Bitcoin Price Falls Below $54,000 After Mt.Gox Transfers $2.7 billion in BTC

05.07.2024 7:00 2 min. read Alexander Stefanov

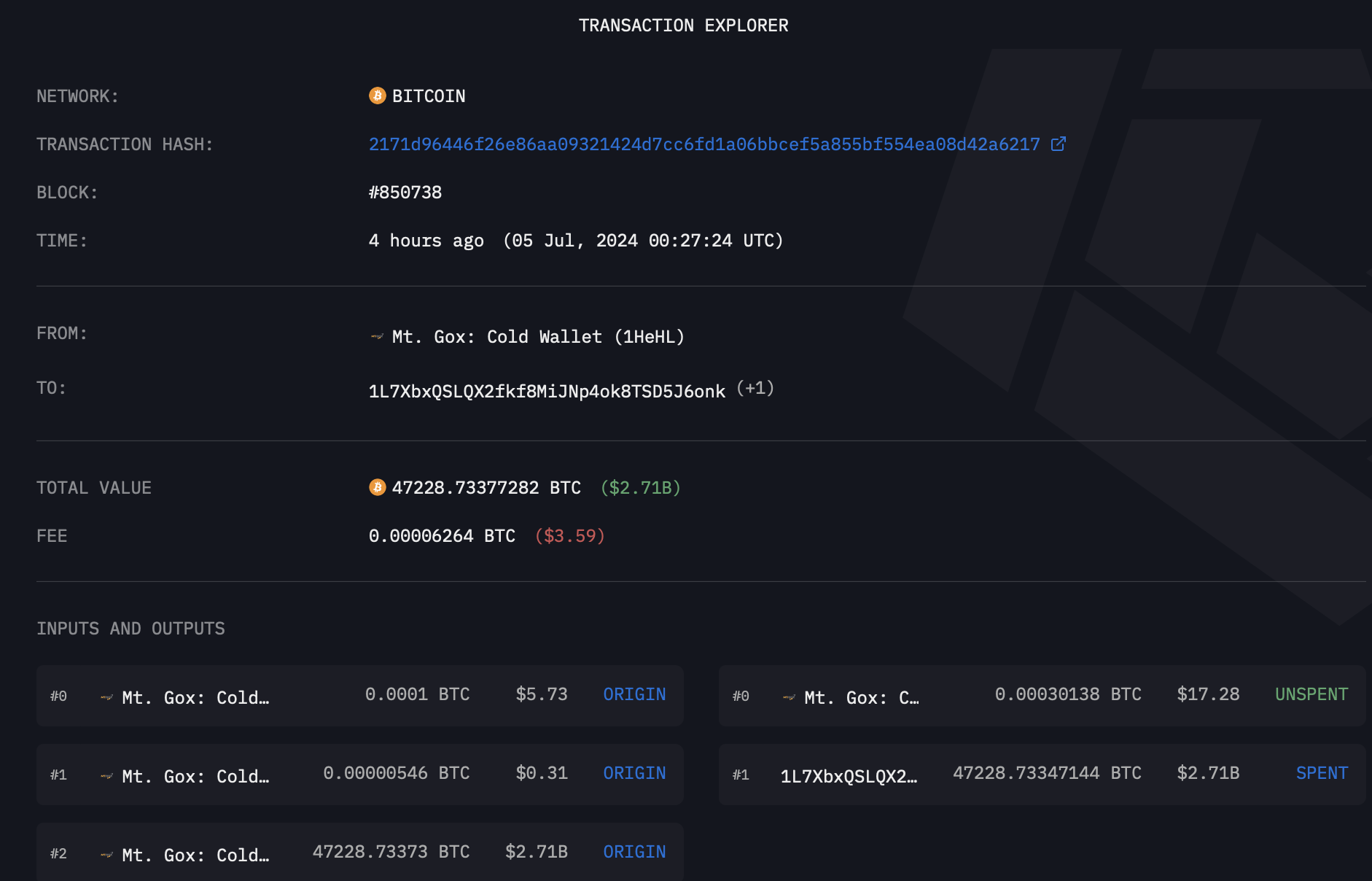

Bankrupt Japanese crypto exchange Mt. Gox has transferred 47,229 BTC (worth approximately $2.71 billion) into a new wallet, making its first significant transaction since May.

This move was undertaken around 00:30 (UTC) on July 5, as reported by blockchain analytics platform Arkham Intelligence.

As of the end of May this year, Mt. Gox’s wallet had transferred around 137,892 BTC, which at the time was worth approximately $9.45 billion. And then the exchange’s actions put selling pressure on the price of Bitcoin.

In recent days, Mt. Gox has conducted several smaller test transactions. This large transfer comes as the exchange prepares to begin repaying its obligations to creditors this month, with BTC tokens totaling about $8.5 billion to be distributed.

Market observers are concerned about the potential impact of putting such a large volume of Bitcoin on the market, fearing a sell-off by Mt. Gox’s creditors who have not had access to their holdings in more than a decade. Still, some analysts suggest that the actual amount likely to be sold is closer to $4.5 billion, which could reduce the risk of a massive market disruption.

Despite these positive predictions, however, at the time of writing Bitcoin is trading at $53,860, reflecting an 8.6% decline in the last 24 hours and over 12.4% for the week.

Since the transfer happened at 00:30 (UTC) it seems that it was the news of it that helped the cryptocurrency’s price fall below the $55,500 level, as the decline began shortly after.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read -

5

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

Bitcoin’s network hashrate has fallen 3.5% since mid-June, marking the sharpest decline in computing power since July 2024.

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

Bitcoin has officially overtaken Alphabet (Google’s parent company) in global asset rankings, becoming the sixth most valuable asset in the world, according to the latest real-time market data.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read -

5

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read