10,000 Dormant Bitcoin Moved After 14 Years: Volatility Ahead?

04.07.2025 20:00 2 min. read Alexander Zdravkov

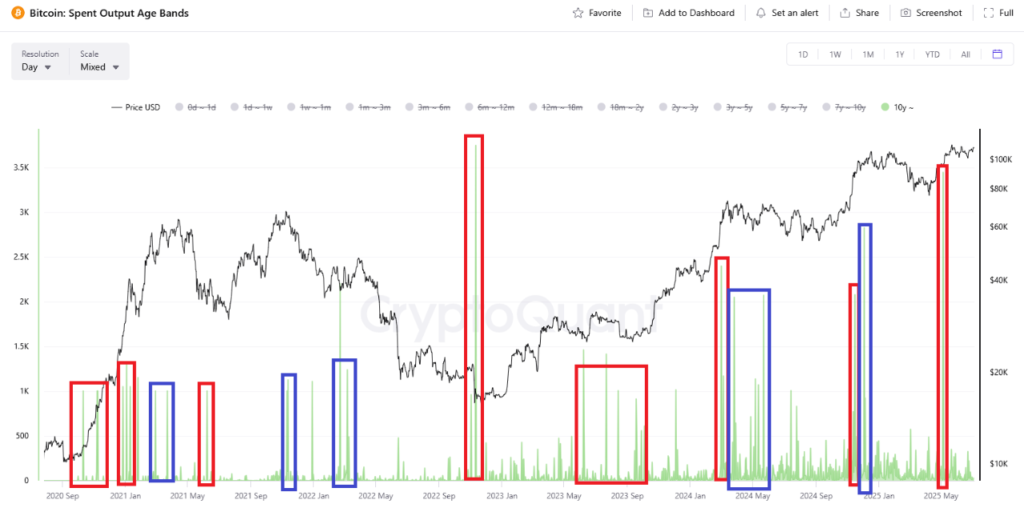

A remarkable on-chain event has caught the crypto market’s attention: 10,000 BTC, untouched for over 14 years, were moved earlier today, according to a new report from CryptoQuant.

The transaction marks one of the largest-ever movements by long-term holders and could carry significant implications for market sentiment and price volatility.

Not an Internal Transfer — Possible Trading Intent

Unlike internal reshufflings or wallet migrations driven by security concerns, the pattern of this transaction suggests it may have been executed with trading intent. While the destination address and purpose remain unconfirmed, the structure and timing of the move point to a genuine reactivation of old funds—potentially by an early adopter or miner.

CryptoQuant analysts note that this could be the largest transfer of 10+ year dormant Bitcoin ever recorded. Previously, the biggest such move involved 3,700 BTC during the post-FTX collapse in late 2022—a moment many now view as the market bottom.

Context Matters: Not All Old BTC Moves Are Bearish

Although large transfers of dormant Bitcoin often spark panic selling and bearish sentiment, analysts caution against jumping to conclusions. As seen in past events like Mt. Gox wallet restructuring, not all movements signify liquidation.

“It’s a mistake to interpret all old-holder activity as purely bearish,” the report states. Intent is key, and determining whether today’s transfer was made for security, custodial reshuffling, or actual selling is essential before drawing market conclusions.

Rare On-Chain Signal May Precede Volatility

While the true motive remains unknown, what is clear is that this rare on-chain footprint could become a precursor to increased market activity. Long-term dormant wallets rarely move, and when they do, they often precede heightened volatility or pivotal shifts in market structure.

Traders and analysts will be watching closely in the coming days to see whether this transfer turns into selling pressure—or merely a historical anomaly.

-

1

Chinese Bitcoin Mining Giants Shift to U.S. Amid Rising Tariff Pressures

19.06.2025 21:00 2 min. read -

2

Norwegian Mining Firm Adopts Bitcoin as Treasury Reserve

23.06.2025 22:00 1 min. read -

3

Bitcoin’s Biggest Holders Could Trigger Next Major Crash, Analyst Warns

16.06.2025 12:00 1 min. read -

4

Ethereum Loses Retail Momentum as Bitcoin Pulls Ahead

20.06.2025 21:00 1 min. read -

5

Retail Mood Turns Sour—And That Could Be Bullish for Bitcoin, Says Analyst Firm

21.06.2025 19:00 1 min. read

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

According to on-chain analyst Darkfost, Bitcoin is entering a new stage of on-chain behavior marked by two key developments: a rare third peak in the SOPR Trend Signal during a single bull cycle and a sustained outflow dominance in exchange flows.

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

According to the latest Santiment report, the crypto market is entering a critical phase, with a mix of bullish on-chain signals and cautionary sentiment indicators.

Mysterious $8.6B Bitcoin Transfer Sparks Speculation Over Satoshi-Era Wealth

In a stunning on-chain event that has reignited curiosity across the crypto community, more than $8.6 billion worth of Bitcoin linked to the network’s earliest years—commonly referred to as the “Satoshi era”—was quietly moved on Friday in what analysts believe is the largest single transfer of early-mined BTC ever recorded.

Esports Giant Moves Into Bitcoin Mining

The parent company behind the iconic esports brand Ninjas in Pyjamas (NIP) is taking a sharp turn into the world of Bitcoin mining, signaling a significant evolution from pure entertainment to digital infrastructure.

-

1

Chinese Bitcoin Mining Giants Shift to U.S. Amid Rising Tariff Pressures

19.06.2025 21:00 2 min. read -

2

Norwegian Mining Firm Adopts Bitcoin as Treasury Reserve

23.06.2025 22:00 1 min. read -

3

Bitcoin’s Biggest Holders Could Trigger Next Major Crash, Analyst Warns

16.06.2025 12:00 1 min. read -

4

Ethereum Loses Retail Momentum as Bitcoin Pulls Ahead

20.06.2025 21:00 1 min. read -

5

Retail Mood Turns Sour—And That Could Be Bullish for Bitcoin, Says Analyst Firm

21.06.2025 19:00 1 min. read