XRP Faces Pressure as Network Growth Slows and Bearish Patterns Form

21.04.2025 8:00 2 min. read Alexander Stefanov

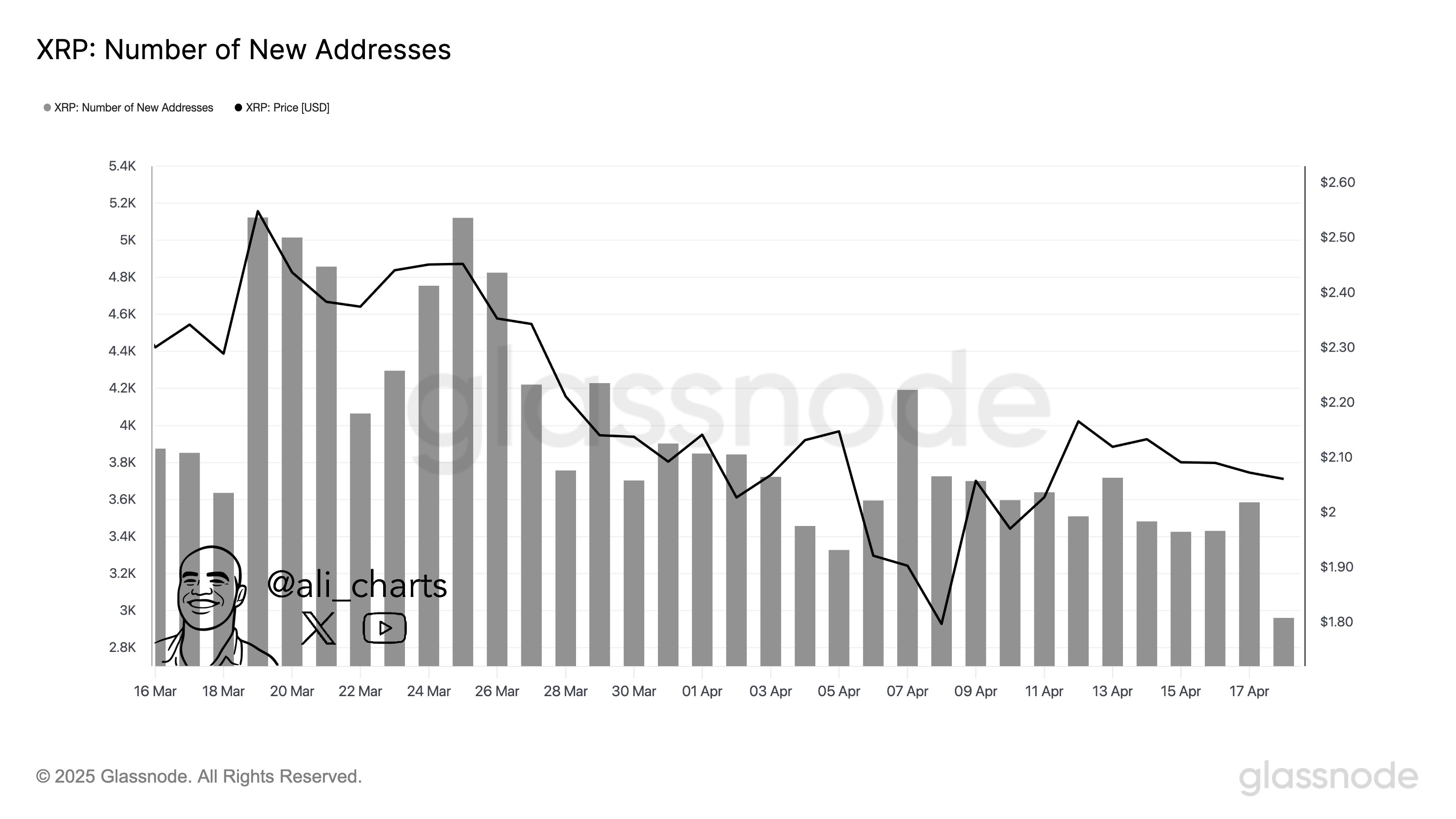

The XRP network is flashing early warning signs, with a steep drop in newly created wallet addresses raising concerns about fading interest.

Over the past month, new address activity has declined by 44%, falling from around 5,200 on March 22 to just 2,900 by April 17, according to Glassnode data. This cooling adoption trend coincides with a broader price dip, suggesting that investor enthusiasm may be waning.

Technical signals are adding to the caution. Crypto analyst Ali Martinez recently pointed to a bearish head-and-shoulders pattern on XRP’s chart, with the price breaking below a key neckline at $2.05—a level that has since been retested and rejected.

If this pattern plays out fully, XRP could retrace to the $1.30–$1.40 range, marking a possible 30% drop from current levels.

The bearish case is further supported by an uptick in short positions and increasing whale activity, as traders anticipate more downside. Another analyst, CrediBULL, believes XRP must hold the $1.60 zone to avoid deeper losses and potentially reset for a recovery.

At present, XRP is trading at $2.04 after a 7% weekly decline, showing short-term weakness while still holding above its 200-day moving average—a sign of longer-term resilience. However, sentiment remains shaky. The Fear & Greed Index sits at 37, indicating investor caution, while momentum indicators such as RSI remain neutral. Unless XRP can reclaim lost ground soon, a larger correction could be on the horizon.

-

1

Cardano ETF Approval Odds Hit Record High on Polymarket

22.06.2025 12:00 2 min. read -

2

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

21.06.2025 13:00 2 min. read -

3

Ethereum Price Prediction: This Trader Thinks ETH Could Soon Hit $12,000 – Here’s Why

25.06.2025 23:53 3 min. read -

4

Dogecoin’s Slump Could Be the Setup for a Massive Breakout

22.06.2025 14:00 2 min. read -

5

Solana Price Prediction: Trader Thinks SOL Could Rise to $200 in July – Here’s Why

26.06.2025 22:25 3 min. read

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

As Bitcoin enters a new on-chain trend phase, two altcoins are standing out for their growing correlation with the leading cryptocurrency and their resilience amid market shakeouts, according to new analysis by Joao Wedson, CEO of analytics firm Alphractal.

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

Digital asset investment products recorded $1.04 billion in inflows last week, pushing total assets under management (AuM) to a record high of $188 billion, according to the latest report from CoinShares.

SEC Accelerates Spot Solana ETF Timeline as July Deadline Looms

The U.S. Securities and Exchange Commission (SEC) is reportedly expediting the review process for spot Solana (SOL) exchange-traded funds, pushing issuers to submit amended S-1 filings by the end of July.

Bonk Price Prediction: Binance.US Mention Triggers 9% Jump – Can BONK Reach $1?

Bonk (BONK) has gone up by 9% in the past 24 hours and currently sits at $0.00002330 after Binance.US shared a cryptic X post that mentioned the token. On Sunday afternoon, the exchange shared a picture of its logo hitting its head with a bat – a clear reference to the viral meme that inspired […]

-

1

Cardano ETF Approval Odds Hit Record High on Polymarket

22.06.2025 12:00 2 min. read -

2

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

21.06.2025 13:00 2 min. read -

3

Ethereum Price Prediction: This Trader Thinks ETH Could Soon Hit $12,000 – Here’s Why

25.06.2025 23:53 3 min. read -

4

Dogecoin’s Slump Could Be the Setup for a Massive Breakout

22.06.2025 14:00 2 min. read -

5

Solana Price Prediction: Trader Thinks SOL Could Rise to $200 in July – Here’s Why

26.06.2025 22:25 3 min. read