Why is the Crypto Market Down Today?

01.08.2024 19:42 3 min. read Alexander Stefanov

After a strong July, which saw a rebound that lifted Bitcoin to nearly $70,000, the crypto market has taken a sharp downturn by the end of the month.

CoinMarketCap data shows that the broader crypto scene is down nearly 5.46% to $2.26 trillion. This decline is largely attributed to the weak US economy and recent decisions by the Federal Reserve.

Market Performance Overview

Bitcoin and most cryptocurrencies have experienced significant losses. The contracting BTC prices have negatively impacted top altcoins, with Solana experiencing a flash crash of nearly 11%. Ethereum and XRP also saw notable losses, shedding 6% and 10%, respectively.

BTC also experienced a sharp decline of 5.25% in the past 24 hours to below $63,000.

Federal Reserve’s Impact

The primary driver behind the recent dip in crypto prices is the Federal Reserve’s decision to hold interest rates steady at 5.5%. Despite Federal Reserve Chair Jerome Powell hinting at a potential rate cut in September, the decision was received negatively by the market, particularly by crypto investors. This uncertainty contributed to the downturn in both the crypto and stock markets.

Stock Market Tumbles

The stock market also reacted negatively to recent economic data. On Thursday, the Dow Jones Industrial Average dropped 480 points (1.2%), the S&P 500 shed 0.9%, the Nasdaq Composite slipped 1.3%, and the Russell 2000 index fell nearly 3%. These declines were driven by fears of a possible recession, reversing the momentum from earlier in the week. The only sectors that managed to stay afloat are real estate and utilities.

Economic Indicators

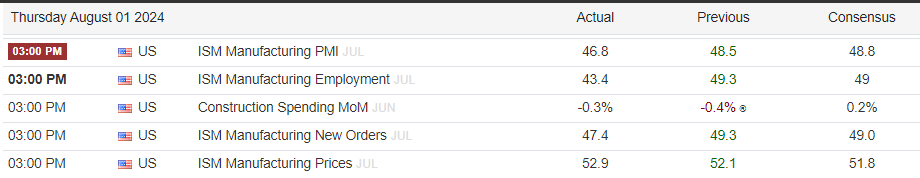

Several key economic indicators have raised concerns about the health of the US economy:

- Initial Jobless Claims: Rose to 249,000 last week, higher than the forecasted 235,000, marking the highest level since August 2023.

- ISM Manufacturing Index: Came in at 46.8%, indicating economic contraction and falling short of expectations.

- 10-Year Treasury Yield: Broke below 4% for the first time since February.

These indicators suggest a cooling economy, heightening fears of an impending recession.

Analyst Perspectives

Some analysts view the Federal Reserve’s recent move as a lack of commitment, especially when inflation is cooling. Powell emphasized a data-driven approach, relying on economic data, particularly inflation, to determine future rate cuts. Interest rates have been steady at 5.5% since July 2023, with many in the traditional finance sector anticipating a potential rate cut in September.

Chris Rupkey, chief economist at FWDBONDS, commented,

“The economic data keep rolling on in the direction of a downturn, if not recession, this morning. The stock market doesn’t know whether to laugh or cry because while three Fed rate cuts may be coming this year and 10-year bond yields are falling below 4.00%, the winds of recession are coming in hard.”

Conclusion

The weak economic data, combined with the Federal Reserve’s decision to maintain high interest rates, has sparked fears of a recession and contributed to the recent decline in crypto prices. As investors navigate this uncertain landscape, the potential for future rate cuts in September remains a key factor to watch.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read

XRP: What’s the Next Target After Bullish Breakout?

XRP has emerged from a months-long consolidation with renewed bullish momentum, reigniting trader interest in its next major price target.

Bitcoin Dominance Holds Firm as Altcoins Show Early Signs of Rotation

Despite recent gains across select DeFi and RWA tokens, Bitcoin continues to dominate the crypto landscape, with the Altcoin Season Index sitting at 43/100, according to today’s CoinMarketCap data.

XRP Eyes Next Target as Bullish Crossover Sparks 560% Surge

XRP is back in the spotlight after crypto analyst EGRAG CRYPTO highlighted a powerful historical pattern on the weekly timeframe—the bullish crossover of the 21 EMA and 55 SMA.

Top 5 Most Trending Cryptocurrencies Today: Zora, Pudgy Penguins, SUI and More

Crypto markets are buzzing with momentum as several altcoins post double-digit gains and surging volumes.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read