US Recession is Becoming More Likely With Each Passing Month

20.06.2024 9:30 1 min. read Alexander Stefanov

A number of economic indicators associated with forecasting recessions are currently reporting warning signals.

The Game of Trades investment research platform, pointed out the presence of serious difficulties in the labor market, where the pace of job cuts is accelerating aggressively.

Historically, since 1995, such trends have preceded recessions. Recent indications show that annual permanent job losses have risen to levels seen during the dot-com bubble, the 2008 financial crisis and the COVID-19 pandemic, raising fears of a potential recession in the second half of 2024

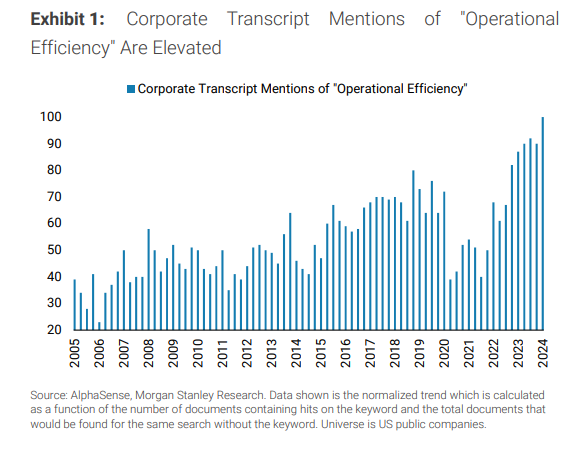

Additionally, data from AlphaSense indicates that many US corporations are likely to undertake mass layoffs as references to “operational efficiency“, especially since 2020.

Despite the current bull market momentum, experts warn that the US could be facing one of the worst recessions in history, potentially rivaling the Great Depression of 1929. Two-year Treasury yields are forecast to drop sharply, which also is a signal of impending economic collapse.

Speculation has focused on the timing of the recession, with many predicting it will occur in the second half of 2024, influenced by the Federal Reserve’s upcoming interest rate decision.

-

1

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

2

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

3

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

4

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

U.S. inflation accelerated in June, dealing a potential setback to expectations of imminent Federal Reserve rate cuts.

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

In a surprising long-term performance shift, gold has officially outpaced the U.S. stock market over the past 25 years—dividends included.

U.S. Announces Sweeping New Tariffs on 30+ Countries

The United States has rolled out a broad set of new import tariffs this week, targeting over 30 countries and economic blocs in a sharp escalation of its trade protection measures, according to list from WatcherGuru.

Key U.S. Economic Events to Watch Next Week

After a week of record-setting gains in U.S. markets, investors are shifting focus to a quieter yet crucial stretch of macroeconomic developments.

-

1

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

2

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

3

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

4

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read