XRP Registers Gains Despite Negative Crypto Market Results

31.07.2024 10:39 1 min. read Kosta Gushterov

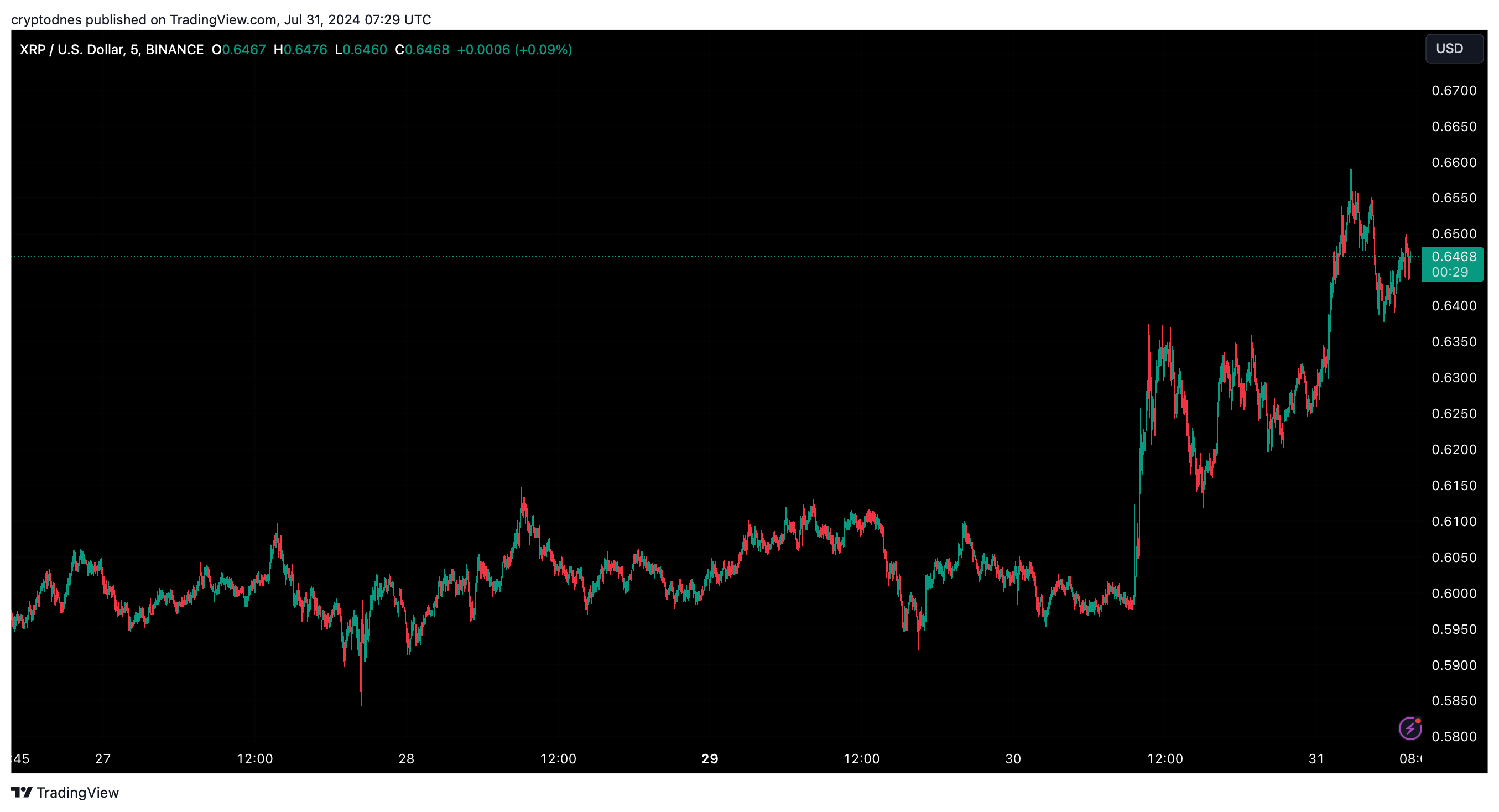

After a fairly long period of trading in a relatively narrow range, XRP appears to be defying the mostly negative results of the broader crypto market by registering gains over the past day.

XRP has appreciated by just over 8% in the last 24 hours, reaching around $0.646 at the time of writing, the highest since March 25, fueled by optimism surrounding the potential settlement of the SEC’s lawsuit against Ripple and the planned unlocking of tokens.

Traders are interpreting the recent SEC filing, which hints at an amendment to the complaint against Binance without naming tokens, as a positive sign for the resolution of the case against Ripple.

This spurs bullish sentiment despite Ripple’s planned unlocking of 1 billion XRP.

This market optimism comes despite the logical expectation that an increase in token supply will lead to a drop in prices. However, research suggests that the additional liquidity from unlocking the tokens may actually support the bullish trend.

In contrast to XRP’s performance, the crypto sector’s market cap has lost just over 0.4% in the past 24 hours. Bitcoin (BTC) and Ethereum (ETH) also registered losses of 0.9% and 0.6% respectively over the same time period.

-

1

Ethereum Loses Retail Momentum as Bitcoin Pulls Ahead

20.06.2025 21:00 1 min. read -

2

After a Bleak Week for Crypto, Eyes Turn to This Week’s Token Unlocks

23.06.2025 10:00 2 min. read -

3

Mass Liquidations and Wallet Dumps Sink ZKJ

17.06.2025 15:00 1 min. read -

4

Binance to Delist Three Spot Trading Pairs on June 20

18.06.2025 19:00 1 min. read -

5

USDC Poised for Futures Collateral Role in Coinbase–Nodal Clear Initiative

19.06.2025 16:00 1 min. read

Altcoin Market: In Which Stage are we Now, According to Top Crypto Expert

Crypto markets have been under pressure for months, and many investors are asking the same question—where exactly are we in the altcoin market cycle?

Here is Why Institutions are Choosing Ethereum, According To Vitalik Buterin

Ethereum may not be the fastest or cheapest blockchain—but that’s precisely why institutional investors are embracing it.

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

According to the latest Santiment report, the crypto market is entering a critical phase, with a mix of bullish on-chain signals and cautionary sentiment indicators.

Russia’s Rostec to Launch Ruble-Backed Stablecoin on Tron Blockchain

Russian state-owned defense and technology giant Rostec has unveiled plans to launch a ruble-pegged stablecoin and digital payments platform by the end of 2025, marking one of the country’s most significant moves yet toward blockchain-based financial infrastructure.

-

1

Ethereum Loses Retail Momentum as Bitcoin Pulls Ahead

20.06.2025 21:00 1 min. read -

2

After a Bleak Week for Crypto, Eyes Turn to This Week’s Token Unlocks

23.06.2025 10:00 2 min. read -

3

Mass Liquidations and Wallet Dumps Sink ZKJ

17.06.2025 15:00 1 min. read -

4

Binance to Delist Three Spot Trading Pairs on June 20

18.06.2025 19:00 1 min. read -

5

USDC Poised for Futures Collateral Role in Coinbase–Nodal Clear Initiative

19.06.2025 16:00 1 min. read