XRP Eyes Next Target as Bullish Crossover Sparks 560% Surge

26.07.2025 21:30 1 min. read Kosta Gushterov

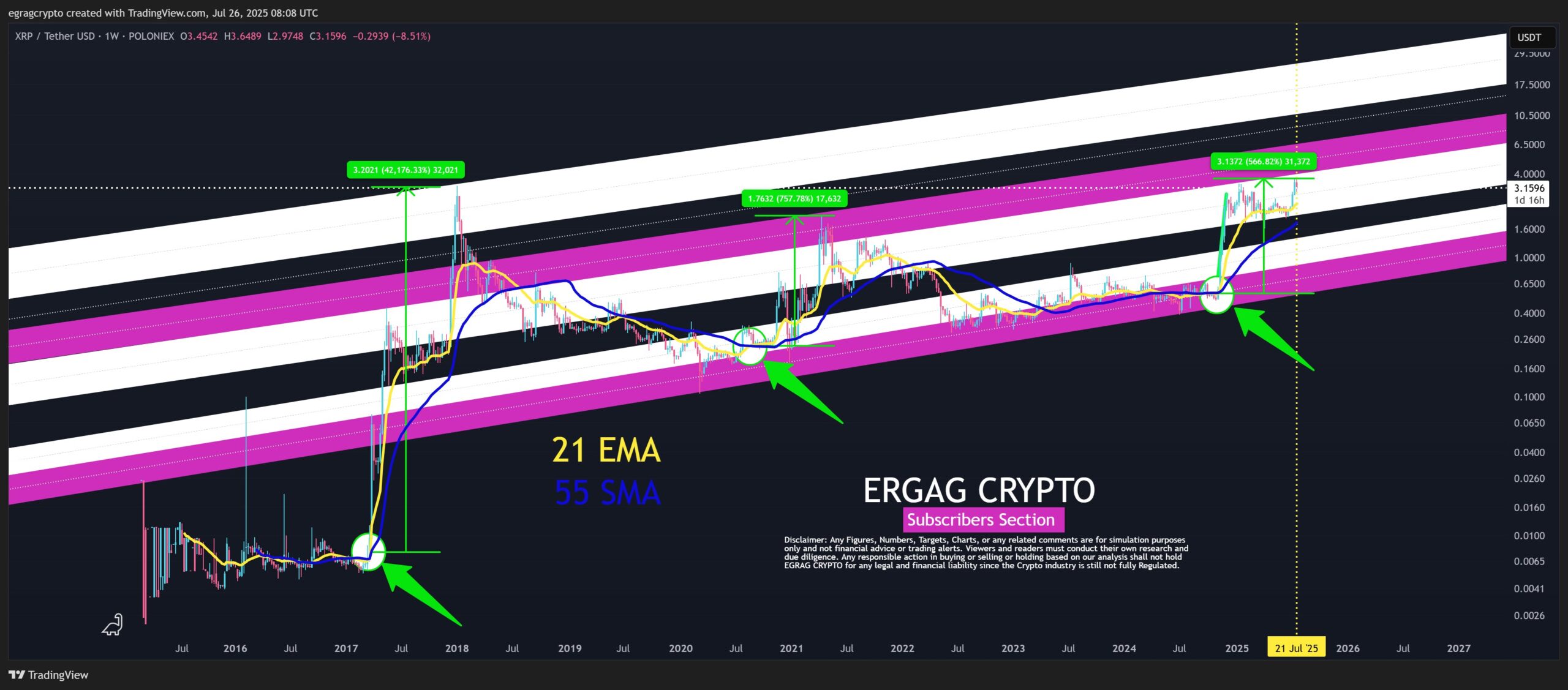

XRP is back in the spotlight after crypto analyst EGRAG CRYPTO highlighted a powerful historical pattern on the weekly timeframe—the bullish crossover of the 21 EMA and 55 SMA.

This technical signal has previously led to explosive price movements in past market cycles and appears to be repeating.

In March 2017, the same bullish crossover triggered a staggering 40,000% rally, marking one of XRP’s most legendary runs. A similar setup in August 2020 resulted in a 750% price surge, confirming the crossover as a recurring bullish catalyst for the token.

While a short-lived spike occurred in April 2023, EGRAG dismisses it as statistically insignificant. The real focus is on October 2024, when XRP once again confirmed a bullish cross between the 21-week EMA and the 55-week SMA. According to EGRAG’s analysis, this move has already fueled a 560% rally, hinting at much larger upside potential if history repeats.

The chart shared by the analyst suggests possible price projections between $9 and $24, depending on how strong this cycle’s momentum becomes. With market optimism rising around XRP’s regulatory outlook and rising on-chain activity, bulls are closely watching whether this technical setup will continue delivering gains.

If the pattern holds, XRP could be entering the early stages of a breakout similar to previous cycles—positioning itself as one of the top altcoins to watch in the current market.

-

1

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

2

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read -

3

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

21.07.2025 17:14 3 min. read -

4

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read -

5

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read

Interactive Brokers Weighs Stablecoin Launch

Interactive Brokers, one of the world’s largest online brokerage platforms, is exploring the possibility of issuing its own stablecoin, signaling a potential expansion into blockchain-driven financial infrastructure as U.S. crypto regulation begins to ease.

BNB Coin Price Prediction: As BNB Chain Daily Transaction Volumes Explode Can It Hit $900?

Trading volumes for BNB Coin (BNB) have doubled in the past 24 hours to $3.8 billion as the price rises by 7%. This favors a bullish BNB Coin price prediction at a point when the token just made a new all-time high. BNB is the second crypto in the top 5 to make a new […]

PENGU Price Soars While Whale Transfers Raise Alarms

The Pudgy Penguins’ PENGU token is under intense scrutiny after large transfers from its team wallet raised potential red flags.

BNB Hits New All-Time High Amid Token Launch Frenzy

BNB surged to a new all-time high on July 28 around $860, breaking above the critical $846 level following a sharp 7% intraday move.

-

1

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

2

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read -

3

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

21.07.2025 17:14 3 min. read -

4

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read -

5

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read