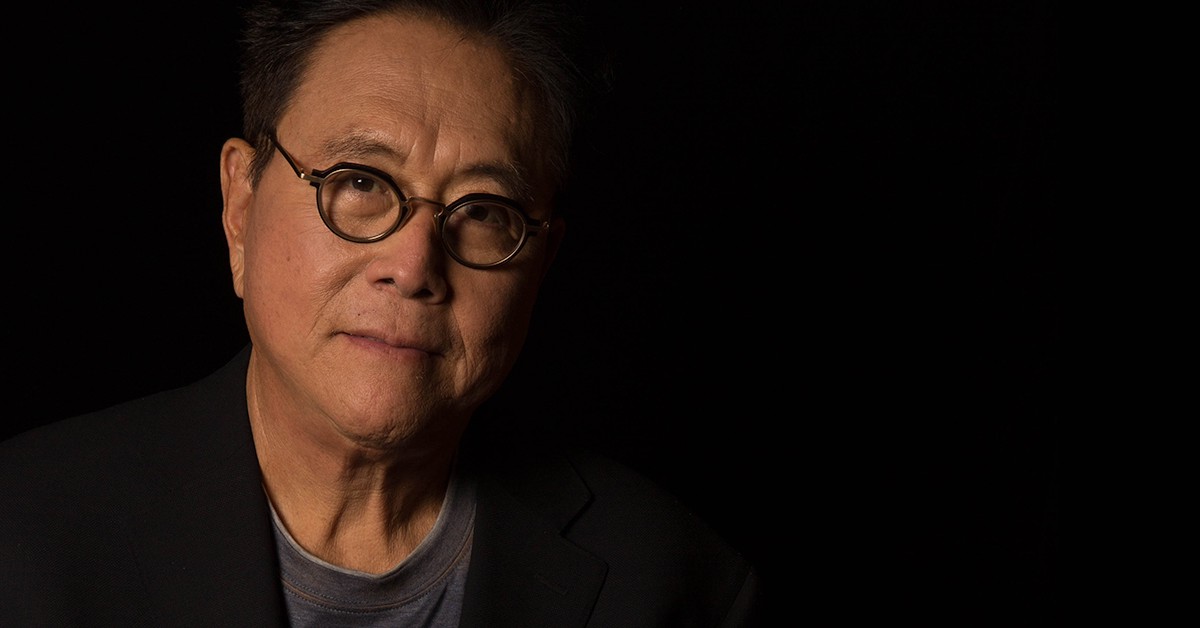

U.S. Debt Crisis May Worsen Robert Kiyosaki Advocates Bitcoin Over Dollar

14.09.2024 17:00 2 min. read Alexander Zdravkov

Robert Kiyosaki, the author renowned for Rich Dad Poor Dad, has voiced serious concerns about the U.S.’s escalating national debt, which currently stands at a staggering $35 trillion.

Kiyosaki argues that this burgeoning debt is a grave threat to the economic stability of the nation. He believes that neither Donald Trump nor Kamala Harris will be able to effectively address this crisis. Instead, Kiyosaki suggests abandoning the U.S. dollar in favor of investing in assets like Bitcoin, gold, and silver.

Kiyosaki criticizes the government’s heavy dependence on debt, pointing out that annual interest payments on the national debt have exceeded $1 trillion, overshadowing all other federal expenses combined. With the debt increasing at an alarming rate of $1 trillion every 100 days, he asserts that this is fueling inflation and diminishing the value of the dollar.

In a related proposal, Senator Cynthia Lummis has recommended that the U.S. government buy 1 million Bitcoins over the next five years, mirroring El Salvador’s strategy of accumulating Bitcoin to bolster its financial reserves.

Donald Trump has also proposed using Bitcoin as a tool to address the national debt. His plan involves acquiring a large amount of Bitcoin and holding it for two decades, hoping that the appreciation in value will help pay down the debt. This idea has sparked a range of opinions among economists, with some seeing potential in the strategy and others warning about Bitcoin’s inherent volatility.

Bitcoin is increasingly viewed as a safeguard against economic turmoil by some institutional investors. Experts like Michael Saylor predict that Bitcoin’s value could rise dramatically, which might offer some relief for the U.S. debt problem. Nevertheless, the viability of Bitcoin as a solution remains debated, with opinions divided on whether it could effectively stabilize the economy.

-

1

Bitcoin: Is the Cycle Top In and How to Spot It?

09.07.2025 16:00 2 min. read -

2

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

3

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

4

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

5

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read

Charles Schwab to Launch Bitcoin and Ethereum Trading Soon, CEO Confirms

Charles Schwab is preparing to roll out spot Bitcoin and Ethereum trading, according to CEO Rick Wurster during the firm’s latest earnings call.

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

According to data shared by Wu Blockchain, over $5.8 billion in crypto options expired today, with Ethereum leading the action.

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

BlackRock is seeking to enhance its iShares Ethereum Trust (ticker: ETHA) by incorporating staking features, according to a new filing with the U.S. Securities and Exchange Commission (SEC) submitted Thursday.

IMF Disputes El Salvador’s Bitcoin Purchases, Cites Asset Consolidation

A new report from the International Monetary Fund (IMF) suggests that El Salvador’s recent Bitcoin accumulation may not stem from ongoing purchases, but rather from a reshuffling of assets across government-controlled wallets.

-

1

Bitcoin: Is the Cycle Top In and How to Spot It?

09.07.2025 16:00 2 min. read -

2

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

3

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

4

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

5

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read