US Investors Pour $365M into Bitcoin ETFs as Price Continues to Soar

27.09.2024 13:00 1 min. read Alexander Zdravkov

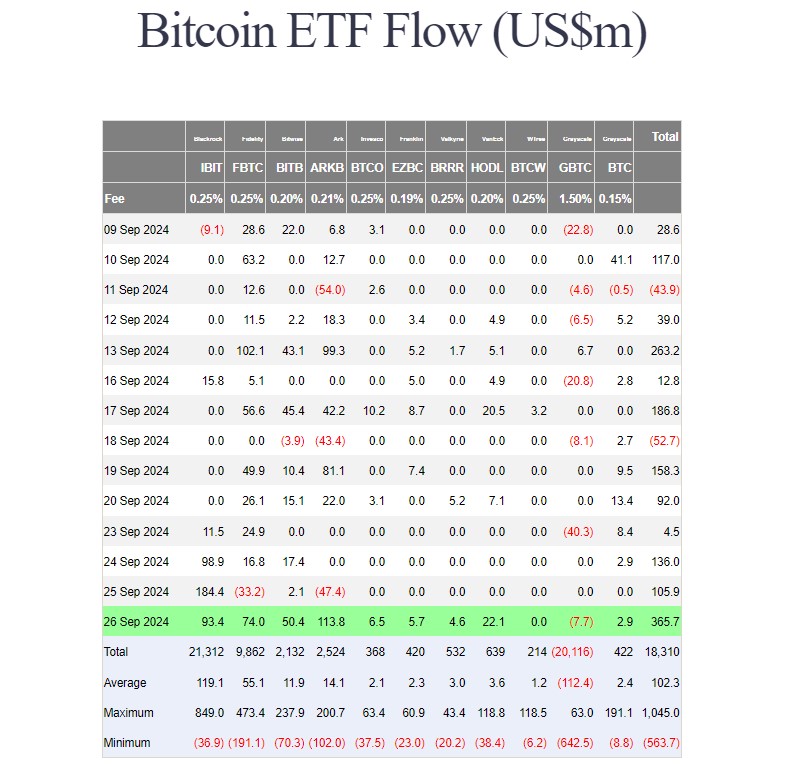

On Thursday, U.S. investors funneled approximately $365 million into spot Bitcoin ETFs, pushing total inflows to over $600 million for the week, according to data from Farside Investors.

This surge in investment came as Bitcoin reached a monthly peak of $65,000.

ARK Invest’s ARKB ETF saw a strong rebound, attracting around $114 million after a brief decline earlier in the week. BlackRock’s IBIT continued its growth streak with an additional $93 million, while Fidelity’s FBTC and Bitwise’s BITB combined pulled in $124 million.

Other funds, including those from VanEck, Invesco, Valkyrie, and Franklin Templeton, also recorded gains. However, WisdomTree’s BTCW saw no new inflows. Grayscale’s Bitcoin Mini Trust brought in nearly $3 million, while its larger GBTC product experienced a $7 million outflow, marking the smallest withdrawal in the past two weeks.

The renewed interest in Bitcoin ETFs aligns with Bitcoin’s recent surge, which broke through the $65,000 mark following positive U.S. economic data, including a 3% rise in GDP and a drop in weekly jobless claims.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

4

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

5

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

4

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

5

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read