Will Trump Follow Through on Pardon Promise for Ross Ulbricht?

21.01.2025 15:00 2 min. read Alexander Zdravkov

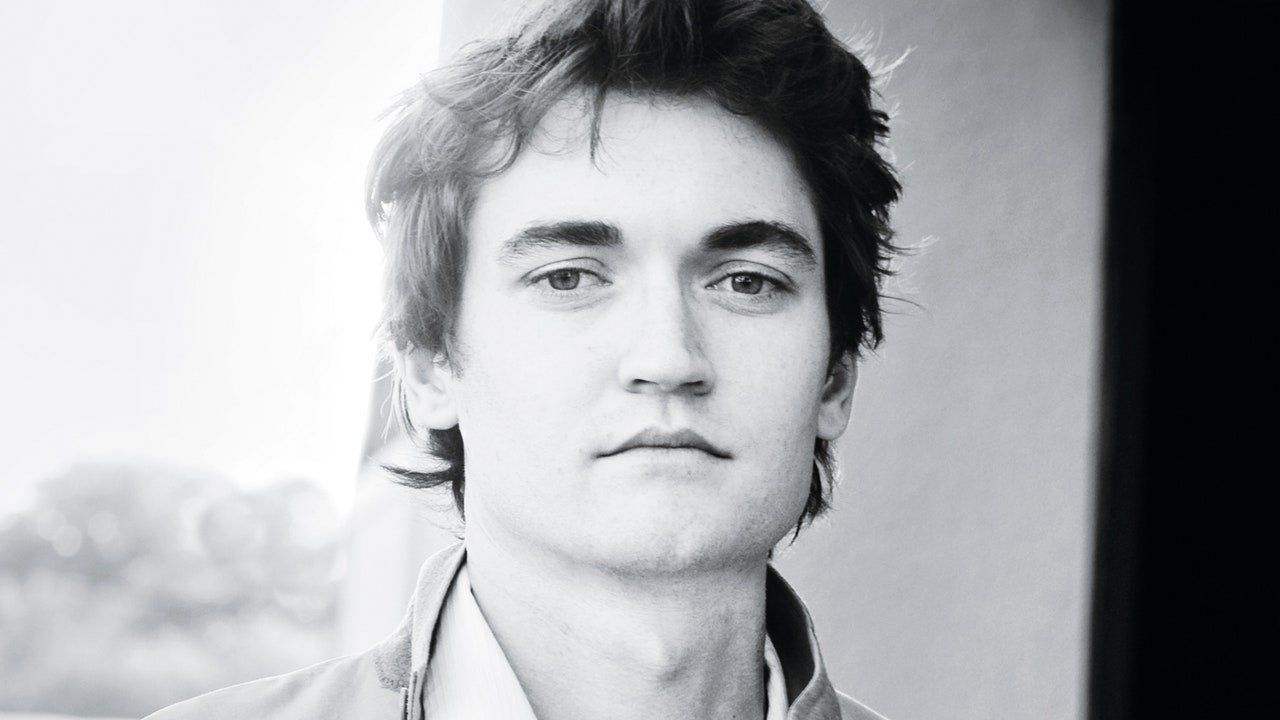

Speculation is mounting over a potential presidential pardon for Ross Ulbricht, the creator of the Silk Road marketplace.

Elon Musk recently hinted at the possibility, replying on X that “Ross will be freed too” in response to a user urging Donald Trump to take action. Libertarian National Committee Chair Angela McArdle further fueled expectations by suggesting the pardon could happen within the next day.

Ulbricht, who has been serving a life sentence since 2015 for operating the darknet marketplace, has long expressed regret for his actions. During his incarceration, he has focused on personal development, including pursuing education and advocating for his release. Trump had previously pledged during his campaign to commute Ulbricht’s sentence, and many now believe he may finally make good on that promise. The likelihood of a pardon within the first 100 days of his presidency is estimated at 94% on the betting platform Polymarket.

Despite widespread anticipation, Trump’s inauguration speech avoided any mention of cryptocurrency. Hopes that he might outline plans for a Bitcoin reserve or assert U.S. dominance in the crypto space were left unfulfilled. His initial executive orders also bypassed any crypto-related policies, leaving the industry waiting for clarity.

Even without immediate action, Trump’s administration has made notable pro-crypto appointments. Paul Atkins has been named to lead the SEC, while Caroline Pham will head the CFTC. Additionally, a new role focused on both artificial intelligence and cryptocurrency—dubbed the “AI and Crypto Czar”—will be filled by David Sacks, signaling a potential shift toward more favorable regulatory policies.

Industry leaders remain hopeful that Trump will take significant steps to support digital assets. Circle CEO Jeremy Allaire has expressed confidence that executive orders easing restrictions on crypto-related banking could be on the horizon, potentially bringing an end to what some have called “Operation Choke Point 2.0.”

-

1

Here is Why the Fed May Cut Rates Earlier Than Expected, According to Goldman Sachs

08.07.2025 15:00 2 min. read -

2

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read -

3

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

29.06.2025 9:00 2 min. read -

4

Donald Trump Signs “One Big Beautiful Bill”: How It Can Reshape the Crypto Market

05.07.2025 9:56 2 min. read -

5

Market Odds of a U.S. Recession in 2025 Drop in Half Since May

05.07.2025 18:30 2 min. read

BitGo Files Confidentially for IPO With SEC

BitGo Holdings, Inc. has taken a key step toward becoming a publicly traded company by confidentially submitting a draft registration statement on Form S-1 to the U.S. Securities and Exchange Commission (SEC).

Crypto Greed Index Stays Elevated for 9 Days — What it Signals Next?

The crypto market continues to flash bullish signals, with the CMC Fear & Greed Index holding at 67 despite a minor pullback from yesterday.

U.S. Public Pension Giant Boosts Palantir and Strategy Holdings in Q2

According to a report by Barron’s, the Ohio Public Employees Retirement System (OPERS) made notable adjustments to its portfolio in Q2 2025, significantly increasing exposure to Palantir and Strategy while cutting back on Lyft.

Key Crypto Events to Watch in the Next Months

As crypto markets gain momentum heading into the second half of 2025, a series of pivotal regulatory and macroeconomic events are poised to shape sentiment, liquidity, and price action across the space.

-

1

Here is Why the Fed May Cut Rates Earlier Than Expected, According to Goldman Sachs

08.07.2025 15:00 2 min. read -

2

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read -

3

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

29.06.2025 9:00 2 min. read -

4

Donald Trump Signs “One Big Beautiful Bill”: How It Can Reshape the Crypto Market

05.07.2025 9:56 2 min. read -

5

Market Odds of a U.S. Recession in 2025 Drop in Half Since May

05.07.2025 18:30 2 min. read