XRP Price Prediction: XRP Soars Over 30%, Can it Hit $10 in this Bull Run?

15.07.2025 0:49 5 min. read Nikolay Kolev

The total crypto market cap has hit a staggering $3.89 trillion, with bullish momentum surging as Bitcoin trades at new all-time highs above $120,000.

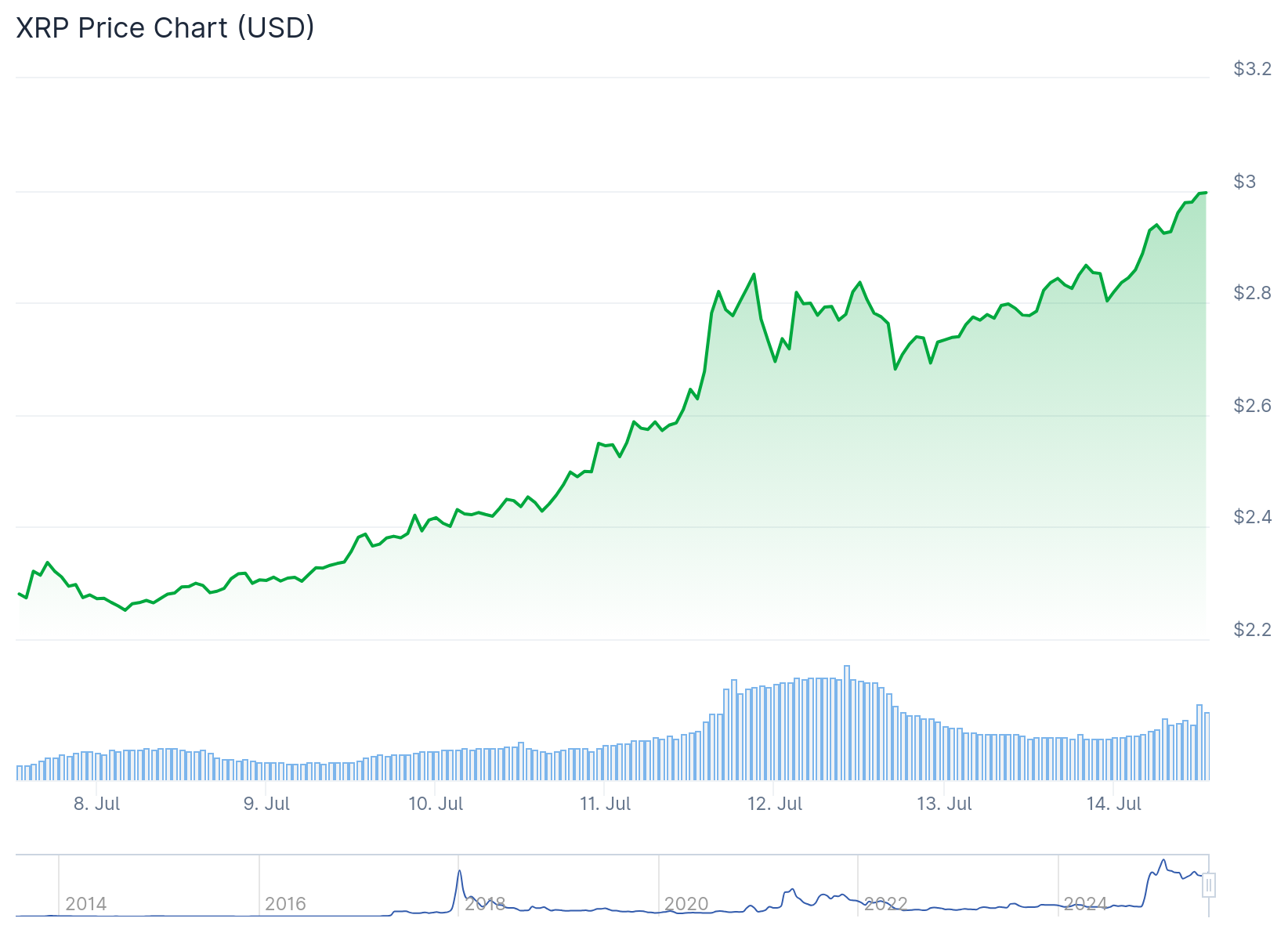

Among the standout gainers is XRP, which has jumped 31% in just the past seven days, drawing attention from traders, analysts and long-term holders alike. With XRP regaining ground and positive headlines flooding the space, many analysts believe that the token could reach new highs in the current bull cycle.

Could XRP be on track to hit $10 or even higher in the current market conditions, or could lower cap altcoins such as Bitcoin Hyper offer bigger gains?

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

XRP Rallies to $2.99 as Experts Predict 10x Momentum

XRP is the cryptocurrency developed by Ripple that is finding TradFi acceptance thanks to its ability to enable fast, low-cost international money transfers for banks and financial institutions.

After years of sideways movements between 2018 and 2023, XRP saw a dramatic breakout in November 2024, shortly after Donald Trump returned to the U.S. presidency with a clear pro-crypto stance.

The new political climate triggered a sharp rally, which sent XRP soaring from $0.50 in November 2024 to $3.30 by January 2025. The 560% price explosion captured market-wide attention.

Following the rally, the token experienced a correction to $1.79 amid broader market cooldowns. However, XRP has now surged back to $2.99, climbing 38% in the past month, with 31% of that gain coming in just the last week.

One of the biggest catalysts for this rally has been the SEC’s decision to settle its long-standing lawsuit with Ripple Labs for $50 million, resolving years of legal uncertainty that had weighed on the project.

With the ongoing bullishness, crypto influencer Bark, who has over 220K followers on X, predicts that XRP could climb between 10x to 20x, indicating a potential new ATH.

Fueling further optimism, Bloomberg analysts James Seyffart and Eric Balchunas believe there’s a 95% chance the SEC will approve an XRP Spot ETF this year. Such an approval could make it easier for everyday investors to gain exposure to XRP through traditional brokerage accounts, potentially driving major inflows.

With a market cap of $176 billion, XRP ranks as the third-largest cryptocurrency in the world. While XRP’s recent gains are impressive, many traders look to lower cap altcoins that offer more upside potential during bull runs, and one token that’s been catching eyes of late is Bitcoin Hyper.

Could Bitcoin Hyper be the Best Altcoin for this Bull Run?

Bitcoin Hyper is building the first dedicated Layer 2 (L2) solution designed specifically for the Bitcoin network. Its mission is to solve Bitcoin’s issue of slow transactions and high fees, and make BTC usable across other crypto areas like instant payments, DeFi, and gaming.

The project’s native token, HYPER, is currently available through presale, which has already stormed past $2.7 million, showing huge investor confidence. The token is used across the ecosystem for staking, transactions, and future governance of the Bitcoin Hyper ecosystem.

Built on Solana’s high-speed SVM (Solana Virtual Machine), Bitcoin Hyper enables DeFi apps, staking protocols, and even meme coin projects to run at lightning speed using BTC. This combination brings near-instant settlement, smart contract support, and decentralized trading tools, all layered on top of Bitcoin.

Bitcoin Hyper uses a trustless canonical bridge to verify BTC deposits via smart contracts. It works similarly to how Ethereum L2s have reduced the costs and extended the abilities of ETH.

To ensure safety and accuracy, ZK-proofs (zero-knowledge rollups) batch and validate transaction data before syncing it back to Bitcoin’s main chain. With plans to integrate dApps, NFT platforms, and DAO governance, Bitcoin Hyper is one of the top new utility tokens to watch.

Analysts Are Bullish on HYPER as Staking Activity Surges

Clinix Crypto, a popular YouTuber with nearly 100K subscribers, recently called Bitcoin Hyper one of the most exciting early-stage projects in the market right now.

He noted that presale tokens tend to attract major attention during bull markets, especially when Bitcoin is hitting new highs. Clinix emphasized that while many meme coins lack real function, Bitcoin Hyper stands out by offering actual utility tied to the Bitcoin network.

As demand for faster Bitcoin transactions grows, he believes scalable L2 solutions like Hyper will become essential. That’s why he’s tracking HYPER’s performance closely during this cycle.

Clinix also pointed out the project’s passive income appeal. At the time of writing, HYPER tokens can be staked to earn an APY (annual percentage yield) of up to 316%.

More than 166 million tokens have already been staked in a staking model that is designed to reduce the APY as more tokens are locked in, rewarding early adopters with the highest returns.

While XRP is already a proven large-cap asset, Bitcoin Hyper presents itself as a high-upside alternative, with a lower valuation and significant room for growth as the bull market expands.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Eclipse Labs Bans Team from ES Token Airdrop to Prevent Insider Abuse

26.06.2025 21:00 1 min. read -

2

Chainlink Bounces From Key Support, Eyes Breakout From Downtrend

29.06.2025 17:00 2 min. read -

3

Binance to Delist Five Tokens on July 4

02.07.2025 20:00 2 min. read -

4

What Are the Most Talked-About Words in Crypto Today?

28.06.2025 7:30 2 min. read -

5

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

30.06.2025 18:00 2 min. read

6 Altcoins Gaining Attention After Market Rally, Says Analyst

Crypto markets are buzzing once again, and according to analyst Miles Deutscher, a fresh wave of altcoins is drawing investor interest.

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

Standard Chartered has taken a major step into the cryptocurrency space, becoming the first globally systemically important bank to offer spot trading for Bitcoin (BTC) and Ethereum (ETH) to institutional clients.

These Blockchains are Quietly Heating up—Sonic Leads With 89% Address Growth

According to on-chain analytics firm Nansen, several blockchain networks are witnessing a sharp rise in user activity, led by Sonic, which recorded an impressive 89% growth in active addresses over the past 7 days.

These Are the Most Trending Altcoins Right Now, According to CoinGecko

Crypto analysis platform CoinGecko has revealed the most talked-about altcoins in recent hours, highlighting a surge in investor interest across a range of sectors—from meme coins to DeFi and gaming tokens.

-

1

Eclipse Labs Bans Team from ES Token Airdrop to Prevent Insider Abuse

26.06.2025 21:00 1 min. read -

2

Chainlink Bounces From Key Support, Eyes Breakout From Downtrend

29.06.2025 17:00 2 min. read -

3

Binance to Delist Five Tokens on July 4

02.07.2025 20:00 2 min. read -

4

What Are the Most Talked-About Words in Crypto Today?

28.06.2025 7:30 2 min. read -

5

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

30.06.2025 18:00 2 min. read