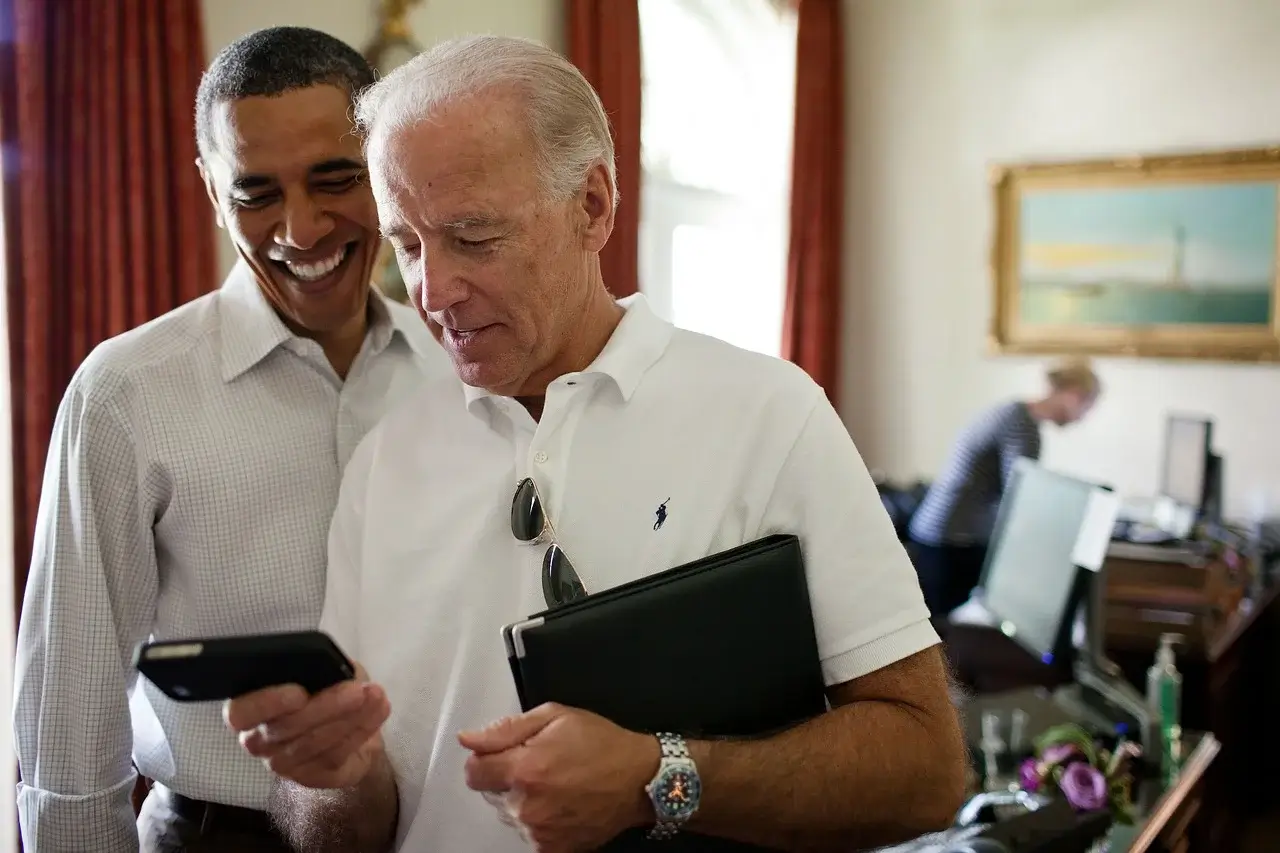

Will Biden’s Debate Struggles Affect Stock Market Confidence?

05.07.2024 11:00 1 min. read Alexander Stefanov

As President Joe Biden faces mounting challenges following a tumultuous TV debate last week, investors are contemplating the potential market impact of any shift in Democratic leadership.

Market trends have closely mirrored the fluctuating fortunes of Biden and his Republican opponent, former President Donald Trump, observed Adam Turnquist, chief technical strategist at LPL Financial.

He noted a correlation between market movements and Trump’s electoral prospects since March, suggesting that market sentiment aligns with perceptions of political stability rather than endorsing specific policies.

Turnquist emphasized that market reactions indicate a preference for certainty over uncertainty, with earlier trends showing a positive market response when Biden was initially favored to win.

Recent debates and subsequent speculation about Biden’s candidacy have intensified concerns within the Democratic party. While the White House has affirmed Biden’s commitment to remain in the race, Vice President Kamala Harris has gained traction in betting markets as a potential alternative.

Meanwhile, PredictIt odds favor Trump’s reelection at 59%, contrasting sharply with Biden’s diminished support at around 16% post-debate.

Polls following the debate reflect a tightening race, with Trump pulling ahead in some surveys, underscoring ongoing uncertainties in the political landscape.

-

1

Ripple Faces Legal Setback as Court Rejects Bid to Ease Penalties

26.06.2025 16:54 1 min. read -

2

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

29.06.2025 21:00 2 min. read -

3

Ripple Has Applied for a National Banking License

03.07.2025 7:00 2 min. read -

4

What Will Happen With the Stock Market if Trump Reshapes the Fed?

29.06.2025 13:00 2 min. read -

5

Barclays Blocks Crypto Credit Card Payments in Latest Blow to Retail Investors

26.06.2025 8:00 2 min. read

Weekly Crypto Roundup: Bitcoin Hits ATH, Ethereum Surges, Trump Advances Crypto Reforms

Analyzing the latest updates shared by Wu Blockchain, this past week underscored a pivotal shift in the crypto landscape. Bitcoin surged to a new all-time high of $123,226, pushing the overall crypto market cap beyond $4 trillion—a milestone reflecting renewed investor confidence and accelerating institutional flows.

Charles Schwab to Launch Bitcoin and Ethereum Trading Soon, CEO Confirms

Charles Schwab is preparing to roll out spot Bitcoin and Ethereum trading, according to CEO Rick Wurster during the firm’s latest earnings call.

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

BlackRock is seeking to enhance its iShares Ethereum Trust (ticker: ETHA) by incorporating staking features, according to a new filing with the U.S. Securities and Exchange Commission (SEC) submitted Thursday.

IMF Disputes El Salvador’s Bitcoin Purchases, Cites Asset Consolidation

A new report from the International Monetary Fund (IMF) suggests that El Salvador’s recent Bitcoin accumulation may not stem from ongoing purchases, but rather from a reshuffling of assets across government-controlled wallets.

-

1

Ripple Faces Legal Setback as Court Rejects Bid to Ease Penalties

26.06.2025 16:54 1 min. read -

2

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

29.06.2025 21:00 2 min. read -

3

Ripple Has Applied for a National Banking License

03.07.2025 7:00 2 min. read -

4

What Will Happen With the Stock Market if Trump Reshapes the Fed?

29.06.2025 13:00 2 min. read -

5

Barclays Blocks Crypto Credit Card Payments in Latest Blow to Retail Investors

26.06.2025 8:00 2 min. read