Which Is the Next Bitcoin Price Target?

06.07.2025 20:00 2 min. read Kosta Gushterov

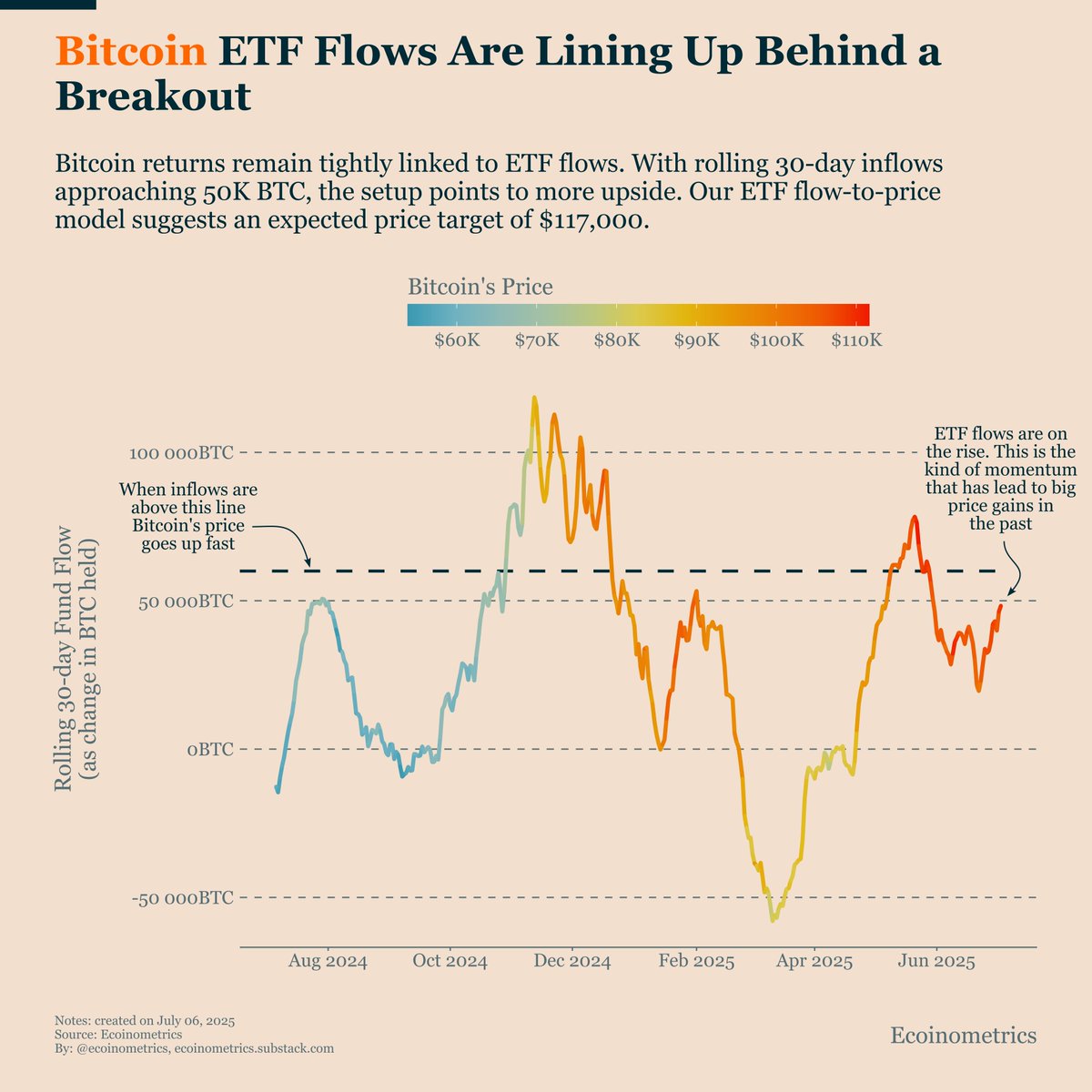

Bitcoin could be on the verge of another major breakout as institutional inflows return to levels that historically trigger rapid price acceleration.

According to a new analysis by Ecoinometrics, 30-day rolling inflows into Bitcoin exchange-traded funds (ETFs) are nearing 50,000 BTC — a threshold that has previously signaled the start of powerful bull moves.

The report highlights a strong correlation between ETF fund flows and Bitcoin’s price direction. When rolling ETF inflows exceed the 50,000 BTC mark, past data shows Bitcoin’s price tends to surge significantly, as seen in Q4 2024 and early 2025. During those periods, BTC climbed rapidly toward new highs, driven largely by institutional demand reflected in spot ETF purchases.

Ecoinometrics’ ETF flow-to-price model now points to a potential target of $117,000, assuming inflows continue to rise. The model uses past inflow surges to estimate fair value, and current momentum suggests BTC may soon revisit the upper price bands that historically align with strong fund accumulation.

The accompanying chart shows color-coded bands corresponding to BTC’s price range ($60K–$110K) and compares them with the 30-day fund flow trajectory. During periods of high inflows — particularly above 50K BTC — the price has consistently trended higher, entering warmer-colored zones on the chart.

ETF inflows are once again rising in July, a sign that institutional confidence remains robust despite recent consolidation. This return of positive fund momentum reinforces the $117K projection and suggests that Bitcoin may soon enter its next breakout phase — as long as the inflow pattern continues.

With fund flows acting as a leading indicator of institutional demand, all eyes are now on whether the 50K BTC inflow level will be decisively breached. If so, Bitcoin’s path toward six-figure territory could become increasingly likely in the months ahead.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

3

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

4

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

5

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

3

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

4

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

5

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read