Next Major Crash, Analyst Warns

16.06.2025 12:00 1 min. read -

4

Ethereum Loses Retail Momentum as Bitcoin Pulls Ahead

20.06.2025 21:00 1 min. read -

5

Retail Mood Turns Sour—And That Could Be Bullish for Bitcoin, Says Analyst Firm

21.06.2025 19:00 1 min. read