US Bitcoin ETFs Continue With Their Positive Inflows

11.07.2024 11:23 1 min. read Kosta Gushterov

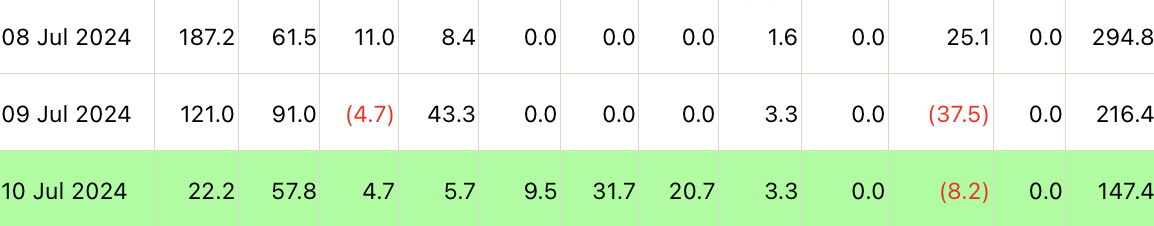

The U.S. spot Bitcoin exchange traded fund (ETF) sector doesn't seem to be losing confidence in the asset, as it posted positive results again on June 10, registering total inflows of $147.4 million.

Leading financial institutions this time were Franklin Templeton (EZBC) and Fidelity (FBTC) with $31.7 million and $57.8 million, respectively.

They are followed by BlackRock’s IBTC with $22.2 million, which still reflects a decline given that this ETF attracted $121 million on July 9.

Also on July 8, IBTC registered an impressive daily inflow of $187.2 million, helping to bring the total for all U.S. spot ETFs to $294 million for the day, registering its strongest day of net inflows in more than a month.

Grayscale’s ETF was the only participant to see negative results over the same time period, registering outflows of $8.2 million.

-

1

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

Gold advocate Peter Schiff issued a stark warning on monetary policy and sparked fresh debate about Bitcoin’s perceived scarcity. In a pair of high-profile posts on July 12, Schiff criticized the current Fed rate stance and challenged the logic behind Bitcoin’s 21 million supply cap.

Bitcoin Price Hits Record Highs as Exchange Balances Plunge

A sharp divergence has emerged between Bitcoin’s exchange balances and its surging market price—signaling renewed long-term accumulation and supply tightening.

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

Bitcoin touched a new all-time high of $118,000, but what truly fueled the rally?

Bitcoin Lesson From Robert Kiyosaki: Buy Now, Wait for Fear

Robert Kiyosaki, author of Rich Dad Poor Dad, has revealed he bought more Bitcoin at $110,000 and is now positioning himself for what macro investor Raoul Pal calls the “Banana Zone” — the parabolic phase of the market cycle when FOMO takes over.

-

1

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read