Will Biden’s Debate Struggles Affect Stock Market Confidence?

05.07.2024 11:00 1 min. read Alexander Stefanov

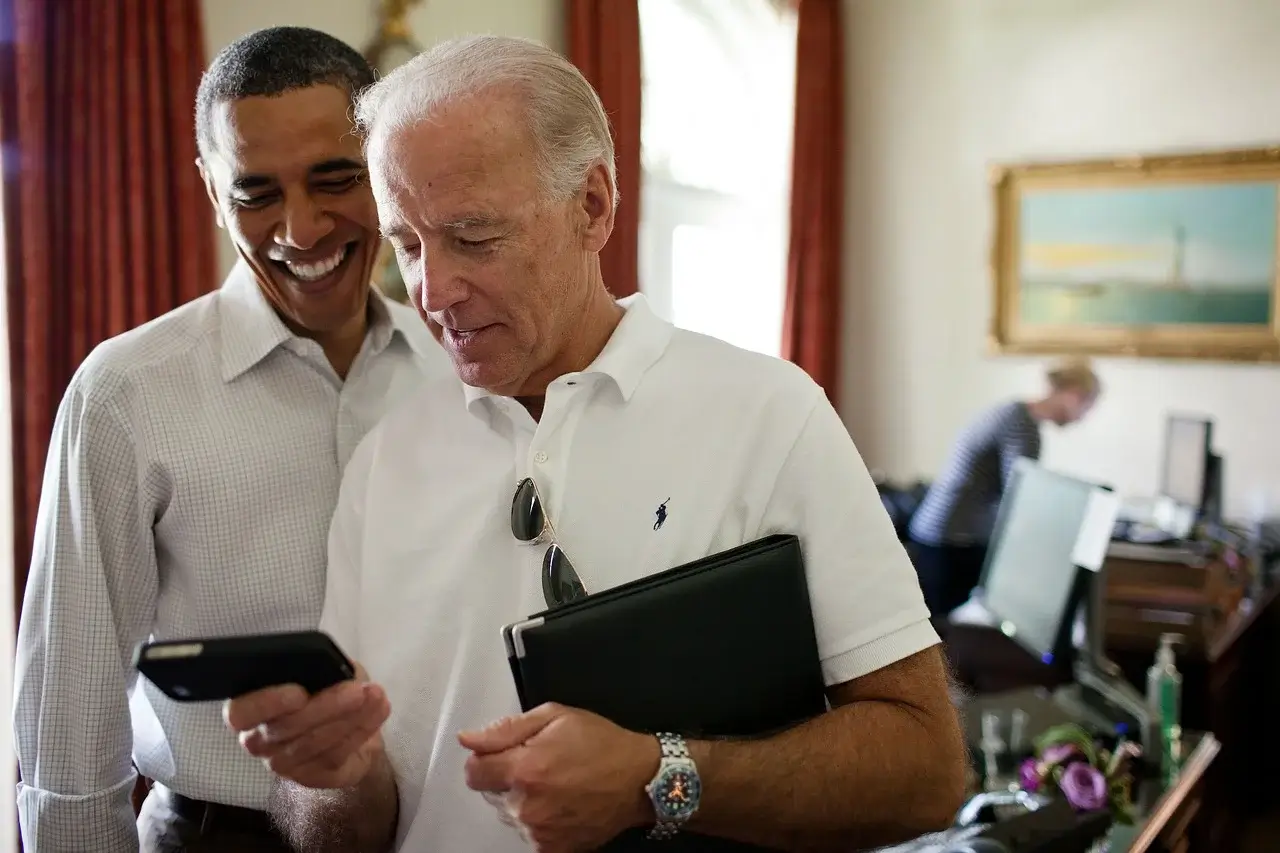

As President Joe Biden faces mounting challenges following a tumultuous TV debate last week, investors are contemplating the potential market impact of any shift in Democratic leadership.

Market trends have closely mirrored the fluctuating fortunes of Biden and his Republican opponent, former President Donald Trump, observed Adam Turnquist, chief technical strategist at LPL Financial.

He noted a correlation between market movements and Trump’s electoral prospects since March, suggesting that market sentiment aligns with perceptions of political stability rather than endorsing specific policies.

Turnquist emphasized that market reactions indicate a preference for certainty over uncertainty, with earlier trends showing a positive market response when Biden was initially favored to win.

Recent debates and subsequent speculation about Biden’s candidacy have intensified concerns within the Democratic party. While the White House has affirmed Biden’s commitment to remain in the race, Vice President Kamala Harris has gained traction in betting markets as a potential alternative.

Meanwhile, PredictIt odds favor Trump’s reelection at 59%, contrasting sharply with Biden’s diminished support at around 16% post-debate.

Polls following the debate reflect a tightening race, with Trump pulling ahead in some surveys, underscoring ongoing uncertainties in the political landscape.

-

1

Trump’s 2024 Crypto Earnings Top $58 Million—DeFi Stake Drives Most of the Haul

16.06.2025 9:00 2 min. read -

2

Tron Sets Sights on Wall Street Through Reverse Merger

17.06.2025 7:00 1 min. read -

3

Tether Now Among World’s Largest Holders of U.S. Treasuries, CEO Says

21.06.2025 9:00 1 min. read -

4

Big Funds Sell $51B in May, But Buybacks Cushion U.S. Stock Market

20.06.2025 10:00 2 min. read -

5

Canton Network Developer Secures $135M to Expand Institutional Blockchain Use

25.06.2025 12:00 1 min. read

Robinhood Faces Scrutiny from European Bank Over Tokenized Stock Offerings

Lithuania’s central bank has reached out to Robinhood for further details regarding its newly launched stock token products, following a public distancing by OpenAI from the initiative.

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

As President Trump accelerates his tariff strategy ahead of the August 1 deadline, new White House letters reveal formal trade warnings sent to multiple nations, including Tunisia, Cambodia, Indonesia, and others.

UAE Regulators Dismiss Toncoin Residency Rumors

United Arab Emirates authorities have formally denied reports linking Toncoin (TON) ownership or staking to long-term visa eligibility, calling the circulating claims inaccurate and misleading.

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

Changpeng Zhao, the former head of Binance, has hinted at the possibility of a new initiative that would allow BNB token holders to obtain long-term residency in the United Arab Emirates through a token-staking model.

-

1

Trump’s 2024 Crypto Earnings Top $58 Million—DeFi Stake Drives Most of the Haul

16.06.2025 9:00 2 min. read -

2

Tron Sets Sights on Wall Street Through Reverse Merger

17.06.2025 7:00 1 min. read -

3

Tether Now Among World’s Largest Holders of U.S. Treasuries, CEO Says

21.06.2025 9:00 1 min. read -

4

Big Funds Sell $51B in May, But Buybacks Cushion U.S. Stock Market

20.06.2025 10:00 2 min. read -

5

Canton Network Developer Secures $135M to Expand Institutional Blockchain Use

25.06.2025 12:00 1 min. read