Vitalik Buterin Reveals 90% of His Wealth Is in Ethereum Amid Community Concerns

28.08.2024 10:30 2 min. read Alexander Stefanov

Ethereum co-founder Vitalik Buterin recently addressed concerns about Ethereum's role as a store of value, especially after scrutiny surrounding the Ethereum Foundation's (EF) recent financial activities.

Buterin revealed that about 90% of his net worth is in ETH, signaling his confidence in the cryptocurrency.

This comes amid debates within the Ethereum community regarding the platform’s significance in decentralized finance (DeFi) and the importance of ETH’s value for securing the network under its Proof of Stake (PoS) system. Some community members have expressed concern that the EF hasn’t strongly advocated for ETH as a store of value, especially in light of recent significant transactions.

One such transaction involved the transfer of 35,000 ETH (valued at $94 million) to the Kraken exchange, raising eyebrows over the potential market impact. Aya Miyaguchi, the EF’s Executive Director, explained that the move was part of routine treasury management to meet operational costs, including grants and salaries, which require fiat currency.

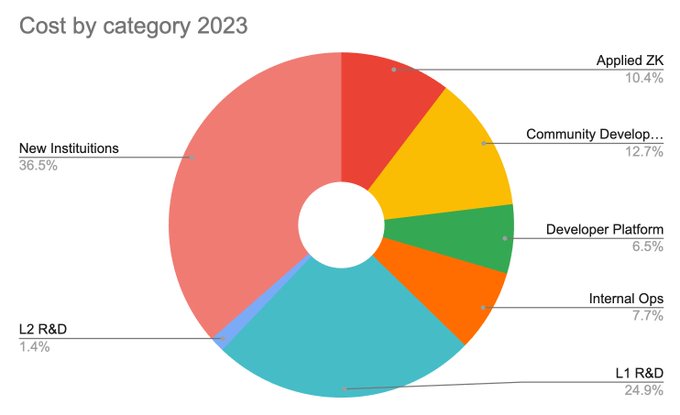

In response to transparency concerns, EF member Josh Stark provided a breakdown of the Foundation’s expenditures, including grants supporting the Ethereum ecosystem. The Foundation also plans to release a detailed financial report by the end of the year to address ongoing concerns.

Despite the criticism, some community members defended the EF, pointing out that its spending is relatively minor compared to Ethereum’s market cap. Meanwhile, Buterin’s views on DeFi, particularly the sustainability of yields, have also sparked discussions, with some in the community emphasizing DeFi’s critical role in the crypto space.

As these conversations unfold, Ethereum “whales” have been observed selling large amounts of ETH, further fueling discussions about the platform’s future.

-

1

Educational Company Enters Crypto Market with $500M Solana Reserve Plan

04.06.2025 16:00 1 min. read -

2

Cardano Shows Signs of Recovery as Market Sentiment Turns Positive

17.06.2025 16:00 1 min. read -

3

Canada Green-Lights First XRP ETF, Beating the U.S. to Market

17.06.2025 9:00 1 min. read -

4

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

06.06.2025 13:00 1 min. read -

5

Public Company Makes Bold Bet on Ethereum With $463M Investment

13.06.2025 19:00 1 min. read

History Shows War Panic Selling Hurts Crypto Traders

Geopolitical conflict rattles markets, but history shows panic selling crypto in response is usually the wrong move.

Pennsylvania Man Sentenced to 8 Years for $40M Crypto Ponzi Scheme

The U.S. Department of Justice has sentenced Dwayne Golden, 57, of Pennsylvania to 97 months in prison for orchestrating a fraudulent crypto investment scheme that stole over $40 million from investors.

Snorter Token ($SNORT) Price Prediction, ChatGPT Forecasts 10x by end of 2025

Snorter Token ($SNORT) is a new meme coin and utility token designed to enhance crypto trading with its Telegram-native trading bot, Snorter Bot. This bot is equipped with sniping capabilities, copy trading, and swap functionalities, offering traders the ability to profit from the volatile crypto markets. As the presale has garnered significant attention, raising over […]

At Least Five Law Firms Target Former Strategy Over Misleading BTC Risk Disclosures

Bitcoin-focused investment firm Strategy Inc. (formerly MicroStrategy) is facing mounting legal pressure as at least five law firms have filed class-action lawsuits over the company’s $6 billion in unrealized Bitcoin losses.

-

1

Educational Company Enters Crypto Market with $500M Solana Reserve Plan

04.06.2025 16:00 1 min. read -

2

Cardano Shows Signs of Recovery as Market Sentiment Turns Positive

17.06.2025 16:00 1 min. read -

3

Canada Green-Lights First XRP ETF, Beating the U.S. to Market

17.06.2025 9:00 1 min. read -

4

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

06.06.2025 13:00 1 min. read -

5

Public Company Makes Bold Bet on Ethereum With $463M Investment

13.06.2025 19:00 1 min. read