XRP Registers Gains Despite Negative Crypto Market Results

31.07.2024 10:39 1 min. read Kosta Gushterov

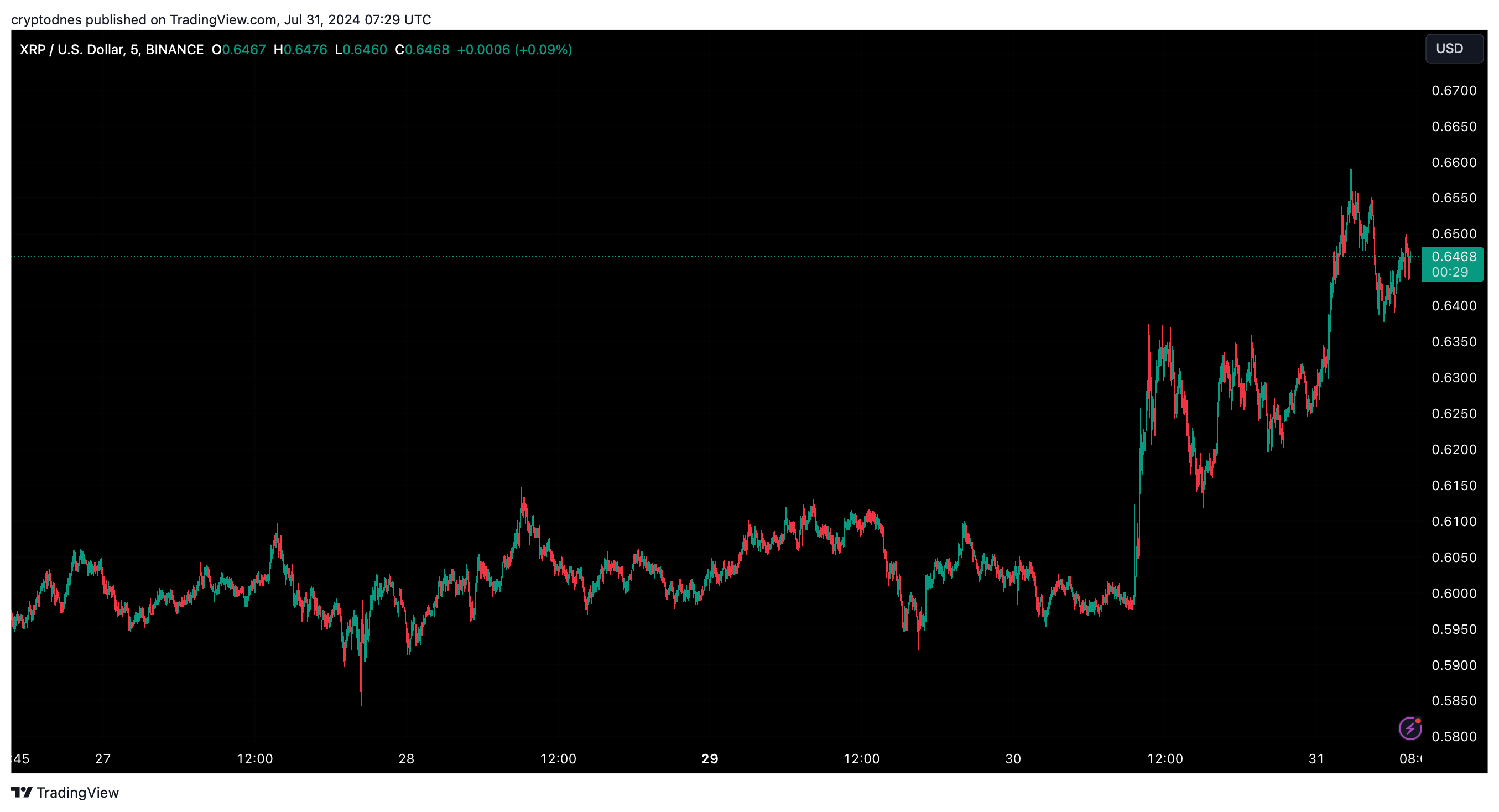

After a fairly long period of trading in a relatively narrow range, XRP appears to be defying the mostly negative results of the broader crypto market by registering gains over the past day.

XRP has appreciated by just over 8% in the last 24 hours, reaching around $0.646 at the time of writing, the highest since March 25, fueled by optimism surrounding the potential settlement of the SEC’s lawsuit against Ripple and the planned unlocking of tokens.

Traders are interpreting the recent SEC filing, which hints at an amendment to the complaint against Binance without naming tokens, as a positive sign for the resolution of the case against Ripple.

This spurs bullish sentiment despite Ripple’s planned unlocking of 1 billion XRP.

This market optimism comes despite the logical expectation that an increase in token supply will lead to a drop in prices. However, research suggests that the additional liquidity from unlocking the tokens may actually support the bullish trend.

In contrast to XRP’s performance, the crypto sector’s market cap has lost just over 0.4% in the past 24 hours. Bitcoin (BTC) and Ethereum (ETH) also registered losses of 0.9% and 0.6% respectively over the same time period.

-

1

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

21.06.2025 13:00 2 min. read -

2

Ethereum Price Prediction: This Trader Thinks ETH Could Soon Hit $12,000 – Here’s Why

25.06.2025 23:53 3 min. read -

3

Solana Price Prediction: Trader Thinks SOL Could Rise to $200 in July – Here’s Why

26.06.2025 22:25 3 min. read -

4

Dogecoin’s Slump Could Be the Setup for a Massive Breakout

22.06.2025 14:00 2 min. read -

5

Peter Schiff Doubts Stablecoins Can Shield a Weakening Dollar

19.06.2025 13:00 1 min. read

Here is How Ethereum Can Change Wall Street, According to ETH Co-founder

Ethereum co-founder and Consensys CEO Joe Lubin believes Ethereum’s growing use in corporate treasuries could redefine how traditional finance views the second-largest digital asset.

Whale Activity Alert: Which Altcoins Saw Millions Flow Into Exchanges?

A wave of large-scale altcoin deposits has hit centralized exchanges over the past 24 hours, according to data from on-chain analytics platform Santiment.

Trump’s Truth Social Files For Spot Crypto ETF Holding 5 Cryptocurrencies

Truth Social, the media venture linked to U.S. President Donald Trump, has taken a bold step into the digital asset space with a fresh filing for a spot cryptocurrency exchange-traded fund (ETF).

Whales Quietly Accumulate Four Altcoins: Early Signals of Potential Rally

Large-scale investors are steadily increasing long positions in several overlooked altcoins, signaling a potential early-stage accumulation phase.

-

1

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

21.06.2025 13:00 2 min. read -

2

Ethereum Price Prediction: This Trader Thinks ETH Could Soon Hit $12,000 – Here’s Why

25.06.2025 23:53 3 min. read -

3

Solana Price Prediction: Trader Thinks SOL Could Rise to $200 in July – Here’s Why

26.06.2025 22:25 3 min. read -

4

Dogecoin’s Slump Could Be the Setup for a Massive Breakout

22.06.2025 14:00 2 min. read -

5

Peter Schiff Doubts Stablecoins Can Shield a Weakening Dollar

19.06.2025 13:00 1 min. read