Bitcoin’s Consolidation Around $60,000 Could Last Several Months

27.06.2024 18:30 2 min. read Alexander Stefanov

A renowned analyst and crypto trader shared his bullish enthusiasm for Dogecoin (DOGE).

The Relative Strength Index (RSI) of Bitcoin, the leading DeFi asset, has reached its most oversold level in over 300 days.

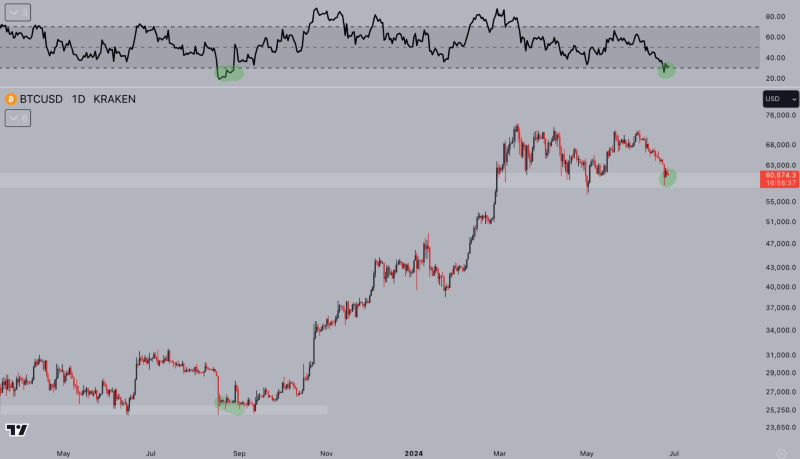

Bitcoin’s RSI has now reached 30, a level last seen in September 2023. This previous phenomenon led to an over three-month consolidation just below key resistance at $30,000, as Jelle’s pseudonymous crypto analyst noted in a post on X (Twitter) on June 27.

Given this historical chart pattern, the expert suggested that if history repeats itself, Bitcoin, the largest crypto asset by market cap, could face an over three-month consolidation below $70,000.

However, Jelle also pointed out that after this “period of shredding” followed by a “capitulation at key support,” BTC could see significant upside, as he mentioned in a comment below his post, noting that the asset is already very close to key support levels.

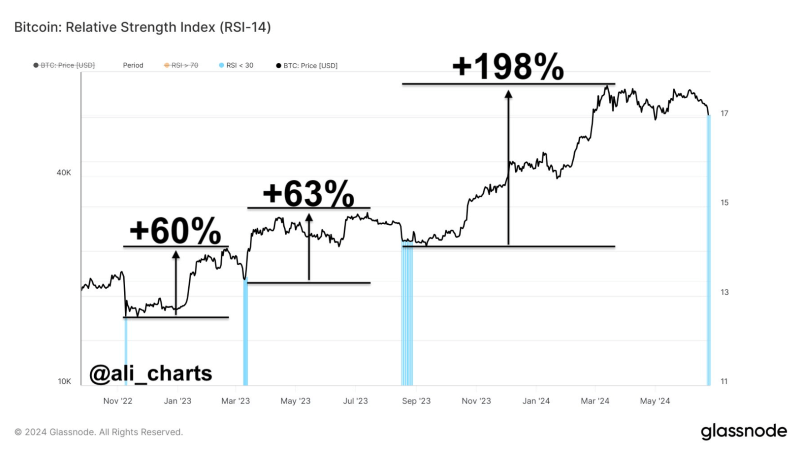

One indicator of future price performance is the RSI. Professional crypto trader Ali Martinez highlighted that the current RSI suggests that it is an ideal time to buy the declining Bitcoin.

However, the crypto market is notoriously volatile and conditions can change unexpectedly. Therefore, conducting thorough research and keeping up-to-date on relevant events is crucial when investing in assets like Bitcoin, despite its bullish outlook for future price performance.

At the time of writing, BTC was trading for $61,246.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read

Ethereum’s On-chain Volume Surges 288% — Is a Breakout Next?

Ethereum’s network just witnessed a seismic shift in activity.

Binance Launches New Airdrop and Trading Competition

Binance has officially launched a new airdrop event for Verasity (VRA) through its Binance Alpha platform, giving eligible users the chance to claim free tokens and compete for a massive prize pool.

XRP: What’s the Next Target After Bullish Breakout?

XRP has emerged from a months-long consolidation with renewed bullish momentum, reigniting trader interest in its next major price target.

Bitcoin Dominance Holds Firm as Altcoins Show Early Signs of Rotation

Despite recent gains across select DeFi and RWA tokens, Bitcoin continues to dominate the crypto landscape, with the Altcoin Season Index sitting at 43/100, according to today’s CoinMarketCap data.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read