Whales Buy the Dip as Retail Panics: This Week in Crypto

29.06.2025 14:00 3 min. read Kosta Gushterov

The latest market turbulence, fueled by geopolitical tensions and investor fear, offered a textbook case of how sentiment swings and whale behavior shape crypto price action.

In Santiment’s newest “This Week in Crypto” livestream, analyst Brian dissected the dramatic events of late June, providing an in-depth look at how smart money responded while retail investors scrambled.

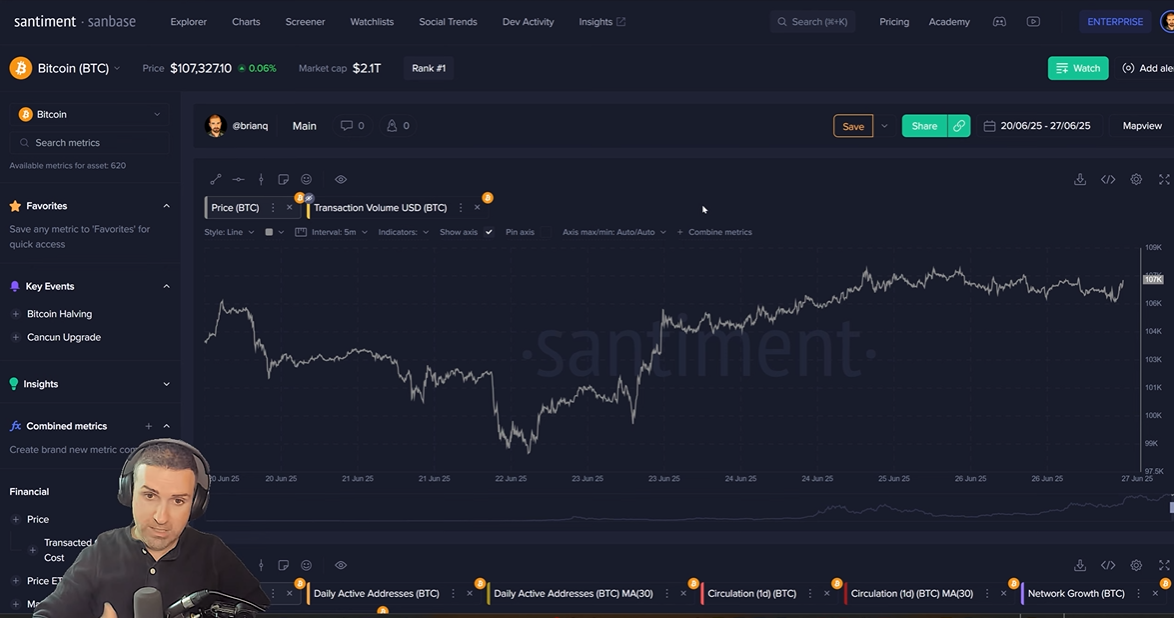

Bitcoin Plunges Below $100K as Panic Takes Hold

The week kicked off with a jolt: escalating U.S.-Iran tensions sent shockwaves across financial markets. Bitcoin reacted sharply, falling to $98,500—its lowest point in nearly two months. According to Brian, this swift decline was emotionally driven, underscoring how geopolitical uncertainty often leads to impulsive selloffs in crypto. He advises traders to wait 24–48 hours before reacting to global events, as initial moves are often misleading.

Whales Accumulate, Retail Retreats: A Familiar Pattern Repeats

While retail traders sold in panic, whales quietly bought the dip. Wallets holding between 10 and 10,000 BTC added 22,200 BTC in just 18 days. Brian explained that these periods of fear offer ideal entry points for seasoned investors. Santiment’s sentiment data hit monthly lows just before the rebound, indicating classic “maximum fear equals maximum opportunity” behavior. Meanwhile, wallets holding at least 10 BTC reached a 3.5-month high—another clear sign of growing whale confidence.

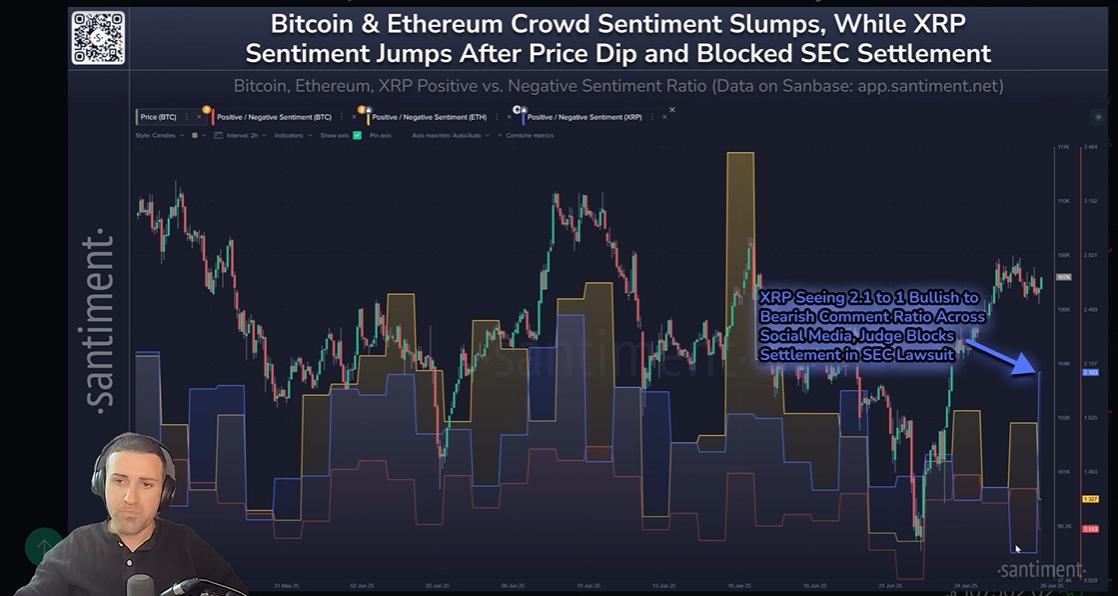

XRP Sentiment Climbs Despite Legal Setback

In an unexpected twist, XRP sentiment rose even after Judge Torres blocked the proposed $50 million SEC settlement. While the news cast fresh uncertainty over Ripple’s case, the XRP community responded positively, signaling potential hidden optimism. Brian noted that this divergence between price and sentiment can foreshadow bullish momentum.

Ethereum Faces Doubts, But Contrarian Signals Emerge

Unlike Bitcoin, Ethereum lagged during the recovery. Futures funding rates for ETH turned negative, revealing an influx of short positions. However, Brian warned that such bearish crowding often precedes a short squeeze—a scenario where rising prices force short traders to buy back in, further accelerating gains.

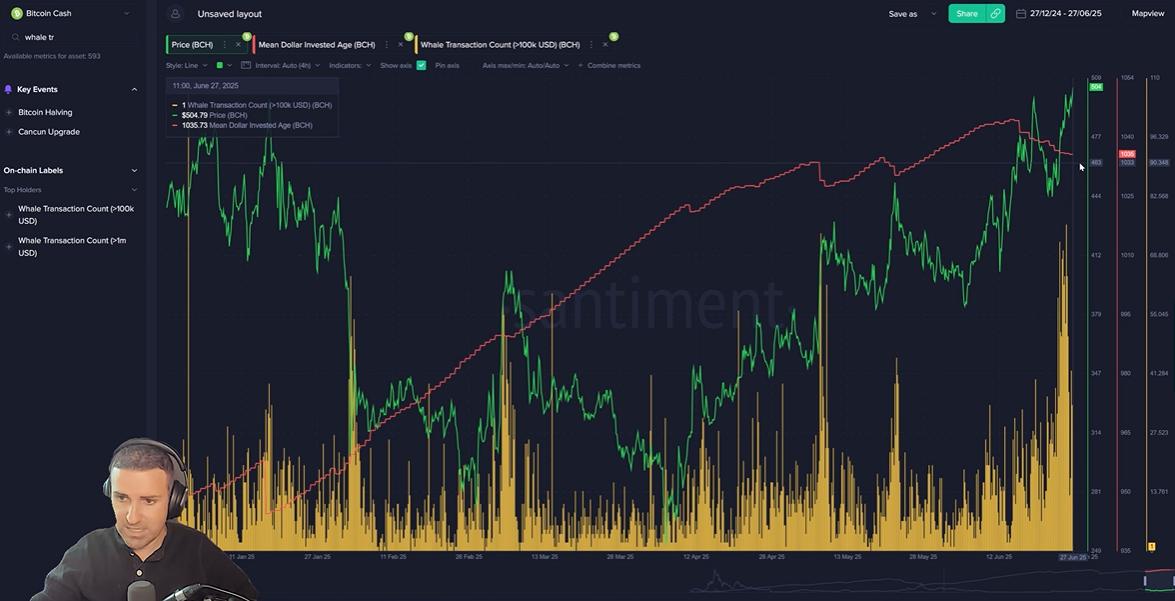

BCH and GameFi Narratives Heat Up

Bitcoin Cash (BCH) drew attention with its largest whale transaction spike of the year. Combined with increased social dominance and declining “mean dollar invested age,” the data suggests that dormant coins are moving—often a precursor to price action. On a narrative level, discussions about GameFi, stablecoins, and Bitcoin versus fiat money dominated Santiment’s Alpha Narratives tool, offering early insight into where trader attention is heading next.

Key Takeaway: Watch Whale Activity and Sentiment Spikes

This week’s events reaffirm a crucial lesson: on-chain data tells the story behind the charts. As retail panic peaks, whale accumulation and sentiment bottoms often signal that the worst has passed. Investors who track wallets, social sentiment, and funding rates can position themselves ahead of the curve.

For a deeper look, Santiment offers real-time dashboards that track these metrics—helping traders navigate volatility with confidence and clarity.

-

1

What Will Happen With the Stock Market if Trump Reshapes the Fed?

29.06.2025 13:00 2 min. read -

2

U.S. Bank Advises Clients to Drop These Cryptocurrencies

29.06.2025 10:00 2 min. read -

3

FTX Halts Recovery Payments in 49 Countries: Here Is the List

04.07.2025 18:00 2 min. read -

4

Chinese Tech Firms Turn to Crypto for Treasury Diversification

26.06.2025 17:00 1 min. read -

5

What Are the Key Trends in European Consumer Payments for 2024?

29.06.2025 8:00 2 min. read

Greed Holds as Market Momentum Builds: What is the Market Sentiment

The crypto market remains firmly in “Greed” territory, with CoinMarketCap’s Fear & Greed Index clocking in at 69/100 on July 19. Despite a modest 24-hour dip from 71, the index has now held above 60 for 11 consecutive days.

Top 7 Crypto Project Updates This Week

The crypto industry saw major advancements this past week across DeFi, NFT, Layer 2, and AI-powered platforms.

Peter Thiel-Backed Crypto Exchange Files for IPO

Cryptocurrency exchange Bullish, backed by billionaire investor Peter Thiel, has officially filed for an initial public offering (IPO), marking a major step toward entering the public markets.

Tether Plans U.S.-Issued Stablecoin After Trump Signs GENIUS Act

With President Trump officially signing the GENIUS Act into law, the regulatory landscape for stablecoins in the U.S. has entered a new phase—prompting major reactions from the industry’s top players.

-

1

What Will Happen With the Stock Market if Trump Reshapes the Fed?

29.06.2025 13:00 2 min. read -

2

U.S. Bank Advises Clients to Drop These Cryptocurrencies

29.06.2025 10:00 2 min. read -

3

FTX Halts Recovery Payments in 49 Countries: Here Is the List

04.07.2025 18:00 2 min. read -

4

Chinese Tech Firms Turn to Crypto for Treasury Diversification

26.06.2025 17:00 1 min. read -

5

What Are the Key Trends in European Consumer Payments for 2024?

29.06.2025 8:00 2 min. read