What Percentage of Bitcoin Holders Are in Profit After Price Broke $64K?

26.09.2024 19:30 1 min. read Alexander Zdravkov

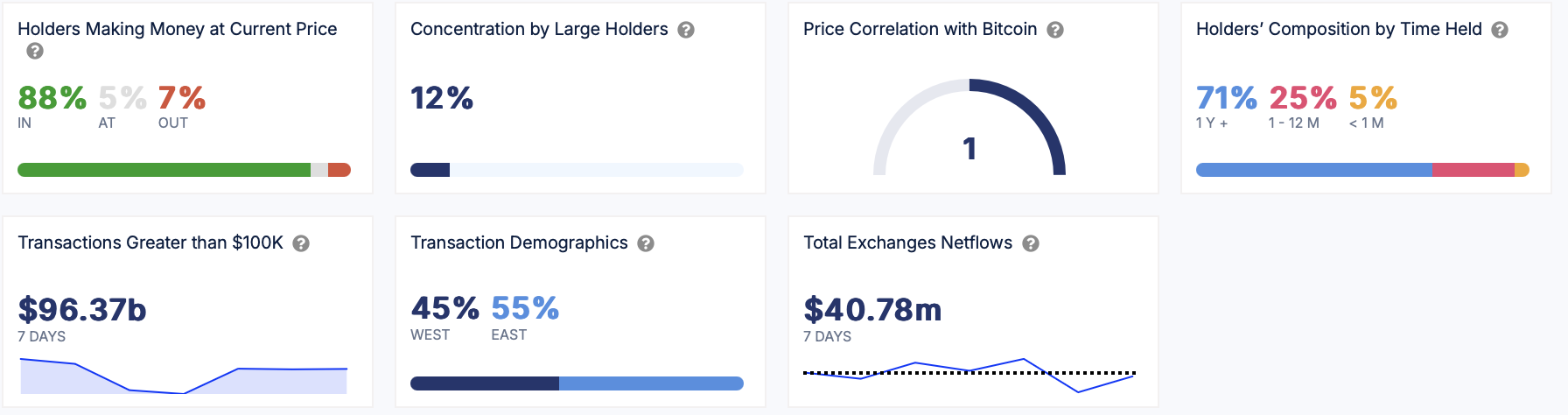

After the price of Bitcoin broke above $64,000, the majority of cryptocurrency holders are in profit.

With the price of BTC around $65,300 at the time of writing, around 88% of holders of the asset are in profit according to information provided by IntoTheBlock.

This marks a recovery from earlier in the summer when they were only around 65% when prices fell below $55,000.

The higher percentage suggests that more holders are making profits, which often correlates with positive market sentiment.=

Historically, rising profit percentages have accompanied upward price movements, serving as a barometer of market confidence and potentially influencing trading behavior.

The recovery to 88% reflects renewed investor optimism after periods of volatility.

-

1

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

2

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

3

Bitcoin: Historical Trends Point to Likely Upside Movement

08.07.2025 16:00 2 min. read -

4

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

5

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

14.07.2025 18:34 2 min. read

Strategy Launches Fourth Preferred stock Offering to Fuel Bitcoin Buys

Strategy Inc. (NASDAQ: MSTR) has announced the launch of its fourth perpetual preferred stock offering, marking a new phase in the company’s ongoing efforts to expand its Bitcoin treasury holdings.

Public Companies Now hold Over $100 Billion in Bitcoin — 4% of Total Supply

According to new data shared by Bitcoin Magazine Pro, publicly traded companies now collectively hold over 844,822 BTC, valued at more than $100.5 billion, marking a historic milestone for institutional Bitcoin adoption.

Trump Media Holds $2B in Bitcoin as Crypto Plan Expands

Trump Media and Technology Group, the parent company of Truth Social, Truth+, and Truth.Fi, has officially disclosed that it now holds approximately $2 billion in Bitcoin and Bitcoin-related securities.

Strategy Adds 6,220 BTC, Pushing Total Holdings Past 607,000

Michael Saylor’s Strategy has confirmed another major Bitcoin purchase, acquiring 6,220 BTC last week for approximately $739.8 million.

-

1

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

2

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

3

Bitcoin: Historical Trends Point to Likely Upside Movement

08.07.2025 16:00 2 min. read -

4

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

5

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

14.07.2025 18:34 2 min. read