What’s Driving July’s Crypto Conversations, According to Santiment

05.07.2025 22:00 2 min. read Kosta Gushterov

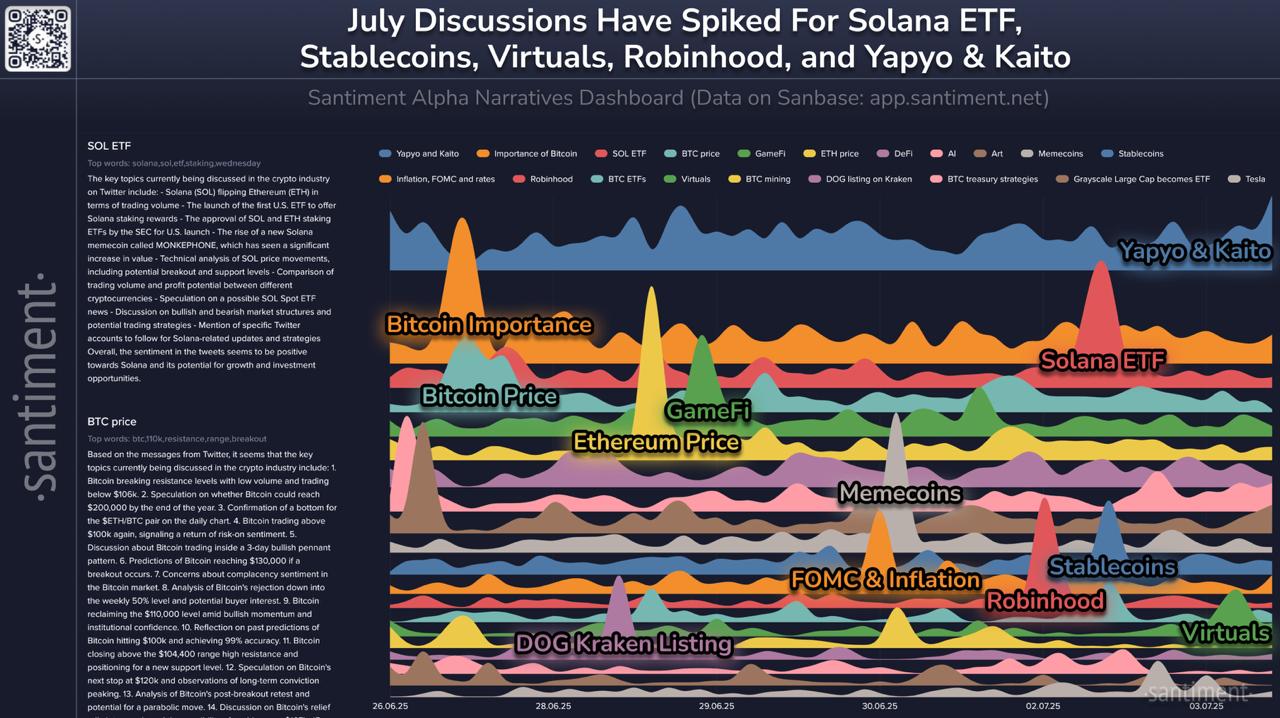

According to Santiment’s latest narrative dashboard, the start of July has seen a surge in online discussions around a wide range of crypto themes, with Solana ETFs, stablecoins, Virtuals, Robinhood, and AI bot projects like Yapyo & Kaito leading the spike in mentions across platforms.

The July 4 update, which coincided with both U.S. Independence Day and Santiment’s anniversary, highlights how shifting market narratives are influencing trader sentiment and community focus.

Santiment’s Alpha Narratives Dashboard, which tracks thematic trends across crypto conversations, shows that Solana ETF speculation is currently dominating attention.

This includes talk around the approval of the U.S. spot ETF tied to Solana and the integration of staking rewards as part of its offering.

In addition to ETF excitement, stablecoins have re-entered the spotlight, potentially due to recent geopolitical developments and policy debate around digital dollar infrastructure. Meanwhile, Virtuals, a segment associated with metaverse and augmented identity platforms, has gained renewed attention, alongside Robinhood, likely triggered by the platform’s growing crypto trading volume and ETF exposure.

Interestingly, Yapyo & Kaito—AI-focused bots or crypto-native agent tools—have emerged as new hot topics. Their rise reflects growing interest in AI-enhanced trading or analysis tools within the crypto space, aligning with broader tech adoption trends.

Santiment’s dashboard also continues to track legacy narratives like Bitcoin price volatility, Ethereum fundamentals, memecoins, and inflation-related chatter, though they have seen relatively moderate spikes compared to the newer focal points.

With attention cycling rapidly in crypto, Santiment’s data suggests that narrative rotation is a key driver of short-term volatility and engagement. As ETF approvals and policy shifts continue to unfold, these leading discussion topics may offer a window into evolving market sentiment.

-

1

FSB Flags Mounting Crypto Risks as Stablecoins Tighten Grip on Finance

13.06.2025 11:00 2 min. read -

2

Coinbase Picks Luxembourg for Its New EU Headquarters, Secures MiCA License

21.06.2025 11:00 1 min. read -

3

Circle’s Market Cap Surges Past Its Own Stablecoin

24.06.2025 12:00 1 min. read -

4

Crypto Market May Be in Early Stages of Multi-Year Rally, Says Real Vision CEO

21.06.2025 17:00 2 min. read -

5

Trump’s 2024 Crypto Earnings Top $58 Million—DeFi Stake Drives Most of the Haul

16.06.2025 9:00 2 min. read

UAE Regulators Dismiss Toncoin Residency Rumors

United Arab Emirates authorities have formally denied reports linking Toncoin (TON) ownership or staking to long-term visa eligibility, calling the circulating claims inaccurate and misleading.

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

Changpeng Zhao, the former head of Binance, has hinted at the possibility of a new initiative that would allow BNB token holders to obtain long-term residency in the United Arab Emirates through a token-staking model.

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

The first week of July brought notable advancements in crypto infrastructure, governance, and trading.

EU Risks Falling Behind in Digital Finance, Warns Former ECB Board Member

Europe’s reluctance to embrace stablecoins and blockchain technology could erode its monetary sovereignty and marginalize the euro in the next phase of global finance, according to former European Central Bank board member Lorenzo Bini Smaghi.

-

1

FSB Flags Mounting Crypto Risks as Stablecoins Tighten Grip on Finance

13.06.2025 11:00 2 min. read -

2

Coinbase Picks Luxembourg for Its New EU Headquarters, Secures MiCA License

21.06.2025 11:00 1 min. read -

3

Circle’s Market Cap Surges Past Its Own Stablecoin

24.06.2025 12:00 1 min. read -

4

Crypto Market May Be in Early Stages of Multi-Year Rally, Says Real Vision CEO

21.06.2025 17:00 2 min. read -

5

Trump’s 2024 Crypto Earnings Top $58 Million—DeFi Stake Drives Most of the Haul

16.06.2025 9:00 2 min. read