XRP Faces Pressure as Network Growth Slows and Bearish Patterns Form

21.04.2025 8:00 2 min. read Alexander Stefanov

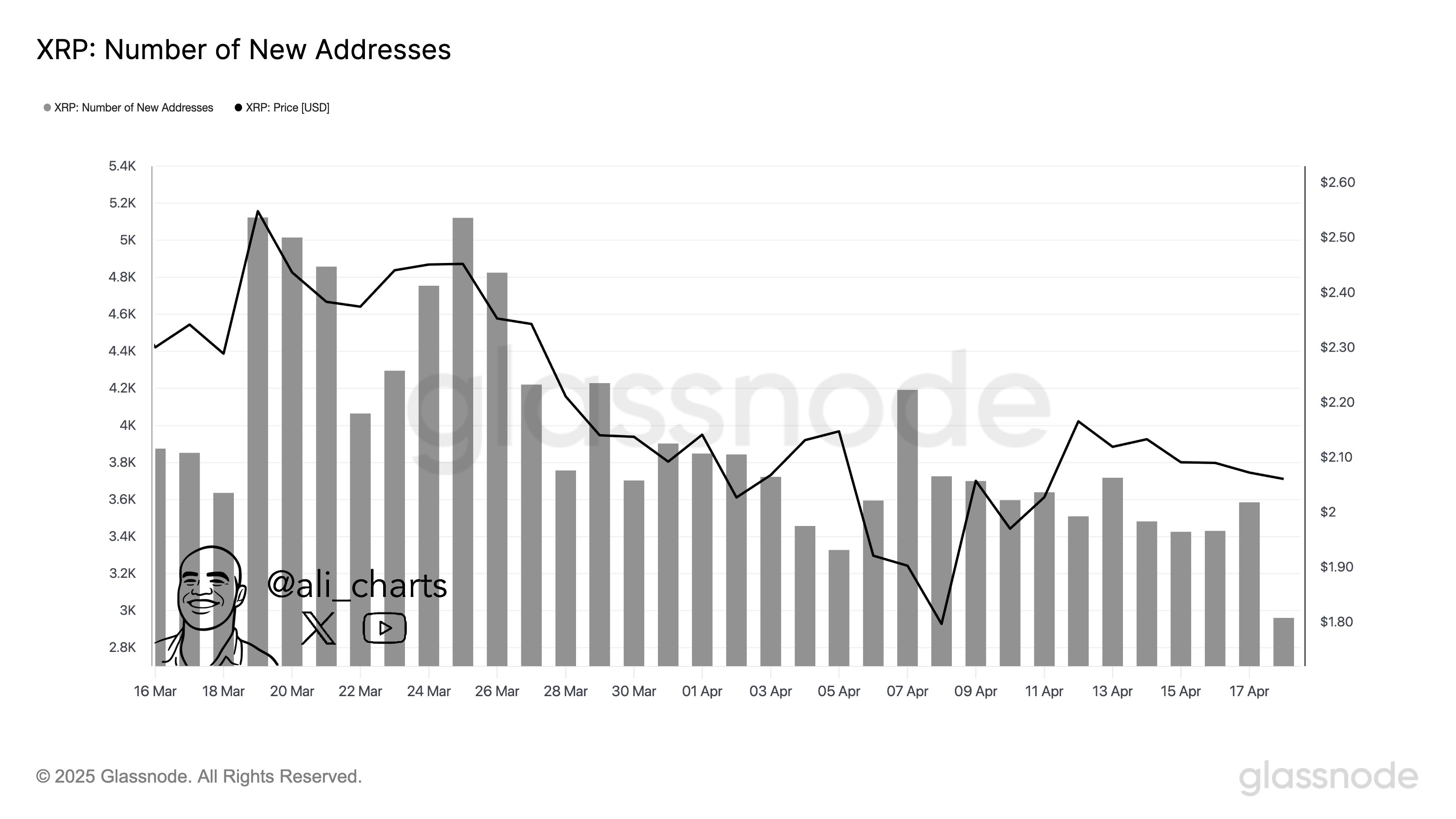

The XRP network is flashing early warning signs, with a steep drop in newly created wallet addresses raising concerns about fading interest.

Over the past month, new address activity has declined by 44%, falling from around 5,200 on March 22 to just 2,900 by April 17, according to Glassnode data. This cooling adoption trend coincides with a broader price dip, suggesting that investor enthusiasm may be waning.

Technical signals are adding to the caution. Crypto analyst Ali Martinez recently pointed to a bearish head-and-shoulders pattern on XRP’s chart, with the price breaking below a key neckline at $2.05—a level that has since been retested and rejected.

If this pattern plays out fully, XRP could retrace to the $1.30–$1.40 range, marking a possible 30% drop from current levels.

The bearish case is further supported by an uptick in short positions and increasing whale activity, as traders anticipate more downside. Another analyst, CrediBULL, believes XRP must hold the $1.60 zone to avoid deeper losses and potentially reset for a recovery.

At present, XRP is trading at $2.04 after a 7% weekly decline, showing short-term weakness while still holding above its 200-day moving average—a sign of longer-term resilience. However, sentiment remains shaky. The Fear & Greed Index sits at 37, indicating investor caution, while momentum indicators such as RSI remain neutral. Unless XRP can reclaim lost ground soon, a larger correction could be on the horizon.

-

1

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

2

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

3

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

4

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

5

Ethereum Price Prediction: ETH Ongoing Accumulation Favors Bullish Outlook – Can It Rise to $5,000?

08.07.2025 16:35 3 min. read

Dogecoin Soars 11% as Bit Origin Bets $500M on Meme Coin Reserves

Dogecoin posted an 11% surge in 24 hours, powered by institutional moves, bullish chart signals, and growing altcoin momentum.

Dogecoin Price Prediction: DOGE Volumes Nearly Double – Can It Get to $1 In This Cycle?

Dogecoin (DOGE) has gone up by 10% in the past 24 hours and currently sits at $0.2360 as the top meme coin is playing catch-up with newcomers to maintain its leadership. In the past 30 days, DOGE has shined as it has delivered gains of 40.5%. Trading volumes in the past day have surged by […]

Binance to Support Maker (MKR) Token Swap and Rebranding to Sky (SKY)

Binance has officially announced its support for the upcoming token swap, redenomination, and rebranding of Maker (MKR) to a new token named Sky (SKY).

Top 10 Trending Cryptocurrencies, According to CoinGecko

As of July 18, 2025, the cryptocurrency market continues to showcase sharp volatility, led by meme tokens, Layer 1 innovations, and key large-cap assets.

-

1

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

2

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

3

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

4

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

5

Ethereum Price Prediction: ETH Ongoing Accumulation Favors Bullish Outlook – Can It Rise to $5,000?

08.07.2025 16:35 3 min. read