Bitcoin Trades Below $58,000 – How Much More Downturn Can We Expect?

04.07.2024 12:15 2 min. read Alexander Stefanov

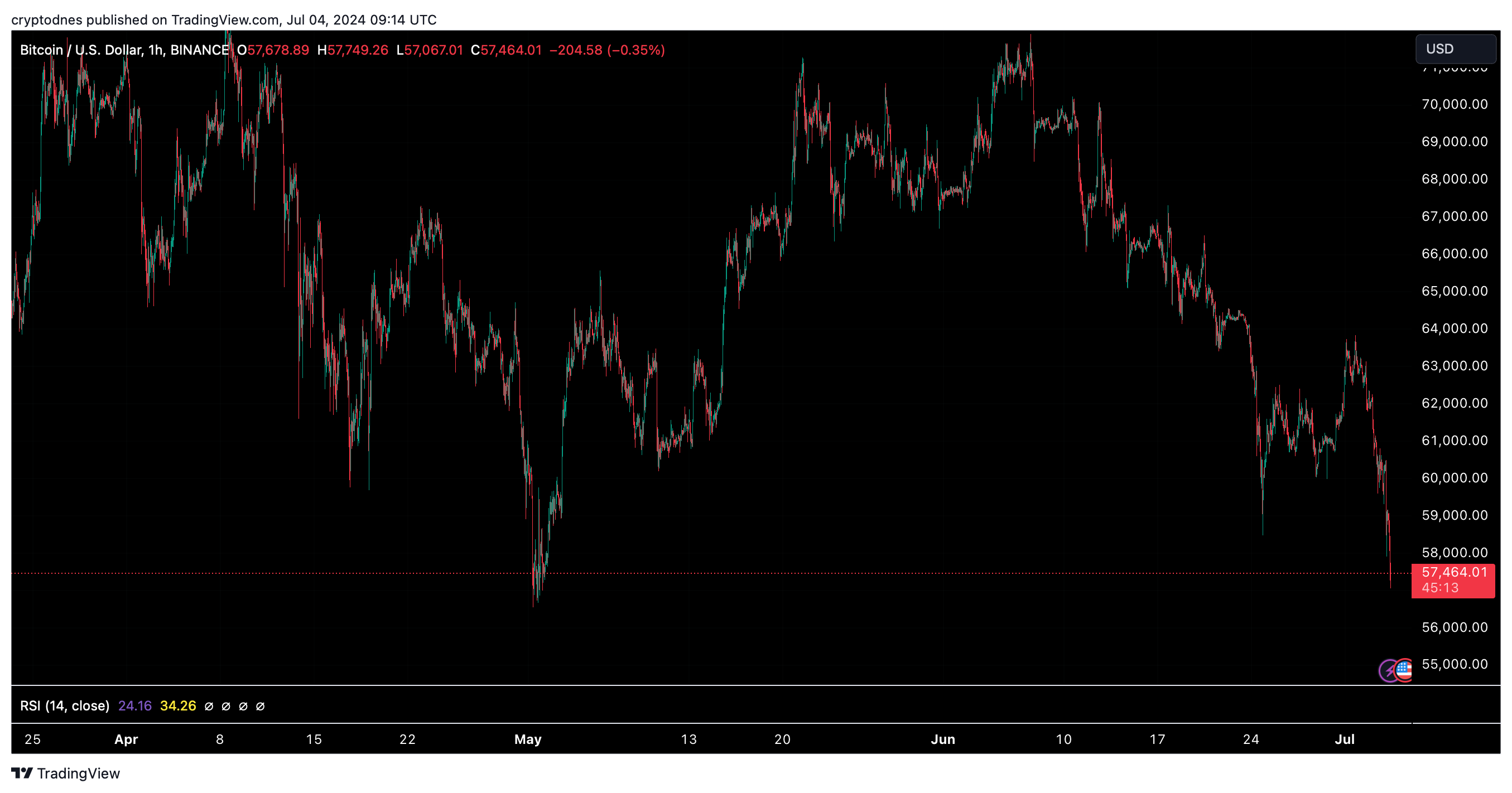

The price of Bitcoin (BTC) recently slipped below a significant support level at $60,000, even dropping below $58,000.

Over the past 24 hours, the price of BTC has dropped by about 5%, trading for $57,400 at the time of writing (July 4).

Discussing the declines during the previous trading days, Andrew Kang, co-founder of Mechanism Capital, expressed serious concerns about current market trends, which he said were reminiscent of the conditions that led to the significant crash in May 2021.

He further highlighted the critical nature of current market dynamics that many are ignoring:

Most market participants do not appreciate the significance of the potential loss of a 4-month range in Bitcoin. The closest parallel we can draw is with that of the May 2021 range, when we also exited a parabolic rally in BTC and altcoins.

Kang pointed out the similarities in current market conditions, especially in terms of leveraged positions, which now exceed $50 billion:

That figure doesn’t include the Chicago Mercantile Exchange (CME)… but it’s compounded by the fact that in this scenario we have an even longer range (18 weeks versus 13) and we haven’t had extreme washouts yet, whereas in the middle of the 2020-2021 bull market we had several.

Kang also revised his forecast for the bottom of Bitcoin, suggesting a more significant decline than previously expected:

Perhaps my initial low estimates of $50,000 were too conservative and we may see more extreme [losses] to $40,000.

He cautioned that such a decline could have a severe impact on the market, and it would take several months of consolidation and a downtrend before any upside reversal could occur.

In retrospect, the May 2021 downturn was marked by a rapid shift in investor sentiment, triggered by external shocks and further exacerbated by high market leverage.

To date, according to Kang, similar conditions appear to be forming, with high leverage and prolonged periods without significant price corrections suggesting that the market may be on the verge of another major downturn.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read