Whale Activity Spikes as Smart Money Eyes Reversal Zones

29.07.2025 16:00 1 min. read Kosta Gushterov

Amid current market volatility, blockchain analytics firm Santiment has reported a notable rise in whale activity targeting a select group of altcoins.

Large transactions—defined as movements over $100,000—have been climbing for several mid-cap assets that are typically overlooked by retail traders.

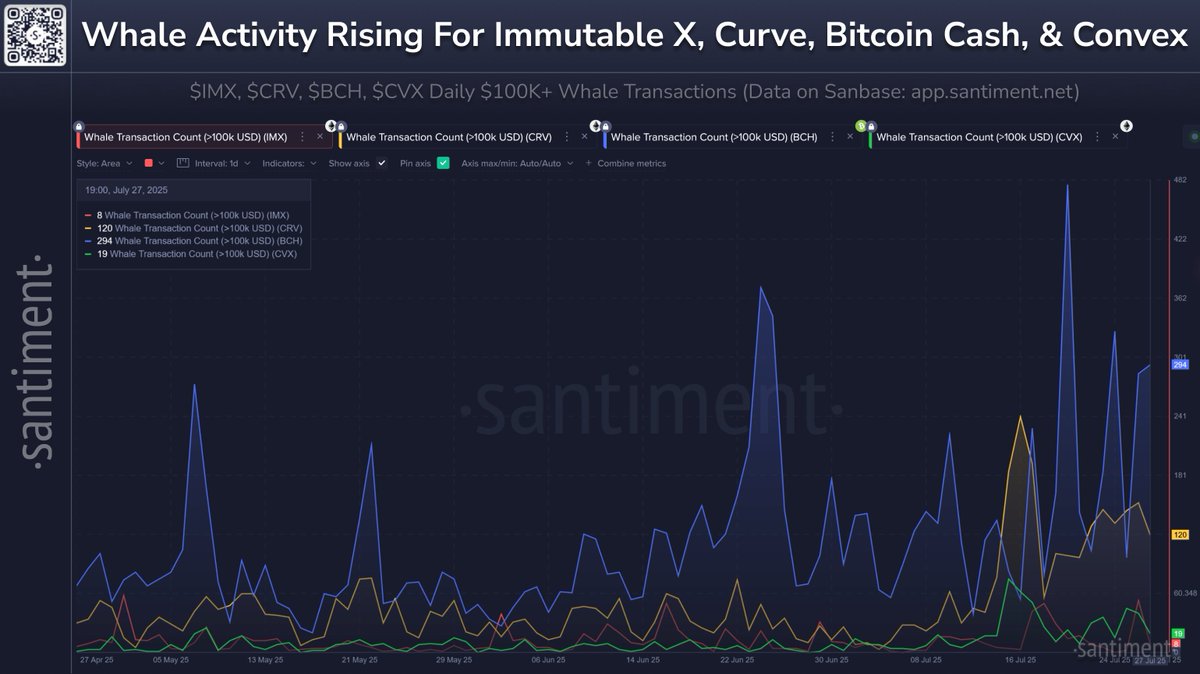

According to Santiment’s on-chain data, Immutable X (IMX) recently experienced its second-highest whale transaction day in the past three months. Meanwhile, Curve (CRV) saw its fourth-highest, while both Bitcoin Cash (BCH) and Convex Finance (CVX) recorded their fifth-highest days in terms of whale transaction count during the same timeframe.

Santiment shared a comparative chart showing transaction spikes across all four tokens. The rise in large transactions may suggest increased accumulation, distribution, or positioning by major holders—often seen as early indicators of trend reversals or incoming volatility. When whales move in clusters, it can reflect either opportunistic buying at local lows or the beginning of more active speculation in preparation for broader market moves.

For investors and analysts monitoring altcoin rotations, this data may serve as an early warning system. Santiment encourages users to track real-time whale activity on their interactive dashboard to help identify potential price inflection points.

As markets remain cautious, spikes in whale movement on mid-cap assets like IMX, CRV, BCH, and CVX could foreshadow a shift in sentiment and capital allocation strategies among larger players.

-

1

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read -

2

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

3

Cardano Surges Past $0.74 — Is a $1 Rally Next?

13.07.2025 18:00 2 min. read -

4

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

5

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read

Fartcoin Price Prediction: Trader Expects Big Bounce as FARTCOIN Nears $1

Fartcoin (FARTCOIN) has gone down by 17.3% in the past 24 hours and currently sits at $1.14. As the token approaches $1, one trader favors a bullish Fartcoin price prediction. DevKhabib, a pseudonymous trader whose X account is followed by nearly 46,000 users, says that he expects a big bounce off the $1 support after […]

Binance to Launch PlaysOut (PLAY) Trading on July 31 With Airdrop

Binance has officially announced the launch of PlaysOut (PLAY), a new token debuting on Binance Alpha, with trading scheduled to begin on July 31, 2025, at 08:00 UTC.

Cboe BZX Files for Injective-based ETF Alongside Solana Fund Proposal

The Cboe BZX Exchange has submitted a filing with the U.S. Securities and Exchange Commission (SEC) seeking approval for a new exchange-traded fund (ETF) that would track Injective’s native token (INJ).

Bernstein Warns Ethereum Treasuries Pose New Risks

Bernstein has flagged growing risks in Ethereum’s corporate adoption trend, cautioning that the rise of “ETH treasuries” could reshape the network’s supply and risk dynamics.

-

1

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read -

2

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

3

Cardano Surges Past $0.74 — Is a $1 Rally Next?

13.07.2025 18:00 2 min. read -

4

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

5

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read