10,000 Dormant Bitcoin Moved After 14 Years: Volatility Ahead?

04.07.2025 20:00 2 min. read Alexander Zdravkov

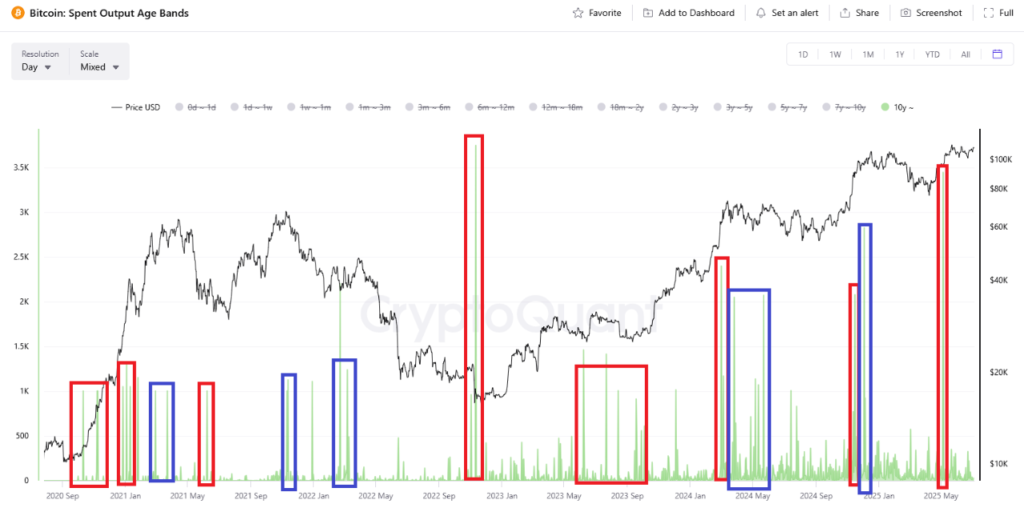

A remarkable on-chain event has caught the crypto market’s attention: 10,000 BTC, untouched for over 14 years, were moved earlier today, according to a new report from CryptoQuant.

The transaction marks one of the largest-ever movements by long-term holders and could carry significant implications for market sentiment and price volatility.

Not an Internal Transfer — Possible Trading Intent

Unlike internal reshufflings or wallet migrations driven by security concerns, the pattern of this transaction suggests it may have been executed with trading intent. While the destination address and purpose remain unconfirmed, the structure and timing of the move point to a genuine reactivation of old funds—potentially by an early adopter or miner.

CryptoQuant analysts note that this could be the largest transfer of 10+ year dormant Bitcoin ever recorded. Previously, the biggest such move involved 3,700 BTC during the post-FTX collapse in late 2022—a moment many now view as the market bottom.

Context Matters: Not All Old BTC Moves Are Bearish

Although large transfers of dormant Bitcoin often spark panic selling and bearish sentiment, analysts caution against jumping to conclusions. As seen in past events like Mt. Gox wallet restructuring, not all movements signify liquidation.

“It’s a mistake to interpret all old-holder activity as purely bearish,” the report states. Intent is key, and determining whether today’s transfer was made for security, custodial reshuffling, or actual selling is essential before drawing market conclusions.

Rare On-Chain Signal May Precede Volatility

While the true motive remains unknown, what is clear is that this rare on-chain footprint could become a precursor to increased market activity. Long-term dormant wallets rarely move, and when they do, they often precede heightened volatility or pivotal shifts in market structure.

Traders and analysts will be watching closely in the coming days to see whether this transfer turns into selling pressure—or merely a historical anomaly.

-

1

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

06.07.2025 8:00 2 min. read -

2

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

3

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

4

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read

Societe Generale Backs Bitcoin and Ethereum ETP Expansion

French banking giant Societe Generale has entered the crypto space more directly, forming a strategic partnership with 21Shares.

Strategy Launches $2 Billion Raise to Buy More Bitcoin

MicroStrategy is doubling down on its Bitcoin strategy with a massive $2 billion fundraising move. Originally planned at $500 million, the company expanded its offering after seeing strong investor demand.

Arkham Intelligence: U.S. Government Holds at Least 198,000 BTC

The U.S. government now holds over 198,000 BTC, valued at approximately $23.5 billion, according to data from Arkham Intelligence.

Tesla Q2 Earnings Surge on Bitcoin Rally and AI Growth

Tesla stunned investors in Q2 2025 with a $1.2 billion profit, nearly tripling its previous quarter’s net income.

-

1

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

06.07.2025 8:00 2 min. read -

2

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

3

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

4

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read